Thinking about a career in Chartered Accountancy but not sure where to start? This CA course guide is here to make things easier. Whether you’re in school, just finished 12th, or already pursuing commerce, understanding the CA course details is the first step toward becoming a Chartered Accountant.

Right from the CA Foundation level to the Final exams, this CA course guide divides each phase — eligibility, syllabus, duration, and training — in an easy, simple manner. If you’re on the lookout for authentic CA course guide to start your CA journey with clarity, you’ve come to the right place.

Chartered Accountants is the most preferable course after Class 12th. Most commerce students take the CA Course after they pass their Class 12th exam. Thousands of students enroll in this course every year to become Chartered Accountants.

Whether you’re searching for “how to start a CA course after 12th” or “full details of CA course”, this article has everything you need. This is your go-to CA course guide for 2025 to start your Chartered Accountancy journey with full clarity and confidence.

Chartered Accountant Course Details 2025

| Particulars | CA Foundation Course Details | CA Intermediate Course Details | CA Final Course Details |

|---|---|---|---|

| Last Date of Registration for Sept. 2025 | Before 30th April 2025 | Before 30th April 2025 | Before 30th April 2025 |

| Examination Held | January, May and September | January, May and September | January, May and September |

| Validity of Registration | 3 Years | 5 Years | 5 Years |

| Subjects | 4 Subjects (1 Group) | 6 Subjects (2 Groups) | 6 Subject (2 Groups) |

| Fees | 9800 | 18000 | 22000 |

| Eligibility | Should Appear 12th Exams | Should Clear Foundation or Graduation or PG | Should Clear Intermediate Level and 2-Year Practical Training |

CA Full Form and Meaning

CA Full Form: The full form of CA is Chartered Accountant. CA is a professional course conducted by ICAI, a Government body. It has three levels- CA Foundation, CA Intermediate, and CA Final. Each level has different subjects. To get the complete details about CA Course read the article carefully.

Meaning of CA:- A Chartered Accountant (CA) is a financial professional who has advanced accounting qualifications and works in a variety of sectors to provide services to individuals and businesses.

To become a Chartered Accountant in India, you must pursue the CA course. The major job profiles of a CA are Accountant, Financial Analyst, Auditor, Senior Executive, etc.

Table of Contents

CA Course Details 2025

Chartered Accountancy (CA) is a well-known and most demanding professional course in India. It is imperative for such students who want to establish their career in the field of finance, auditing, tax, and accounts to know about the CA course details. The CA course details involve different stages like CA Foundation, CA Intermediate, and CA Final, and articleship or practical training, which together become a professional CA.

With increasing demand for CAs in different industries, having CA course details in whole assist the students in planning study, exam schedule, and career in an organized manner. In case you are in search of complete and updated CA course details, the following ca course guide has all the details about eligibility, syllabus, exam pattern, and registration process. Now let’s move on to CA course details in order to begin your studies in the fascinating world of Chartered Accountancy!

The CA Course has three levels: CA Foundation, CA Intermediate, and CA Final. CA Foundation Levels contains 4 subjects and papers in which students have to score a minimum of 40% Marks in a Single subject and Overall 50% marks in all subjects.

Whereas CA Intermediate and CA Final Consist of 6 Subjects and a paper, and just like the foundation, passing criteria for those are similar.

The below table mentions the CA Course complete details:

| Particulars | CA Course Details |

| Full-Form | Chartered Accountancy |

| Conducting Body | ICAI (Institute of Chartered Accountants of India) |

| Exams Levels | CA Foundation CA Intermediate CA Final |

| Fees | Rs. 4 lakhs |

| Duration of CA Course | 48 Months |

| Degree | Bachelors |

| CA Course Eligibility | For CA Foundation Route: 50% in class 12th For Direct Entry Route: After Graduation |

| Passing Criteria | Minimum 40% Marks in Each Subject and Aggregate 50% Marks Overall. |

| Average CA Salary in India | Rs. 10,00,000 LPA |

| Job Roles | Accountant, Banker, Financial Manager, Consultant, Auditor |

| CA Job Profiles | Accountants, Finance Managers, Accounting Managers, Business Analysts, Chartered Engineers, etc. |

CA Course Structure

The CA course (Chartered Accountancy course) is among the most prestigious professional courses in India, regulated by the Institute of Chartered Accountants of India (ICAI). The CA course, due to its depth and intensity, is best suited for those students wishing to pursue a career in finance, accounting, taxation, and auditing.

