If you’re searching for “CA salary in India” or “How much does a CA earn?”, you’re probably wondering how much a Chartered Accountant really earns in today’s market. Let’s dive into the latest CA salary insights based on experience, location, and industry.

What is the Starting Salary of a CA in India?

The CA salary in India starts from Rs. 10 lakhs per annum, and can go as high as Rs. 50 lakhs per annum. Moreover, the Chartered Accountant salary in India can reach up to 1 crore or more per annum depending on their skills and experience.

Moreover, the CA monthly Salary will depend on his rank in CA Final, Articleship experience, job role, and the company in which he is working. Furthermore, fresher CAs who have cleared the exams in the first attempt get higher salary packages of INR 12- 13 lakhs per annum. Moreover, the salary provided to a CA topper in India is INR 15 to 20 Lakhs per annum.

| Particulars | Salary |

| CA Final cleared in many attempts | INR 8-9 Lakhs |

| CA Final cleared in 1st attempt | INR 12-13 Lakhs |

| CA Final Toppers | INR 15-25 Lakhs |

Chartered Accountants are among the highest-paid professionals in India, and their salaries are in lakhs. The primary reason for the high salary of a CA in India is the growth in the financial sector, which increased the demands and jobs of CAs.

The Big 4 companies and MNCs in India are among the biggest employers of CA. Moreover, CAs working outside India can earn handsome packages of up to INR 70 to 80 lakhs pa.

In Addition, you learn about the entire CA course. Click on this article to learn the complete details about the CA Course guide.

In this article, you’ll know the Chartered Accountant’s salary and the major factors that affect it, such as experience, skills, job profile and location.

Furthermore, to earn high perks of money, a lot of hard work and discipline are required. You will also need good CA articleship experience and clear the CA exams on the first attempt with an AIR. So, if you’re interested in accounting, taxation, and finances, Chartered Accountancy is an excellent and high-income career for you.

Read in Hindi: CA ki Salary

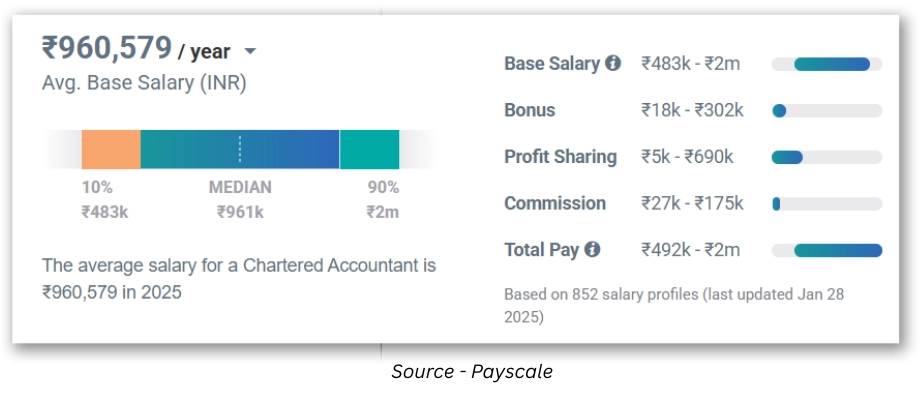

Average Salary of a CA in India 2025

Based on the ICAI Report 2025, the average CA salary in India is between Rs. 12 – 13 lakhs per annum and can go up to Rs. 50 – 60 lakhs.

- CA Salary in India per month – Rs. 50,000.

- Starting Salary of a Chartered Accountant – INR 8-9 LPA.

- Highest CA Salary Offered in Campus Placement 2025 – INR 29 LPA.

- Highest Salary of CA in India 2025 – Rs. 76 Lakhs per annum.

Check out the average salary of a Chartered Accountant in India in the table below:

| Particulars | Per Annum Salary | Monthly Salary |

| Average Salary for Freshers | INR 3.5 Lakh P/A | 29,000 P/M |

| Lowest salary | INR 2.5 to 3.0 Lakh P/A | INR 20000 – 23000 P/M |

| Experienced (2-3 yrs) | INR 5 to 7 Lakh P/A | INR 41000 – 58000 P/M |

| Highest Salary | INR 60 to 70 Lakh P/A | INR 5,00,000 to 5,80,000 Lakh P/M |

| CA final Rankers Salary | INR 15 to 25 Lakh P/A | INR 125000 to 200000 Lakh P/M |

Also Check: CMA Salary in India

Minimum Salary Package of a Fresher Chartered Accountant in India

The minimum package of a fresher Chartered Accountant in India is around INR 2.5 to 3 lakhs per annum. Generally, candidates who have cleared the CA exams in multiple attempts will get these low packages. But with consistent efforts and good performance, they can get a better salary in the long run. However, we suggest you work harder and clear the CA exams on the first attempt and get a high salary. Check out the latest RTPs, MTPs and previous year question papers for your CA exams.

Highest Per Month Salary of a CA in India

The highest salary of a fresher CA in India is 2-2.5 lakhs per month. It is offered to candidates who top the CA exams with an All India Rank. After getting experience and expertise, Chartered Accountants can earn up to 5 lakhs per month. However, foreign companies also employ CAs from India and pay them up to INR 76 lakhs per annum in exchange for their services. Furthermore, many chartered Accountants have their own businesses and are earning crores.

Also Read: CA Course Duration

CA Salary in India City-wise(Mumbai, Delhi, etc.)

Chartered Accountants all over India enjoy strong pay packages, but ca salary in india can vary a lot depending on where you work and how much experience you have. As a fresh graduate, you can expect around ₹12–13 lakh per year from campus placements. If you’ve been in the field a few years, data from leading career sites shows that most CAs in big cities earn between ₹10–12 lakh annually.

For example, the average CA salary in India is roughly ₹11.7 lakh in Bangalore, ₹11.6 lakh in New Delhi, ₹10.3 lakh in Mumbai, ₹10 lakh in Kolkata, ₹9.95 lakh in Chennai, and ₹9.76 lakh in Hyderabad. Smaller cities tend to pay a bit less. In Jaipur, CAs take home about ₹9.92 lakh; in Nagpur it’s around ₹9.5 lakh; Kochi averages ₹8.37 lakh; and in Lucknow a CA typically earns about ₹6.07 lakh. This shows how ca salary in India shifts from one region to another. Below, we explore these differences in detail.