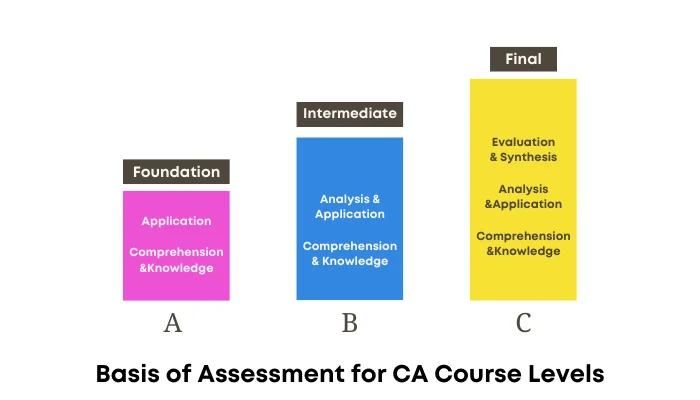

The CA course consists of three detailed levels: CA Foundation, CA Intermediate, and CA Final. At each level, a student’s conceptual knowledge, practical training, and ethical knowledge are developed to become a Chartered Accountant.

CA Foundation – The First Step in the CA Course

CA Foundation is the junior exam of the CA course and is available to students who are finishing Class 12 (10+2). It is the foundation of the entire CA course syllabus with focus on fundamental concepts in:

- Paper-1: Principles and Practice of Accounting

- Paper-2: Business Laws

- Paper-3: Quantitative Aptitude

- Paper-4: Business Economics

CA Foundation course exams are held thrice a year, i.e., in Jan, May and September. The students need to secure at least 40% marks in each of the papers and 50% on aggregate to pass in this level of the CA course. It is a very important stepping stone in the CA course path.

CA Intermediate – The Core of the CA Course

Once they have cleared the Foundation level (or direct entry graduation), students are eligible to register for the CA Intermediate level of the CA course. It is more comprehensive in terms of core areas of accountancy and business legislations and is divided into two groups, each with four papers:

Group 1:

- Paper-1: Advanced Accounting

- Paper-2: Corporate and Other Laws

- Paper-3: Taxation

Group 2:

- Paper-4: Cost and Management Accounting

- Paper-5: Auditing and Ethics

- Paper-6: Financial Management & Strategic Management

CA Intermediate is a more comprehensive and tougher form of the Foundation, and the core of the CA course. The ICITSS (Information Technology and Soft Skills) also has to be finished by the students before the articleship training program is started.

CA Final – Final Level of CA Course

CA Final is the last and most challenging stage of the CA course. The candidates are eligible for this stage on passing both groups of Intermediate and 2.5 years of practical training (Articleship) under a practicing Chartered Accountant. CA Final course consists of two groups with eight papers:

Group 1:

- Paper-1: Financial Reporting

- Paper-2: Advanced Financial Management

- Paper-3: Advanced Auditing, Assurance and Professional Ethics

Group 2:

- Paper-4: Direct Tax Laws & International Taxation

- Paper-5: Indirect Tax Laws

- Paper-6: Integrated Business Solutions

CA Final course prepares the students for senior-level decision-making positions in finance and accounting. Advanced ICITSS also has to be completed by the students prior to attempting this level.

CA course is not a course just to study, it is a professional experience that demands discipline, dedication, and in-depth knowledge. From CA Foundation course to CA Intermediate course to CA Final course, each step of the CA course builds necessary skills required to succeed in the finance world of the modern era.

Whether you are starting or progressing through levels, the CA course in India offers unmatched opportunities and job security. For those interested in accountancy and finance, the CA course is a unique and rewarding journey to professional excellence.

Duration:

- The duration to complete the CA course can be around 4 to 4.5 years, including practical training through articleship.

- Articleship involves working under a practicing CA for a minimum of 2 to 2.5 years.

Subjects Covered:

- The CA course covers various subjects related to accounting, auditing, taxation, business law, economics, and financial management.

- Specific subjects within the Intermediate level include Advanced Accounting, Corporate and Other Laws, Taxation, Cost and Management Accounting, Auditing and Ethics, and Financial Management and Strategic Management.

- Subjects with the Final level include Financial Reporting, Advanced Financial Management, Advanced Auditing, Assurance and Professional Ethics, Direct Tax Laws & International Taxation, Indirect Tax Laws, Integrated Business Solutions.

Eligibility:

- To be eligible for the CA course, candidates have to pass Class 12 with a minimum aggregate of 55% marks.

- Graduates or postgraduates can also apply for the CA course, potentially skipping the Foundation level and giving exam directly for CA Intermediate level.