CA Salaries in Top Metro Cities

In metros—Bangalore, Delhi, Mumbai, Chennai, Hyderabad, Kolkata, and Pune—ca salary in india is generally higher because these hubs host large banks, consultancies, tech giants, and MNCs. Bangalore and Delhi top the list: CAs there earn about ₹11.7 lakh and ₹11.6 lakh on average. That’s well above the national norm.

Mumbai, the financial heart of India, isn’t far behind at ₹10.3 lakh. Kolkata, a major industrial and trade center, pays around ₹10 lakh. In Chennai and Hyderabad, average packages sit just under ₹10 lakh—around ₹9.95 lakh and ₹9.76 lakh—reflecting their booming IT and manufacturing scenes. Pune, another fast-growing hub, typically pays CAs between ₹8–9 lakh on average.

Across these metros, fresh CAs often start at ₹6–8 lakh, while those with five-plus years of experience—especially in corporate finance, audit, or consulting—routinely cross ₹15 lakh. Senior roles in big firms or banks can even reach ₹20–30 lakh. In short, when you look at ca salary in india in these big cities, packages can range from ₹8 lakh for beginners up to ₹30 lakh for seasoned experts.

As you get more & more experience, CA salary in these cities can rise to ₹10–12 lakh for mid-level roles. A CA with 5–10 years under their belt might earn ₹10–12 lakh in a tier-2 city, compared with ₹15 lakh or more in a metro. While smaller centres don’t match metro salaries on paper, the lower cost of living means your take-home goes further. Overall, CA salary in India in tier-2/3 cities typically falls within ₹6–10 lakh.

Salary given to Chartered Accountants in different cities in India are:

| City | Average CA Salary (₹ lakh) | Entry-level Range (₹ lakh) | Mid-level Range (₹ lakh) |

|---|---|---|---|

| Jaipur | 9.92 | 4–8 | 10–12 |

| Nagpur | 9.50 | 4–8 | 10–12 |

| Kochi | 8.37 | 4–8 | 10–12 |

| Lucknow | 6.07 | 4–8 | 10–12 |

Why CA Salary in India Differ by City

Several simple reasons explain why ca salary in india changes from place to place:

- Demand for specialised skills: Metros have more openings in audit, consulting, M&A and corporate finance, so they pay more to attract talent.

- Industry presence: Big banks, tech giants and MNCs cluster in Delhi, Mumbai, Bangalore, etc., driving up salaries. Regional towns rely on smaller firms with tighter budgets.

- Cost of living: High rents and transport in Mumbai and Delhi mean employers must offer bigger pay packets.

- Experience: A newly passed CA might start at ₹6–8 lakh, but someone with 5–10 years in a Big Four or corporate finance role can command ₹20 lakh or more—even in the same city.

- Sector: Multinationals and banks pay more than local chartered firms or government roles. So a CA at a tech firm in Hyderabad could earn more than one at a small accounting practice down the street.

Key Takeaways:

- CA salary in India in metro-cities generally range from ₹8 lakh (entry) to ₹30 lakh (senior).

- Tier-2/3 CA salaries usually fall between ₹6–10 lakh, rising with experience.

- Fresh graduates see roughly ₹12–13 lakh nationally, with the best campus placements crossing ₹15 lakh.

- By understanding these regional CA salary in India trends, CAs and students can set realistic career goals and pick the right city to live and grow.

CA Salary Comparison Between India & Other Countries

The salary given to Chartered accountants differs according to the country he is working in. There are higher demands for CA in certain countries than in others. Furthermore, the salary packages also depend on the standard of living, human resource value, financial sector, and the size of businesses.

Check the below comparison table of CA salary in India vs other countries:

| Country | Fresher | Experience(4-5 yrs) | Lowest Salary | Highest Salary | Average Salary |

| India | INR 698.3k | INR 1000k | INR 437k | INR 7M | INR 804.3k |

| USA | $51.1k | $78.7k | $28k | $267k | $80k |

| Dubai | AED 100k | AED 121k | AED 27k | AED 616k | AED 119k |

| UK | £28.4k | £32.2k | £24k | £62k | £ 35.9k |

| Australia | AU$ 74.1k | AU$64.1k | AU$54k | AU$113k | AU$ 70.9 |

CA Salary in India by Industry(Big 4, MNCs, PSU)

The Big 4 CA Firms

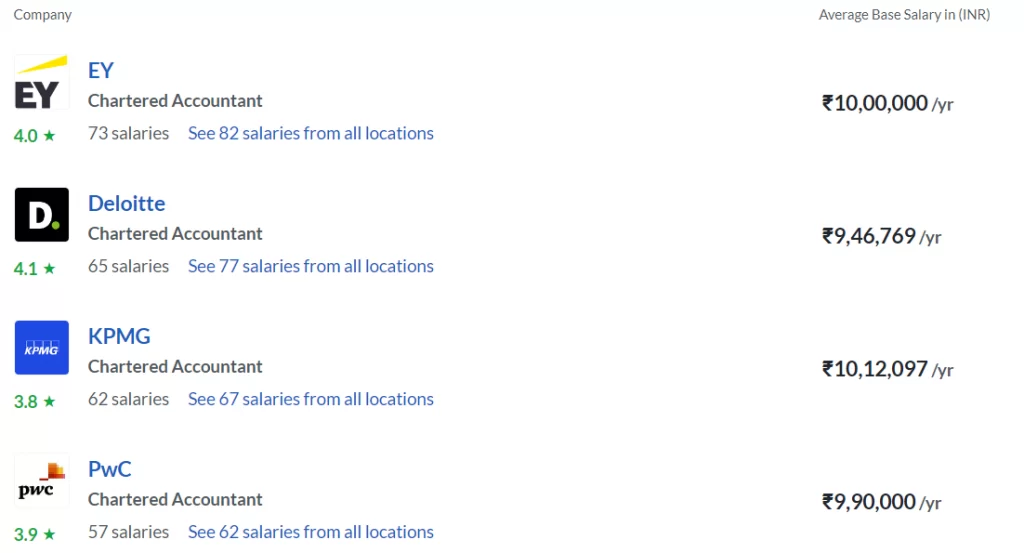

The Big 4 defines the four most extensive accounting firm networks. It consists of E&Y, PWC, Deloitte, and KPMG. The Big 4 firms are among the biggest employers and pay high CA salaries in India. Thousands of students work really hard to get a job in the Big 4 firms.

In Addition, the average CA salary paid by these big 4 firms ranges from INR 6-8 lakhs per annum for freshers. However, after acquiring experience and knowledge, these firms offer up to INR 25 lakhs per annum to a Chartered Accountant, depending on his capability and skill.

Salary of fresher Chartered Accountants in the Big 4 firms:

| Big 4 Firm | Least Salary | Highest Salary |

| Deloitte LLP | INR 45,000 | INR 60,000 |

| PricewaterhouseCoopers | INR 48,000 | INR 68,000 |

| Ernst & Young | INR 40,000 | INR 63,000 |

| KPMG | INR 46,000 | INR 62,000 |

CA Salary in Multi-National Companies and FMCGs

Multinational and FMCG companies offer a starting CA salary of 18-25 lacs per annum. To get a job in multinational companies such as HUL, P&G, RB, and Marico, you need to get an AIR under 50 as they hire only ranked students.

In addition to an attractive Chartered Accountant salary, you’ll receive perks and financial benefits like free conveyance, a leased car, accommodation, insurance, and more.

Salary of CA Firms

The salary offered by top CA Firms generally ranges between INR 3-8 lacs per annum. After all, Joining a CA firm in the initial years will give you great exposure and work experience. Here, a fresher Chartered Accountant learns how to deal with clients or income tax officers. Later, you can start your own practice and can earn higher perks of money.

CA Salary in IT Companies

The salary offered by IT companies to the fresher Chartered accountants ranges from INR 8 to 10 lakhs per annum, and the experienced accountants will get around INR 50-60 lakhs per annum. Furthermore, IT Companies like TCS, Wipro, and Infosys are best for CAs who don’t want an extra workload. In these companies, CAs enjoy a good job with a handsome package and less workload. Also, the work is to increase profit and reduce losses by using their analytical skills and knowledge. However, being an enthusiastic Chartered Accountant is often not preferred as it will not upgrade your knowledge and expertise.

CA Salary in Public Sector Undertakings

The CA salary offered by PSUs ranges between INR 7-15 Lacs per annum. However, the annual increment is very limited, but it is still a good option. In addition, Government companies or PSUs like BSNL, ONGC, BHEL, and GAIL hire many fresher CAs from the ICAI campus placement, and these companies often shortlist the candidates based on their marks ranging from 55% to 60%.

Chartered Accountant Salary in Banks

Chartered Accountant Salary in India basically ranges from Rs 8 Lakhs to Rs 12 Lakhs. But it varies on Banks and your different position. The starting salary of a CA fresher in a Bank is Rs 37,000 per month and experienced CA can earn more. From managing the Financial reports to auditing. CAs are an essential part of the smooth formation of Banks.

CA Salary Range in Banks in 2025

- In the Reserve Bank of India, CA salary should be around Rs 18 Lakhs to Rs 25 Lakhs per year, with an average of Rs 22 Lakhs.

- If you are a fresher with no experience then your Ca salary in India will be Rs 6-9 Lakhs per annum.

- 3-5 years of work experience then Rs 15-25 Lakhs per annum.

- Senior Level 5+ year experience: Rs 25 – 45 Lakhs per annum.

| Experience Level | Salary Range |

| Fresher | ₹6–9 Lakhs |

| 3–5 Years | ₹15–25 Lakhs |

| 5+ Years | ₹25–45 Lakhs |

| RBI CA | ₹18–25 Lakhs |

Key Employers:

- Private Banks: HDFC, ICICI, Kotak and Axis Bank (CA salary Rs 6-9 Lakhs for fresher)

- Public Banks: SBI, Bank of Baroda (CA salary Rs 8-18 Lakhs for fresher and mid-level roles)

- Reserve Bank of India: Rs 18-25 Lakhs per annum for experienced CA with medical and housing facilities.

Factors that Affect the Salary

- Experience – If you are a Fresher, experienced, or a Senior Person then your CA salary in Banks depends on it.

- Different Job Profile – If you have different roles in a Bank such as Taxation, Audit, or Financial Management. Your CA salary varies from it.

- Bank Type also matters – If you are in a Public Bank then it can offer you more packages than a Private Bank, but this is not always right.

- Location – Salary expectations can vary from popular cities like Bangalore and Mumbai Banks provide the Highest CA Salary as compared to others.

- Certification – If you are certified with CPM, CMA, or specialized in Taxation then you can earn 20-30% more.

Note: The salary of a CA is not always fixed, it can vary on your skill, performance, and the area of the Bank where it is situated.

Career Role in Bank for a CA

- Audit Executive: Conducting an audit to identify and control the financial risk

- Risk Manager: Manage Financial Risk for the Bank.

- Financial Analyst: Analyse the financial data and prepare a report.

- Treasury Manager: Manage the cash flow of the bank and financial planning.

Opportunities to Maximize Your Skill

In banking, there is an outstanding growth of CA. As a fresher, you can start your role in Audit and Analytics but you can advance your position as Risk Manager with experience. Continuing learning, such as getting a certificate of CMA or CPA or specializing in Investment Banking, can enhance your CA Salary.

The Banking Sector in India offers a profitable opportunity for CA, with experience and certification, CA can reach senior positions and earn a good CA salary.

CA Salary in Manufacturing Companies

The CA salary offered in manufacturing companies is very lucrative, considering the significant role Chartered Accountants have to play in cost control, budgeting, taxation, and overall financial strategy. Due to the development and growth of manufacturing companies and the shift towards more formalized financial strategies, the need for CAs continues to rise.

Entry-Level CA Salary

For the freshers, the salary of CA in manufacturing companies is between ₹6 to ₹9 lakhs per year. The same may differ depending on different factors such as the company’s size, location, and educational qualification of the candidate. Top companies such as Tata Steel, Reliance Industries, and Aditya Birla Group can possibly offer more packages with some additional benefits and perks.

Mid-Level Salary of CAs

3 to 5 years experienced Chartered Accountants will receive a salary ranging from ₹12 to ₹18 lakhs per annum. Here, candidates generally take up roles like Finance Manager, Costing Manager, or Plant Accountant. CA salary at this level normally comprises performance incentives, retention incentives, and benefits like medical cover and provident fund.

Senior-Level CA Salary

At senior positions such as Financial Controller, Head of Finance, or CFO, CA salary for manufacturing companies can be anywhere between ₹30 to ₹50 lakhs per year or more. These roles need good leadership qualities, financial knowledge, and the ability to manage large teams and multi-crore budgets efficiently. Other perks can also be profit sharing, stock options, and international experience.