Key Aspects:

- Practical Training: Articleship is a mandatory part of the CA course. It provides hands-on practical experience to CA students.

- ICAI: The Institute of Chartered Accountants of India (ICAI) is the governing body responsible for CA education and training in India.

- Exam Structure: The CA exams are conducted thrice a year, in January, May and September.

Why Pursue a CA Course?

The global market is currently seeing unprecedented levels of demand for CA course graduates. CA course grads are an excellent option for applicants who have always wanted to live abroad and enhance their careers.

Candidates who have achieved their CA certification can also start their own auditing company and provide auditing services to clients. While becoming a CA is not easy, many students select it because it provides one of the best career opportunities and steady employment in a number of roles.

Who Can Pursue A CA Course?

Candidates can choose the Chartered Accountant course if auditing, taxes, and accounting interest them. Candidates interested in financial disciplines such as taxation or who want to start their own practice can also enroll in the Chartered Accountant course.

Time management, analytical, reasoning, and communication skills are some of the important qualities needed for a successful career after completing the Chartered Accountant Course.

After completing the Chartered Accountant course, students can find profitable and well-known work opportunities in a range of areas, including finance, banking, and taxation, in both private and public organizations.

Furthermore, a CA can also become an entrepreneur. Candidates who are interested in financial sectors such as taxation or who want to start their own practice can also take the Chartered Accountant course. To pursue the Chartered Accountant course, students must possess some key abilities. Furthermore, a CA can also become an entrepreneur.

Get Updates from VSI Jaipur

CA Course Eligibility Criteria

Registration is the first step in the CA course. However, before filling out the registration form, the candidates must fulfill the eligibility criteria. Check out the eligibility for each level of the Chartered Accountancy course:

- CA Foundation: According to the CA Foundation eligibility, one must have passed the class 12th exams from a recognized board. In addition, the commerce students must secure 50%. At the same time, the Science background students should get at least 55% in their class 12th.

- CA Intermediate: Students can register for CA Intermediate through 2 routes: the CA Foundation route and the Direct entry route. The CA Intermediate eligibility for both the routes are:

- For the CA Foundation route, the candidates need to clear the CA Foundation exam with an aggregate of 50% and at least 40% in each subject.

- For the Direct entry route, candidates need to pass their graduation/ postgraduation with 55% from a commerce background and 60% from other backgrounds.

- Articleship: For articleship registration, the students must have undergone the ICITSS training and should qualify the following criteria:

- Students must have completed at least one group of CA Intermediate.

- Students taking the direct entry can start articleship directly after the CA Intermediate Registration.

- CA Final: For CA Final registration, one must have cleared both the groups of the CA Intermediate exam and complete at least 2.5 years of articleship training.

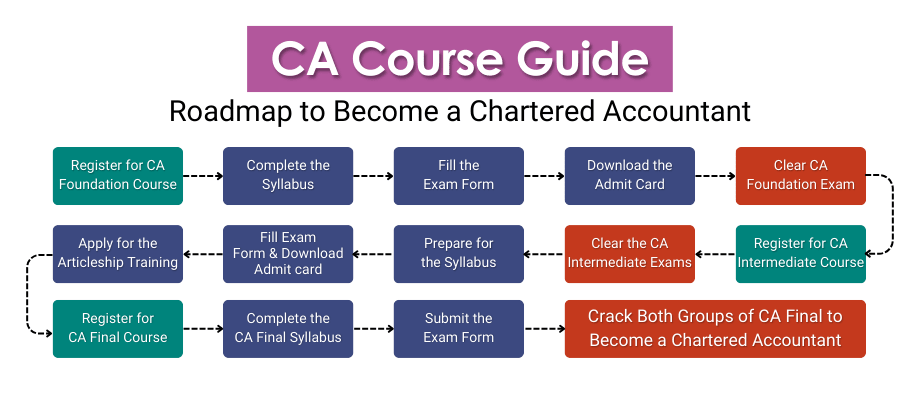

How to Become a CA in India?

Check the step-by-step procedure to become a CA in India:

- Register for the CA Foundation Course.

- Complete the 4 months study period and crack the CA Foundation exams.

- Register for the CA Intermediate Course.

- Crack Both groups of CA Intermediate.

- Enroll for the Practical training after clearing any one group of CA Intermediate.

- Complete the CA Articleship Training for 2 years.

- Register for the CA Final Course.

- Clear Both groups of CA Final Exams and apply for the ICAI membership.

How to Become CA Through the CA Foundation Route

Check out the Below steps to become a Chartered Accountant through the CA Foundation:

Step 1: Register yourself for the CA Foundation Exam and Pass the Exam

Step 2: After Passing the CA Foundation Exams, Register yourself for the CA Intermediate Exams

Step 3: Once you Have passed the CA Intermediate Exams with Both Groups, Apply for the Articleship Training.

Step 4: Compete your 2 Years of Articleship Training.

Step 5: After Completing Articleship Training, Register yourself for the CA Final Exam.

Step 6: Pass the CA Final Exams with Both Groups and Apply for the ICAI membership.

How to Become CA Through Direct Entry Route

Check the below steps to become a Chartered Accountant through the Direct Entry Route:

Step 1: Completed your graduation with a minimum of 60% marks to register for the CA Intermediate Direct Entry Route.

Step 2: Directly register for the CA Intermediate Exams.

Step 3: Register and Complete 4 Week of ICITSS ( Integrated Course on Information Technology and Soft Skills).

Step 4: Pass the CA Intermediate Exam with Both Groups and Register for the CA Articleship Training of 2 Years.

Step 5: After Complete the CA Articleship Training Register for the CA Final Exams.

Step 6: Complete 15 Days of AICITSS (Advanced Integrated Course on Information Technology and Soft Skills) and Orentitation Course before CA Final Exams.

Step 7: Pass the CA Final Exams with Both Groups.

Step 8: Apply for the ICAI Membership.

Note: Additional Course mention with Also applicable when do CA From Foundation Route.

How to Become a Chartered Accountant After Passing Intermediate-Level Exams of the ICSI or the ICAI

Step 1: Sign up for CA Inter with ICAI. The registration process for CA Intermediate is the same for these students as it is for regular students.

Step 2: Study for eight months to prepare for CA Intermediate Exams.

Step 3: Take and pass one or both groups of CA Intermediate exams.

Step 4: Enroll in a three-year Articleship training program upon passing one or both groups of CA Intermediate.

Step 5: Register for the CA Final after completing both groups of CA Intermediate.

Step 6: Complete a 4-week AICITSS course during the last two years of practical training but before taking the CA Final Examination.

Step 7: Sit for the CA Final Examination during the final 6 months of Articleship training.

Step 8: Pass both groups of CA Final exams.

Step 9: Finish Articleship Training.

Step 10: Become a member of ICAI.

Passing Criteria for CA Foundation, Intermediate and Final Exams

The passing criteria is almost the same for all the CA exams. To pass each CA Foundation course, the students must secure 50 per cent in aggregate and 40 per cent in each subject. To pass the CA Foundation exams on the first attempt, students should join a CA Foundation coaching. Check all the details of VSI classes by clicking on this link.

In the Intermediate and Final exams, students have to get a minimum of 40 per cent in each and 50 per cent overall to clear a group. The students who have secured these percentages will only be eligible to register for the next CA courses and become Chartered Accountants.

जानिए भारत में सीए बनने की पूरी प्रक्रिया हिंदी में।

CA Course Duration for Foundation, Inter, and Final

Students are excited to know how many years they can add the prefix CA before their names. As per the CA New Scheme 2025, students can complete the CA course in 48 months.

Before the Old Scheme, students completed the CA Course in 4.5 to 5 years, but in the CA New Scheme, Some changes were made by ICAI. We cover the complete duration of the CA Course from Foundation to Final. The CA Course Duration of each level is here:

CA Foundation: The CA Foundation Course lasts 4 months, and there is a 2-month waiting period for the CA Foundation Result.

CA Intermediate: The study period for the CA Intermediate Course is 4 months, and candidates must wait 2 months for the CA Inter results. Hence, the total duration of the Intermediate Course will be 10 months.

Articleship Training: The total duration of the CA Articleship training is 2 years (as per the CA New Scheme).

CA Final: The study period for the CA Final Course is 6 months and 2 months is the Waiting period for results. Hence, the total duration of the Final Course will be 8 months.

Note: However, the CA course duration depends upon the route you have opted to take to enter the course and the number of attempts you have taken to clear each level.

Also, If any Student fails to Clear any of the CA Exams, an additional 6 months will be added to the Overall duration.