Factors Influencing CA Salary

Several determinants influence the CA salary in the manufacturing industry:

- Company Size and Turnover: Larger companies offer better pay packages.

- Location: Salaries are generally higher in urban cities like Mumbai, Chennai, and Pune.

- Skills and Qualifications: Knowledge of SAP, IFRS, and costing can result in higher pay as can CMA qualifications.

- Performance: Top-performing CAs usually get fast-track promotion and incentive bonuses.

Briefly, the CA salary in manufacturing firms is high with a lot of room for progress. With India encouraging more industrial development under policies like “Make in India,” the need for skilled Chartered Accountants in the manufacturing sector is bound to rise.

Factors Affecting CA Salary Packages in India

Chartered Accountant (CA) Salary in India depends on a few important things like How much experience does the CA have? A person who is just a fresher and passed a CA Exam and starting their first job usually earns around ₹6 – ₹8 Lakh per year. That is considered a decent starting Salary. But it doesn’t stay the same. If someone is learning more and taking on bigger roles in a company, their salary also increases.

After 8 years in this field, many CA earn ₹40 Lakh to ₹50 Lakh per year. Some earn more if they work for big companies or go abroad. This shows that being a CA can lead to a strong and stable career. The more you grow in your job, the better the pay becomes.

Each additional year of experience adds expertise and often leads to managerial roles, both of which boost compensation. Similarly, a CA’s skill set has a significant effect: expertise in high‑demand areas such as auditing, taxation, financial analysis, or risk management allows one to command higher packages.

Indeed, one analysis observes that a CA’s compensation is largely determined by their skills. Thus, professionals who continually upgrade their capabilities (for example, mastering new regulatory knowledge or accounting software) improve their market value and command better pay. Acquiring these specialized skill sets often leads to a marked increase in CA salary in India. Finally, the specific job profile (role and designation) critically influences earnings. Higher designations like Finance Manager, Controller or Chief Financial Officer (CFO) carry much larger salaries than junior posts.

For instance, CFOs in India typically command salaries starting at about ₹35 lakh per year, far above entry‑level ranges. In summary, variations in CA salary in India largely reflect these three factors: more experienced, highly skilled CAs in senior roles earn significantly more than their less experienced or specialized peers. For aspiring CAs, understanding these trends underscores the value of continuous learning and career advancement.

Employers also look at the same thing like how much a CA is experienced, what skills they have and how difficult the Job is. They use this to decide How Much Salary to Offer. It helps them to give fair pay based on actual work being done. That is why CA Salary in India is not the same for everyone. It depends a lot on what the job needs and how well the person fits into this role. It becomes clear why some CA earn less and others earn more. It is not about the title in front of your name, it is about the work behind it.

CA Salary in India Based on Experience – Freshers to Seniors

Chartered Accountants in India are in high demand, and their pay reflects it. A newly qualified CA can expect a starting salary of roughly ₹6–9 lakhs per annum in industry jobs, while leading audit firms often pay about ₹6–8 LPA for fresh CAs. Official placement data shows even higher averages: for example, the latest ICAI campus placement report (Nov/Dec 2024) gave an average package of ₹12.49 LPA and top offers of about ₹26–29 LPA for fresh CAs. In practice, a fresher CA’s salary in India can range widely – as low as ~₹3–4 LPA in smaller firms up to 15–20 LPA in high-profile roles. One report notes small CA firms offering freshers around ₹3–8 LPA while Big Four firms offer ₹6–8 LPA.

Freshers (0–1 years)

For newly qualified, starting CA salary in India vary by employer. Top audit and consulting firms typically start fresh CAs at about ₹6–8 LPA. Smaller firms or corporate accounts teams may offer lower, often in the ₹3–6 LPA range. However, campus placements by the ICAI show higher numbers: the recent drive averaged ₹12.5 LPA for placed CAs, meaning many new CAs at large companies or banks earn well above ₹10 LPA. High performers can land exceptional packages – e.g. offers of ₹26.7 LPA and even ₹29 LPA were reported in late-2024. In short, a fresh CA in India today might earn anywhere from ~₹4 LPA (e.g. small firm) to 15+ LPA (top firms), depending on company and city.

Early Career (1–3 years)

After a couple of years of experience, CA salaries in India generally rise significantly. With 1–3 years’ experience, many CAs move into senior associate or analyst roles. Roughly, salaries may climb into the ₹7–12 LPA range or higher, though exact figures depend on the role. Industry reports suggest mid-level CAs often earn around ₹8–10 LPA. Employers reward this experience with hikes, so second-year CAs often see double-digit increases over fresher pay. By the end of three years, a CA might be leading small audit teams or handling tax portfolios, which can push compensation toward the upper end of that range.

Mid-Career (4–7 years)

At 4–7 years of experience, CAs enter senior roles (Manager, Senior Manager, etc.), and pay jumps further. In big firms, the jump is especially large: for example, the Big Four audit firms report that a CA with ~4–5 years can earn around ₹23 LPA. In industry or mid-size companies, mid-career CAs typically earn in the ballpark of ₹15–25 LPA, depending on sector. Specialized skills (like international tax, risk management, or finance analytics) and promotions to managerial jobs boost salaries. By this stage, many CAs also negotiate annual bonuses or allowances, making total compensation even higher.

Senior-Level (8+ years)

Senior CAs with 8 or more years’ experience command the highest pay. Many become finance managers, divisional CFOs or partners in firms. Salaries vary widely: experienced finance heads in large firms can earn ₹30 LPA and up, with top industry roles easily exceeding ₹50 LPA. A few exceptional cases (e.g. CFOs of major companies or partners in Big4) see compensation in the ₹60–70 LPA+ range. By this point, a CA’s industry, company and role matter more than just years of experience.