ICAI CA Course Fees for Foundation, Inter and Final

The CA Course fee after the 12th class will be Rs. 87,300. For graduate students, the total fees will be Rs. 76,200. This amount includes the registration and the exam form fees, which will be the same for every student.

| ICAI CA Course Fees | Indian Student | Foreigner Student |

|---|---|---|

| CA Foundation Fees | INR 11,300 | $1105 |

| CA Intermediate Fee (Single group) | INR 14,500 | $925 |

| CA Intermediate Fee (Both groups) | INR 20,700 | $1500 |

| CA Intermediate Fee (Direct Entry) | INR 24,900 | $1500 |

| Articleship Fee | INR 2,000 | |

| CA Final Fee(Both Groups) | INR 25,300 | $1650 |

Here, we have not included the cost of coaching and study materials, as they will differ for each student. However, the cost of the CA Course is around Rs. 3 to 4 lakhs in India.

Hey CA aspirants, if you want the admission details of the VSI Jaipur Institute, crucial updates about the CA courses, or the VSI expert-made mock test papers, fill out the form below.

CA Course Registration 2025

Students who want to become CA, have to register for CA foundation level. The registration form is available on the ICAI website and is open all around the year. However, ICAI has fixed deadlines for applying for the particular sessions.

Documents Required for the Registration of CA Course

Check all the documents that you’ll need to register for the CA Course for all the levels:

- PP size photograph and signature.

- Class 12th and 10th self-attested mark sheet.

- Nationality Proof

- CA Foundation mark sheet or Graduation Marksheet (For CA Intermediate Registration)

- CA Intermediate mark sheet (For CA Final Registration)

- Certificate of Articleship training (For CA Final Registration)

How to Register for the Chartered Accountancy Course?

Once you have arranged the documents, it is time to know how to register for the CA course. As the CA Foundation is the first level, here is the procedure to apply for the Foundation level.

- Visit the official ICAI portal.

- Create a new account with ICAI by entering your basic details such as name, email, and number.

- Verify the OTP sent in your mail and number and complete the verification process.

- Now, using the registration credentials you received, login into the portal.

- Click on “Apply for Foundation.”

- Now, the registration form will appear on the screen.

- Enter the enquired details and then click on next.

- Now, upload all the mentioned documents as asked on the site.

- Click on save and next.

- At last, confirm your registration by making the payments.

Therefore, this is the procedure that you need to follow while registering for CA Foundation Exam. The same steps will be followed in CA Intermediate and CA Final, but the only difference is that you have to log in with the same old I’d and upload different documents.

Moreover, for CA Intermediate registration, students go for either CA Foundation or Direct Route. So, you can choose the option accordingly.

For the fee for the ICAI CA Course Registration, you can refer to the below table:

| Course | ICAI Registration Fee (India Centres) | ICAI Registration Fee (Overseas Centers) |

|---|---|---|

| CA Foundation | Rs. 9800 | $ 780 |

| CA Intermediate | Rs. 18000 (Both Groups) Rs. 13000 (Single Groups) | $ 1000 (Both Groups) $ 600 (Single Groups) |

| CA Final | Rs. 22000 | $ 1100 |

How to Fill Exam Form for the CA Exam and Its Fees

The exam forms are different from the registration form. After registration, the next major step is to fill out the examination form. You can find the dates of filing the exam form on the official website.

If you want to know the CA Foundation Exam Date for May 2025. The exam dates for CA Foundation May 2025 are 15, 17, 19, and 21 2025. To know more details, check the link.

For instance, the application form for the May 2025 exams is from 1st March to 14th March 2025 for CA Inter the CA Foundation without the late fee. Make sure to fill out the form before the deadline announced by ICAI. Now, let us see how to fill out the exam form for CA courses.

- Visit the official examination portal of ICAI.

- Use your registration credentials to log in.

- Now, click on the “Apply” option.

- The examination form for the respective course will appear.

- Enter the personal details in the application form carefully and click on save and next.

- At last, pay the exam form fee and complete the process.

To get more information about the exam form at each level, you can visit the following links – CA Foundation Exam Form, CA Inter Exam Form, and CA Final Exam Form.

CA Course Forms Fees

You can check the form fee for each category mentioned by ICAI in the table below.

| CA Course | ICAI Exam Form Fee (Indian Students) | ICAI Exam Form Fee (Overseas Students) |

|---|---|---|

| CA Foundation Exam Form Fees | Rs. 1500 | $ 325 |

| CA Inter Exam Form Fees | Rs. 1500 (Single group) Rs. 2700 (Both groups) | $ 325 (Single group) $ 500 (Both groups) |

| CA Final Exam Form Fees | Rs. 1800 (Single group) Rs. 3300 (Both groups) | $ 325 (Single group) $ 550 (Both groups) |

After submitting the examination form, the students can wait for the admit card, which is released 14 days before the CA course exams. Admit cards for all the CA courses are available on the ICAI website. Besides that it is important for the students to know all about CA exams after filling out the CA exam form. Students can visit the CA exams page to gather information, including paper patterns, dates and more.