| CA Experience | Per Annum Salary |

| 0-1 Year | INR 6-8 lakhs |

| 1-3 Years | INR 7-12 lakhs |

| 4-7 Years | INR 15-25 Lakhs |

| Above 8 Years | INR 60-70 Lakhs |

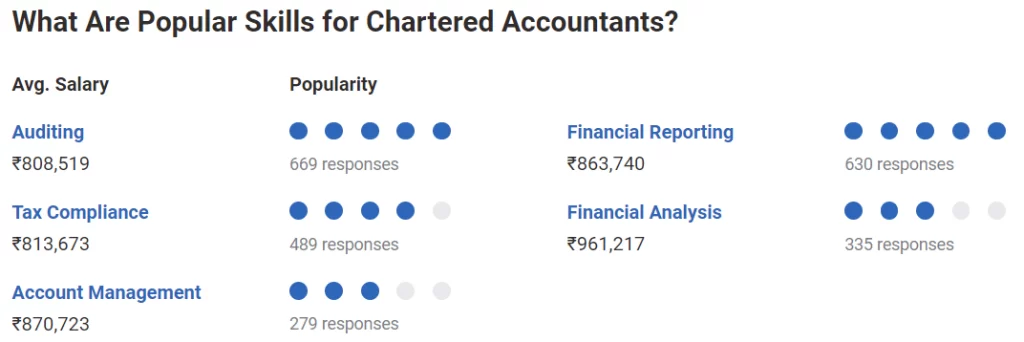

Chartered Accountant Salary Based on Skills

One of the biggest factors that affect a Chartered Accountant’s salary is their skillset. While the average CA salary in India ranges from ₹6 to ₹10 lakhs per year for freshers, professionals with in-demand technical skills earn far more—even in the early stages of their careers. This article breaks down how your skills directly influence CA salary in India, especially for salaried professionals.

Whether you’re a fresher deciding which skills to focus on or a mid-level CA looking to upskill, knowing how each skill impacts salary is key.

Top Technical Skills That Boost CA Salary in India

Below are some of the most valuable technical skills that influence a Chartered Accountant’s salary in India in 2025–2026. These are average annual salaries for salaried CAs across sectors:

- Budget Management – ₹9.5 to ₹11 lakhs

CAs who are experts in budgeting play a key role in cost control and future planning for companies. Employers value their ability to allocate resources efficiently, and this reflects in the higher salary bracket. - Strategic Accounts – ₹8.9 to ₹9 lakhs

Those with a deep understanding of strategic account planning often work closely with senior management. This niche skill commands a premium salary due to its impact on long-term financial decision-making. - Evaluation and Management Auditing – ₹8.5 to ₹9 lakhs

This skill goes beyond regular audits. It involves assessing the performance of departments and suggesting improvements—making CAs in this field highly sought-after. - Financial Analysis – ₹8.5 to ₹8.8 lakhs

This is one of the most in-demand skills in modern accounting roles. CAs who can interpret numbers to help businesses make better decisions often earn above-average packages. - Financial Advisory – ₹8.5 to ₹8.75 lakhs

Professionals who guide individuals or businesses on wealth planning, investment structuring, or mergers and acquisitions often draw strong compensation. - SAP Financial Accounting & Controlling (SAP FICO) – ₹8.1 to ₹8.25 lakhs

This technical software skill is a game-changer. SAP-trained CAs are heavily recruited by MNCs and large corporates for system-based accounting roles. - Financial Reporting – ₹8 to ₹8.2 lakhs

CAs who excel in preparing accurate and compliant financial statements are vital to public and private firms, especially listed companies. - Auditing – ₹7 to ₹7.5 lakhs

Traditional but essential, auditing remains a strong foundation skill. While it starts at a slightly lower salary, experience can push this higher over time. - Account Management – ₹7 to ₹7.25 lakhs

This includes client servicing and long-term relationship management. It’s a mix of numbers and communication, leading to consistent growth in roles and pay. - Internal Audit – ₹7.25 to ₹7.35 lakhs

CAs in this role are responsible for compliance, risk assessment, and internal checks, which are vital in regulated industries. - Accounting – ₹7.25 to ₹7.35 lakhs

The core of all CA work, accounting offers a stable career path. While not the highest paying at entry level, it forms the base for all other high-paying specializations. - Tax Consulting – ₹7.10 to ₹7.25 lakhs

With regular updates in Indian tax laws, consultants are always in demand. Salaries in this area are higher for those with deep knowledge of GST and income tax. - Tax Compliance – ₹7 to ₹7.2 lakhs

Ensuring that individuals and businesses meet all their legal tax obligations, this skill is critical in large organizations and CA firms.

| CA Skills | Per Annum Salary |

| Budget management | INR 9.5-11 lakhs |

| Strategic accounts | INR 8.9-9 lakhs |

| Evaluation and management auditing | INR 8.5-9 lakhs |

| Financial analysis | INR 8.5-8.8 lakhs |

| Financial advisor | INR 8.5-8.75 lakhs |

| SAP financial accounting and controlling | INR 8.10-8.25 lakhs |

| Financial reporting | INR 8.-8.2 lakhs |

| Auditing | INR 7-7.5 lakhs |

| Account management | INR 7-7.25 lakhs |

| Internal audit | INR 7.25-7.35 lakhs |

| Accounting | INR 7.25-7.35 lakhs |

| Tax consulting | INR 7.10-7.25 lakhs |

| Tax compliance | INR 7-7.1 lakhs |

Also, Check Courses After B.COM to Enhance additional Skills as a CA.

CA Salary in Different Job Profiles

A CA has vast knowledge in various fields of finances and taxes and thus has a lot of job opportunities. He can go for Financial officer, Accountant, Finance Manager or Business Analyst. Top placements in big companies or IT firms can offer even ₹8–10 lakh for freshers. For example, audit firms in the “Big 4” usually begin CA freshers around ₹6–8 lakh. This shows the typical CA fresher salary in India.

Private Sector and Corporate Roles

In the private sector (MNCs, startups, accounting firms), salaries grow quickly with experience. Mid-level (3–5 years) CA salary in India is ₹15–25 lakh, covering roles in auditing, taxation, internal audit and finance. Senior CAs and managers in large companies frequently earn above ₹25 lakh.

Top finance positions like finance controller or CFO can command ₹20–30 lakh or more. In fact, seasoned CAs in senior roles may reach ₹40–60 lakh per year. These ranges reflect the diverse chartered accountant job profiles in corporate India.

Government Sector and PSUs

Government and public sector companies also hire CAs. Entry-level CA posts in PSUs (like ONGC, HPCL) offer CA salary packages around ₹6–15 lakh per annum. Banking and regulatory jobs pay higher. For example, an RBI officer (a CA) earns roughly ₹18–25 lakh with allowances.

Even large banks (ICICI, HDFC, SBI) typically start new CAs at ₹5–10 lakh. Though slightly lower than top private jobs, government roles include benefits and steady growth.