CA Course Subjects and Syllabus

Now is the time to learn the CA syllabus and the subjects that will be covered at each level. The CA syllabus revolves around accounting, auditing, financial management, taxes, and laws.

CA Foundation Course Subject and Syllabus 2025

The CA Foundation syllabus is divided into four different subjects. In these four subjects, you will learn about accounting, business laws, quantitative aptitude, mathematics, mercantile Laws, commercial knowledge, etc. Some parts of the CA Foundation syllabus are already covered in your schools.

The four subjects of the CA Foundation course are:

Paper 1: Accounting

Paper 2: Business Laws

Paper 3: Quantitative Aptitude

- Part I: Business Mathematics and

- Part II: Logical Reasoning

- Part III: Statistics

Paper 4: Business Economics

Also, Check the CA Foundation Exam Pattern

Furthermore, you can check the CA Foundation Result. Along with the Result, ICAI also released the CA Foundation Passing Percentage for the Jan 2025 Exams.

CA Intermediate Course Syllabus and Subjects 2025

The CA Intermediate syllabus is divided into two groups, i.e., Group 1 and Group 2. In the CA Intermediate New Scheme, there are only 6 papers divided into two groups, 3 in each. Here, you’ll learn about taxation, cost and management, advanced accounting, corporate laws, auditing, financial management, and more.

The students can appear in either or both groups at once.

Group 1

Paper-1: Advance Accounting

Paper-2: Corporate Laws & Other Laws

Paper-3: Taxation

- Section A: Income-tax Law

- Section B: Goods and Service Tax

Group 2

Paper-4: Cost and Management Accounting

Paper-5: Auditing and Ethics

Paper-6: Financial Management and Strategic Management

- Part I: Financial Management

- Part II: Strategic Management

Register for the CA Intermediate classes from VSI to clear the Intermediate exams on the first attempt.

CA Final Course Syllabus and Subjects

The final stage of the CA Course, CA Final, also has 6 subjects divided into two groups, 3 in each group. Finally, ICAI allows you to appear in both groups or any of the groups at once.

The major topics that the students will cover in the CA Final New Syllabus include Financial Reporting, auditing, strategic cost management, taxation, etc. Here, let us discuss the subjects of the CA Final course:

Group I

Paper-1: Financial Reporting

Paper-2: Advance Financial Management

Paper-3: Advanced Auditing, Assurance and Professional Ethics

Group II

Paper-4: Direct Tax Laws and International Taxation

Paper-5: Indirect Tax Laws

Paper-6 Integrated Business Solution

- Section A – Corporate and Economic Laws

- Section B – Strategic Cost & Performance Management

Best Books to Prepare for Chartered Accountancy

Ideally, all students should refer to the ICAI books. But, if you feel the need for extra material for better

understanding, then we have mentioned some of the best reference books for the CA exams.

CA Foundation Books

- General Economics – S.K.Agarwal

- Padhuka Basics of Accounting for CA Foundation – G. Sekar & b Saravana Prasath

- Fundamentals of Accounting – D.G Sharma

- S Chand Mercantile Laws for CA Foundation – P P S GOGNA

- Mercantile Laws for CA Foundation – P C Tulsian

- Quantitative Aptitude Mathematics With Short Tricks – CA Rajesh Jogani

- Quantitative Aptitude – Dr T.Padma and K.C.P Rao

To get more details on CA Foundation study material and books, check this page.

CA Intermediate Books

- First lessons in Accounting Standards by MP Vijay Kumar

- Taxmann’s Students’ Guide to Accounting Standards by DS Rawat

- A Handbook on Corporate and Other Laws by Munish

- Padhukas Students Handbook On CMA by CA B. Saravana

- T.N. Manoharan’s Students Handbook on Taxation

- Padhuka’s Students Handbook on Advanced Accounting by CA G. Sekar and CA B. Saravana Prasath.

- Dinesh Madan’s Information Technology (IT)

Check the complete list of the best CA Intermediate books for the 2025 exam preparation.

CA Final Books

- Accounting Standards (D.S Rawat)

- CA Praveen Sharma Accounting Standard & INDAs

- SFM Module with Solution by Rahul Malkan

- CA Munish Bhandari (HandBook)

If you find the CA course is difficult to pass then you should register at VSI Jaipur Institute. VSI Jaipur is an established brand and it provides best offline and online classes for CA course in India. At VSI you’ll get all the relevant resources that help you in clearing CA exams in the first attempt.