International and Big 4 Jobs

Many Indian CAs work with global firms or abroad. Big 4 accounting firms recruit Indian CAs through campus placements (often ₹6–8 lakh for freshers) and have offices worldwide. CAs in multinational corporations or finance roles overseas often earn higher (in foreign currency), reflecting the broader CA job scope.

While specific international pay isn’t always public, it’s common for such positions to exceed domestic packages, especially at senior levels.

Factors Affecting CA Salary in India

Several factors influence a CA’s pay. High exam ranks and a strong articleship can lead to top offers from large firms. Location matters: metro cities (Mumbai, Delhi, Bangalore) usually pay more. Company size and sector (finance, tech, manufacturing) affect budgets. Crucially, a CA’s skills and expertise drive salary.

Having a strong foundation in financial knowledge, tax laws and auditing is essential for a well-paid CA. Specialized skills (e.g. advanced taxation, SAP accounting, financial analysis) can further boost earnings. In summary, a CA’s salary in India starts modestly but can grow into the tens of lakhs as experience, skills and opportunities increase.

Given below is the list of Chartered accountant salaries based on their work profiles.

| CA Job Profile | Per Annum Salary |

| Financial officer | INR 35 lakhs |

| Account executive | INR 25 lakhs |

| Accountant | INR 25 lakhs |

| Finance controller | INR 19 lakhs |

| Finance manager | INR 10 lakhs |

| Chartered accountant | INR 7.25 lakhs |

| Financial analyst | INR 6 lakhs |

| Assistant account manager | INR 5 lakhs |

| Senior account executive | INR 4 lakhs |

| Senior accountant | INR 3.5 lakhs |

| Business analyst | INR 4 lakhs |

| Account assistant | INR 2 lakhs |

Must Check: Which is better CA or MBA?

Highest Paying CA Jobs in India

When we think of the CA salary in India, one of the first thoughts that pops into your mind is how broad the earnings potential is. An Chartered Accountant (CA) is one of the most prestigious and lucrative jobs in India. However there are a few exceptions to the rule.

CA positions pay the same amount of money. Certain roles are distinct due to their level of responsibility, the experience needed and the field within which the CA is employed. Let’s take a look at some of the highest paying CA jobs in India and the factors that make them profitable.

1. CA in Investment Banking

Investment banking is among the highest-paying fields for CAs. People who work in this area are involved in mergers and acquisitions IPOs and private equity and massive financial transactions. Because of the complexity and high stakes of the job, the CA salary in India in the area of investment banking can range from 15 to 20 lakhs for those with 3-5 years experience. Senior investment bankers who have more than eight years of work experience could make more than Rs. 40 lakhs per year.

2. Chief Financial Officer

A CA who ascends up the corporate ladder may eventually become a CFO, an extremely sought-after jobs in any organization. CFOs are in charge of the company’s financial planning as well as risk management, reporting and strategic decision-making. In MNCs or large companies CFOs make between Rs50 lakhs and one crore annually or more, with incentive programs that are tied to performance.

3. CA as an Independent Practitioner or Consultant

CAs who have set up the practice of their choice or provide offer consultancy services can earn a substantial amount based on the volume of clients they manage. Offering services such as GST and income tax, internal audits, as well as business advice to companies or start-ups can earn high income. If you are a seasoned professional and a seasoned professional, it is possible to earn a compensation for CAs working in India could be as high as the threshold of Rs30-40 lakhs a year.

The CA salary in India varies significantly based on role, industry, experience and location. Entry-level professionals at top firms may start with annual packages between Rs7-10 lakhs while experienced specialists in niche sectors can command packages as high as Rs. 30 lakhs annually. Continuous learning and specialization are keys to growth – whether within corporate roles or independent practices alike being a Chartered Accountant can open doors of financial success and professional respect.

You can check out the step-by-step process of becoming a CA in our detailed guide.

Does the Number of CA Exam Attempts Affect the CA Salary?

You might think that your rank will pull you back in the starting years to get your dream salary. It is true, but your hard work and smartness can lead you to the level you deserve.

Many people who have taken 2-3 attempts in the CA Final started their careers with one of the Big 4 firms with a starting package of just INR 6-8 lakhs. However, in 4-5 years, they have maintained a good position, and their average salary has risen to INR 24-25 Lakhs per annum. Also, many candidates left the Big 4 firms within one year due to the overload of work pressure.

How to Earn a High CA Salary in India

Becoming a Chartered Accountant is one of the most respected career paths in India, but securing a top-tier CA Salary in India takes deliberate effort. To boost your chartered accountant salary in India, you need to combine exam excellence, strategic career moves, and continuous skill building. Below is a plan that lays out each step, drawing on real-world insights and keeping the Indian context in mind.

1. Get a High Rank in CA Exams

Earning a high rank in your CA exams immediately signals your capability to recruiters and places you on the fast track for premium pay packages. In India, top rank holders often land starting offers well above the average CA Salary in India, sometimes in the ₹18–25 lakh range, simply because firms know they’re hiring the cream of the crop. Achieving a top rank not only boosts your chartered accountant salary in India but also opens doors to your desirable position at the Big Four or major banks.

To aim for a high rank:

- Follow a realistic study plan that covers every topic systematically and leaves room for multiple revisions.

- Take regular mock tests under exam conditions to build stamina and identify weak spots.

- Focus on understanding concepts in subjects like auditing and taxation, rather than rote memorization.

- Join peer study groups or online communities to discuss tricky problems and keep each other motivated.

Candidates who pass on the first try demonstrate reliability and dedication—traits companies value highly. A clean record of first-attempt clears not only accelerates your Articleship start but also gives you a head start on earning a competitive CA fresher income. Remember: every extra attempt delays your entry into full-time roles and can slightly dent your initial pay scale.

2. Clear CA exams in Fewer Attempts

Passing each level of the CA course in as few attempts as possible shows hiring managers you’re disciplined and results-oriented. In the competitive market for accounting talent, firms often prefer candidates who finish exams on schedule. Completing the exams promptly lets you begin your articleship sooner, where your earning potential for CAs really starts to grow.

Key habits to clear exams efficiently:

- Break down subjects by weightage: Prioritize studying topics that carry more marks.

- Regular revision cycles: Schedule weekly and monthly refreshers of difficult areas.

- Analyze past papers: Understand common question patterns and focus your practice.

- Seek timely help: Don’t let doubts linger—consult seniors, mentors, or coaching experts right away.

By minimizing exam attempts, you save months of preparation and jump straight into hands-on work. That means you hit your first real paycheck faster, laying the groundwork for a steadily rising CA Salary in India. Plus, firms notice a track record of quick clears and may reward you with accelerated promotions or higher stipends during Articleship.

If a candidate does not get an All India rank but clears the CA exams in one or two attempts, he can still earn a good monthly income. Based on the recruitment insights of the top CA firms in India, Chartered Accountants will surely get a salary of 14 to 15 lakhs rupees with fewer attempts.

3. Master Financial Accounting and Analysis

Your command over financial accounting and analysis is the bedrock of a strong CA Salary in India. Employers value CAs who can interpret complex statements, build robust financial models, and deliver clear, actionable insights. Whether you’re advising a client on valuation or supporting a corporation’s budget review, those skills translate directly into higher pay.

How to deepen your expertise:

- Dive into case studies: Analyze real company reports to see standards like Ind AS/IFRS in action.

- Build your own models: Practice creating projections, ratio analyses, and scenario simulations in Excel.

- Stay updated on standards: Regularly review ICAI updates and guidance on accounting rules.

- Publish insights: Share bite-sized analyses or chart visuals on LinkedIn to demonstrate your know-how.

Advanced proficiency in accounting not only boosts your current chartered accountant salary in India, but sets you on a path toward leadership roles—finance manager, CFO—where pay scales can cross ₹40 lakh per annum or more. Exhibiting analytical strength makes you indispensable, which firms recognize through faster hikes and performance bonuses.

4. Learn Microsoft Excel

Excel is the CA’s best friend and a key driver of a competitive CA Salary in India. From pivot tables to advanced formulas, mastering Excel elevates your efficiency and analytical depth, enabling you to tackle larger projects and command higher fees or salaries.

To become an Excel power user:

- Master core functions: VLOOKUP, INDEX/MATCH, SUMIFS, and date computations.

- Automate with macros: Record basic VBA scripts to streamline repetitive tasks.

- Visualize data: Create dynamic charts and dashboards that communicate complex data clearly.

- Explore add-ins: Learn to use Power Query and Power Pivot for large datasets.

CAs who demonstrate Excel fluency often move quickly into roles like audit lead or financial planning analyst, both of which carry above-average chartered accountant pay. During interviews, reference specific Excel projects you’ve completed to showcase your hands-on expertise.

5. Join a Good Articleship Firm

Your Articleship choice profoundly impacts your starting CA Salary in India and career trajectory. Stipends at Big Four firms typically start around ₹12,000–15,000 per month in metro hubs and can climb to ₹20,000 by year three. Smaller firms may only pay the ICAI minimum, which is far less.

Why a top firm matter:

- Higher stipends reflect more rigorous training.

- Prestige factor: Big Four experience boosts your CV and negotiating power.

- Pre-placement offers: Many leading firms retain the best clerks as full-time hires at premium pay.

- Diverse exposure: Work on multinational clients and complex assignments.

To secure a strong Articleship:

- Maintain stellar CA exam marks.

- Seek referrals from seniors or professors who know top firms.

- Demonstrate keenness to learn during interviews by asking insightful questions.

Choosing a respected firm not only raises your stipend but often leads to a direct pathway into high-paying roles post-qualification, giving your CA pay scale an early boost.

6. Make Your Communication Skills Strong

Excellent communication is a force multiplier for your CA Salary in India. Whether drafting audit reports, presenting budgets, or advising clients, the ability to convey complex finance jargon in simple terms makes you stand out.

Ways to sharpen your soft skills:

- Write clearly: Practice concise, jargon-free report writing.

- Speak confidently: Volunteer for client meetings or internal presentations.

- Listen actively: Ensure you fully understand questions before responding.

- Train formally: Short workshops in business communication can pay dividends.

CAs who balance technical acumen with polished communication often land leadership roles—trainings, client pitches, stakeholder meetings—which come with higher pay grades and bonuses. Strong communicators also find it easier to negotiate for better chartered accountant salary in India.

7. Locality of Service

Your work location has a direct bearing on your CA Salary in India. Metro cities—Mumbai, Delhi, Bangalore and Chennai—tend to offer more lucrative salaries, sometimes exceeding ₹10 lakh per year even for freshers. Tier-2 cities like Pune or Ahmedabad are catching up but generally start lower.

Consider these points:

- City allowances: Big cities often include cost-of-living adjustments.

- Industry hubs: Finance, IT services, and manufacturing centres typically pay more.

- Remote flexibility: Some firms now offer hybrid roles with metro-level salaries for talent in smaller cities.

By aligning your service location with high-value markets, you position yourself for top offerings and steady growth in your earning potential for CAs. Even within cities, targeting sectors with the biggest budgets—like investment banking or MNC finance teams—can amplify your CA pay scale.

CA Fresher Salary in India Monthly

The Chartered Accountant salary in India in 2025 shows the growing demand for finance professionals in various sectors. Whether you are a fresher, a rank holder, or someone with a decade of experience, understanding the Chartered Accountant salary in India per month is crucial when planning your career.

For freshers, the monthly salary usually ranges from ₹55,000 to ₹75,000. It can be higher for CA rank holders or those placed in metro cities like Mumbai, Delhi, or Bangalore due to higher cost of living and demand.

Show MoreOther Important Points to Consider:

1. CA Ranker Salaries in India: CA rank holders enjoy a significant salary advantage. Their packages often range from ₹15 LPA to ₹25 LPA at the beginning of their careers. Top firms and MNCs actively recruit them for their strong academic credentials.

2. CA Final Ranker Salary in India: A CA final ranker may begin their career with ₹20–25 LPA, rising to ₹35–50 LPA within a few years depending on the company and sector. They also enjoy faster career progression.

3. CA Salary in India Monthly for Freshers: Freshers can expect a salary range of ₹55,000 to ₹90,000 per month. Cities like Mumbai and Gurugram offer higher pay due to demand and industry presence.

4. CA Salary in India after 10 Years: After 10 years, a Chartered Accountant may earn between ₹25 LPA and ₹50 LPA. Leadership roles such as CFO, Head of Finance, or Financial Controller are common at this level.

5. Average Salary of CA in India Per Month: The average monthly salary of a CA is approximately ₹1,00,000. Professionals in investment banking, consulting, or international tax roles tend to earn significantly more.