Training in Chartered Accountancy Course

Training is the third and compulsory stage of the Chartered Accountancy course. Without completing the training, the students cannot appear in the CA Final exam. The training teaches you the daily responsibilities of a CA or Chartered Accountant.

There are four trainings in the CA Course, among which the Articleship training is of 2 years. These are:

- ICITSS Training

- AICITSS Training

- Articleship Training

- Industrial Training (Optional)

ICITSS Training

ICITSS (Integrated Course on Information Technology and Soft Skills) is the first training to develop soft skills and information technology in candidates. This training will consist of Information Technology (IT) and Orientation Course (OC) each of 15 days.

Articleship Training

The Articleship training plays a crucial role in CA Course. This training will give you Two years of practical

knowledge and experience in the work of a CA.

The CA students can apply for the Articleship training only after clearing one or both CA Intermediate groups. But to apply for the Articleship training, students compulsorily need to undergo the ICITSS training.

The students who have taken the direct entry to the CA Intermediate course can directly start the Articleship training after registering themselves for CA Intermediate. But here also, the ICITSS training is compulsory.

After completing the three years of Articleship training, one can apply or register for the CA Final Course. You can check out the guide on how to get an Articleship in the Big 4 firms.

AICITSS Training

AICITSS, or Advanced Integrated Course on Information Technology and Soft Skills is compulsory training conducted by ICAI. This training will teach you 2 skills – Advanced IT and Management & Communication skills. Each of the skills requires 15 days to complete.

The main motive behind this training is to accomplish the candidates with different sets of skills such as communication, presentation, leadership skills, understanding business environment, etc. Therefore, this training also helps the students of CA to get the desired job.

Industrial Training

Industrial training is optional for CA aspirants with the motive of training candidates with industrial functioning and knowledge. So, the candidates who want to make their career in the industries and their development can opt for the industrial training program provided by the ICAI. This training program is optional and depends upon the will of the CA candidates.

Skills Required to Become CA

To become a good Chartered Accountant, a candidate must have these skills:

- Good Communication

- Honesty and Accountability

- Confidentiality

- Ethics

- Ability to constantly learn new things

- Analytical Skills.

- Discipline, Diligence and hard Work

- Ability to Accept Failures

- General Business Interest and Awareness

- Conceptual Understanding

- Managing the tightrope walk

- IT Proficiency

- Organisational and time management skills

- Self-motivation and commitment.

Scope after Chartered Accountancy Course in India

Before enrolling in the course, it is crucial to know the scope of Chartered Accountancy in India. When it comes to CA, you will find ample opportunities as the demands for Chartered Accountants are high.

The primary reason behind the high demand in India is the lack of CAs in the country. A report by the Times of India has shown that India has only 44% of the total needed Chartered Accountants, which is not enough to handle the available workloads in the firms.

Also, with time, the number of businesses and taxpayers is increasing in the country, which eventually increases the demand for CA. This demand will increase in the future as the graph tends to always move in the upward direction.

In India, there are different job roles and opportunities for CA. Also, they work in various sections such as:

- CA Firm

- Financial Institutions

- Businesses

- Consultancy Firms

- Independent Practice

Different Job Roles of a CA

CAs have deep knowledge of different sectors related to finance and taxation. Therefore, they have a wider range of job roles in which they can fit. Here are the job profiles of a Chartered Accountant in which you can go:

- Chartered Accountant

- Financial Officer

- Auditor

- Cost Accountant

- Business Analyst

- Consultant

- Account Assistant

Top Chartered Accountant Firms in India 2025

- Deloitte India

- PwC India

- Ernst & Young India

- KPMG India

- Grant Thornton International

- SR Dinodia & Co. LLP

- Luthra & Luthra India

We have a detailed article on the top 10 CA firms in India. You can check the article to know more about these firms.

CA Salary in India in 2025

After knowing about the CA Course details, let us find the answer to how much a CA earns in India.

The recent placements conducted by ICAI in recent years have indicated that the CA salary in India is around Rs. 70000 to 75000. Moreover, the salary of any Chartered Accountant depends upon their post, experience, knowledge, and their rank. To get even a higher package, the students need to get good ranks in the CA Final exam and clear all the levels with fewer attempts.