6. Maximum Salary of CA in India per Month: The highest monthly salaries are earned by CAs in senior leadership roles in MNCs, especially in investment banking and private equity. Some packages can go upwards of ₹5–6 lakhs/month.

7. CA Salary India Big 4: In the Big 4 (Deloitte, PwC, EY, KPMG), CA freshers earn between ₹8 LPA and ₹15 LPA. With experience, this can rise to ₹30 LPA or more, with opportunities for international exposure and rapid growth.

8. CA Salary in Dubai for Freshers: Indian Chartered Accountants in Dubai earn between AED 8,000 and AED 12,000 monthly, equivalent to ₹1.8L to ₹2.7L. Salaries are tax-free and may include allowances for housing and travel.

9. CA Salary Per Month Based on Experience

- Fresher: ₹55,000 – ₹75,000

- 3–5 years: ₹1.2L – ₹1.8L

- 10+ years: ₹2L – ₹4L+

10.Sector-wise CA Salary in India

- Banking and Finance: ₹10–40 LPA

- IT and Consulting: ₹8–35 LPA

- Manufacturing and FMCG: ₹6–25 LPA

- Startups: ₹5–20 LPA (plus ESOPs)

- Government Sector: ₹7–12 LPA

11.Skills That Impact CA Salary

Skills that can significantly boost a CA’s salary include:

- Financial Modeling

- IFRS and IND AS Knowledge

- International Tax Expertise

- Data Automation & Analytics

- Leadership and Communication Skills

Chartered Accountant Salary in India Monthly by City

| City | Fresher Salary (Monthly) | 10+ Years Experience |

|---|---|---|

| Mumbai | ₹70,000–₹90,000 | ₹3.5L–6L |

| Delhi NCR | ₹65,000–₹85,000 | ₹3L–5L |

| Bangalore | ₹60,000–₹80,000 | ₹2.8L–4.5L |

| Hyderabad | ₹55,000–₹75,000 | ₹2.5L–4L |

| Kolkata | ₹50,000–₹70,000 | ₹2L–3.5L |

Earnings of a Practicing Chartered Accountant

CAs who start their practice can earn a handsome income based on their capabilities to get high-paying clients. On average, the annual income of a practicing Chartered Accountant is around INR 20 to 22 lakhs. Furthermore, if he gets big clients, then he can easily earn around INR 50 lakhs per annum. However, the minimum salary a practicing CA earns is around INR 10-11 Lakhs annually.

Furthermore, Practising CAs can earn a sound income by acquiring high-paying clients. On average, the annual income of a practicing Chartered Accountant is around INR 20 to 22 lakhs. Furthermore, if he gets big-budget clients, then he can easily earn around 50 lakhs rupees yearly. However, the minimum earnings of a practising CA is around INR 10-11 lakhs annually.

Final Thoughts

The CA salary in India continues to show a strong growth trajectory. Whether you’re analyzing CA salary in India per month for freshers, experienced professionals, or those in Big 4 firms, the profession remains one of the most lucrative in India. With technical expertise, global exposure, and sector-specific experience, CAs can aim for top-paying roles both in India and abroad.

Show LessWhat are the Income Sources for CA Other than Salary?

Apart from salary, the other income sources for CA are:

- Consultation Fees – A CA who offers consultation services gets the fees. This fee will be based on the time duration of the consultation or based on the specific tasks.

- Commission—Companies offer a commission to CAs who solve certain financial problems, such as preparing merger books or presenting good books to investors.

- Bonus – CAs whose performance is good and benefits companies in earning higher profits get a bonus in addition to their salary.

Also Read: CA Course Fees in India

Frequently Asked Questions

Q 1. What is CA salary per month in India?

Ans. The average monthly salary of a Chartered Accountant (CA) in India ranges from ₹60,000 to ₹1,50,000 for freshers, while experienced professionals can earn between ₹2,00,000 to ₹5,00,000+ per month. Salaries vary based on factors such as experience, industry, location, and skillset. CAs working in Big 4 firms, investment banking, or multinational companies typically earn on the higher end of the scale.

Q 2. What is CA fresher salary?

Ans. The average salary of a CA fresher in India ranges from ₹6 to ₹8 lakhs per annum, depending on the employer and role. Through ICAI campus placements, top performers can earn ₹10–15 lakhs annually. Freshers joining Big 4 firms typically earn ₹8–12 lakhs, while roles in investment banking may offer ₹15–25 lakhs. Salary varies based on skills, interview performance, and job location.

Q 3. Are Chartered Accountants the Highest paid professionals in India?

Ans. Chartered Accountants are indeed the highest-paid professionals in India. The highest salary of a CA can reach up to 60 to 70 lakhs per annum.

Q 4. Who earns more, a Doctor, CA or Lawyer?

Ans. The CAs earn better than doctors and lawyers when compared between salary, course, work, and duration.

Q 5. Which industries pay high salaries to CA in India?

Ans. The top-paying industries for CAs are Accounting, Financial Services, Banks, IT & Consultation, and Construction.

Q 6. What is the salary of a CA in Delhi?

Ans. In Delhi, the average CA salary is INR 8,25,000 per annum.

Q 7. What is the CA salary in Mumbai?

Ans. In Mumbai, the average CA salary per annum is INR 8,80,000.

Q 8. Why are CA aspirants wasting 5, 6 or more years under so much pressure when the average CA salary is just 7 to 8 lakhs?

Ans. Students must note that 7-8 lakhs is the average salary of a CA fresher. If they can get an AIR and clear the exams in 1-2 attempts, their starting package will be 15 to 20 lakhs. Moreover, even if CA starts with a low package, the growth & salary in this profession is very high.

Q 9. Do those who clear the CA exam on the first attempt earn more salary?

Ans. Yes, candidates who have cleared the CA exams on the first attempt earn a higher salary. They might get an annual package of Rs. 13-15 lakhs per annum.

Q 10. Is it tough to become a CA?

Ans. Yes, it is tough to become a Chartered Accountant. You must clear the three levels of CA exams, which are considered the most difficult exams in India.

Q11. Which has a better salary, CA or CMA?

Ans. CA deals with Accounting, Auditing, and Taxation, while CMA deals only with Management Accounting. That’s why the demand for CA remains high, due to its covering a larger area. For this reason, the salary of a CA is also high. To learn more about the comparison of CA and CMA, click on the CA vs CMA link.