This is the starting salary which definitely increases to Rs. 70 lakhs per annum with time and experience. The students who have cleared the CA Final Exams on the first attempt and other rank holders will get priority in placements and higher packages. Here you can check the CA salary in India.

| Particular | Salary of a CA |

|---|---|

| Freshers | INR 6-7 lac per annum |

| Experienced (4-5 yrs) | INR 9 lac per annum |

| Lowest salary | INR 4-5 Lac per annum |

| Average Salary | INR 8 lac per annum |

| Highest Salary | INR 2 crore per annum |

Read about CA salary in Hindi

Advance Courses after CA For Higher Career Growth

Many candidates after completing their CA search for advanced level courses that will give a boost to their career

and give them a higher salary. So, in the following section, we have mentioned the best courses after CA you should pursue.

- Diploma in Information System Audit

- Chartered Financial Analyst

- Certified Information System Auditor

- Investment Banking

- Financial Risk Management

- Bachelors of Law

Important ICAI links for the Chartered Accountancy Course:

FAQs

Ques 1. When can I start the CA Course?

Ans. One can start CA Course after clearing the class 12th exam or after graduation, while you can still start the preparation after class 10th.

Ques 2. What is the qualification of the CA Course?

Ans. To qualify for the CA Course, you need to clear the class 12th exam with 50%. Graduated students with a commerce background need to get at least 55%, and students with a science background need to get a minimum of 60%.

Ques 3. What are the subjects that I am going to study in Chartered Accountancy?

Ans. The subjects will vary as per the courses. However, overall, you will still study the subjects such as accounting, auditing, finance and management, Cost accounting, Income Tax, General studies of finances, etc., in Chartered Accountancy.

Ques 4. How to join a CA course after graduation?

Ans. After graduation, one can get direct entry to the CA Intermediate course. So, if you have completed graduation, register yourself for the CA Intermediate Course.

Ques 5. What is the duration of the CA Course after the 12th class?

Ans. After the 12th class, it will take almost 48 Months to complete the CA Course.

Ques 6. Is the CA Final course tough to crack?

Ans. Although the CA Final exam syllabus is lengthy, it is not so tough that one cannot pass it. You can definitely crack it in your first attempt with proper strategy and preparation tips.

Ques 7. What is CA Salary?

Ans. The Salary of a Chartered Accountant in India on various based job profiles.

- CA – 7.25 Lakhs Per Annum

- Financial Officer – 35 Lakhs Per Annum

- Assistant Account Manager – 5 Lakhs Per Annum

- Financial Analyst – 6 Lakhs Per Annum

Ques 8. Is there an age limit for CA?

Ans. Candidates can pursue the CA with their completion of the 12th Standard, and there is no upper age limit for the Program.

Ques 9. Can I Enroll in the CA Course after class 12?

Ans. Yes. You must take the Common Proficiency Test (CPT) before enrolling in the CA course after 12th grade. Once you pass this exam and are declared qualified, you can sign up for the CA foundation course.

Ques 10. Is Maths compulsory for CA?

Ans. No, Maths is not compulsory for CA.

Ques 11. What are the registration fees for CA courses?

Ans. The fees to be paid for registration of CA courses are given below:

- CA Foundation: INR 9,800

- CA Intermediate: INR 18,000

- CA Final: INR 22,000

Ques 12. Why CA Course?

Ans. The average compensation for a CA at the beginning of his career is around 7-8 lakh INR per annum. This is higher compared to most other professional courses. There is a single regulatory body certifying an individual as CA compared to other courses which are offered by many institutes thereby reducing disparities among CAs, unlike students who pursue other courses from various colleges.

Ques 13. Is CA a difficult course?

Ans. Becoming a CA is not tough as long as the applicants are committed, diligent, and sincere. This course requires a good amount of effort from the student. Long study hours and concentration are key when preparing for the CA examinations.

Ques 14. Is CA an expensive course?

Ans. It’s not as expensive as a professional finance degree like MBA. The whole cost of the CA course in India, including ICAI fees, books, study materials, coaching, and tuition costs, doesn’t exceed Rs. 4 lakh.

Ques 15. What is the CA New Syllabus?

Ans. The CA New Syllabus is an up-to-date curriculum created to meet the changing demands of the financial and business worlds. In a nutshell, it includes a shorter articleship duration, a new syllabus, and a higher stipend. As an aspiring professional, you should stay current with these changes and plan your CA career to succeed in this demanding but rewarding field.

Ques 16. How to prepare for CA?

Ans. To prepare for CA exams online, start with a structured study plan. Utilize reputable online resources, join virtual study groups, practice mock tests, and seek guidance from experienced mentors. Stay disciplined and focused to excel in your exams.