CA Foundation is the first step of a CA Course, and to crack for the CA Foundation exams, on the first attempt, students must refer to the right and latest study materials. Therefore, we are providing the latest and chapter-wise ICAI CA Foundation study material pdf for the Sept. 2025 attempt. These study modules are the ICAI-prescribed books covering the complete CA Foundation syllabus in an easy and understandable way.

Students can download the chapter-wise CA Foundation Syllabus 2025 PDFs in English and Hindi from the ICAI official website or from the links given below on this page.

Apart from the study material, we’ll also provide a list of the best CA Foundation books that will help in your exam preparation. These reference books will help get into the details of a particular topic.

If you want to know the CA Foundation Exam Date for Sept. 2025. The exam dates for CA Foundation Sept. 2025 are 16, 18, 20 and 22, 2025. To know more details check the link.

The ICAI has recently proposed the CA New scheme of education & training. Under the new syllabus, ICAI will change all the levels of the CA Course and the Articleship.

Table of Contents

Edition of the ICAI Foundation Study Material 2025

| CA Foundation Subjects | Edition |

| 1) Accounting | 2025 |

| 2) Business Laws | 2025 |

| 3) Quantitative Aptitude 1. Business mathematics 2. Logical reasoning &; 3. Statistics | 2025 |

| 4) Business Economics | 2025 |

Steps to Download ICAI CA Foundation Study Material PDF 2025

Follow the steps to download the CA Foundation Course Material pdf for free from the ICAI official website.

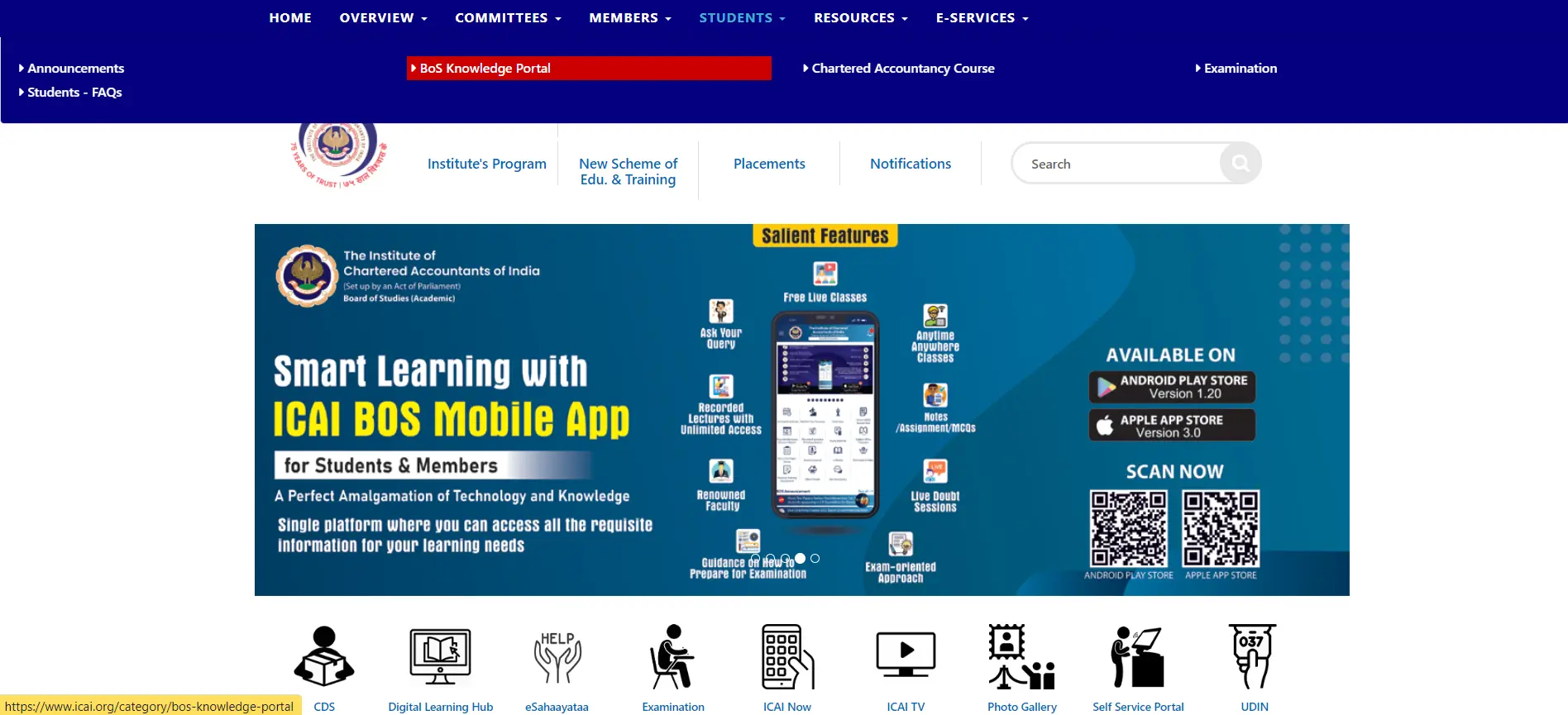

Step 1: Visit the official website of ICAI. Bring your cursor to the ‘Students’ section, and click on the ‘BoS Knowledge Portal’ from the list.

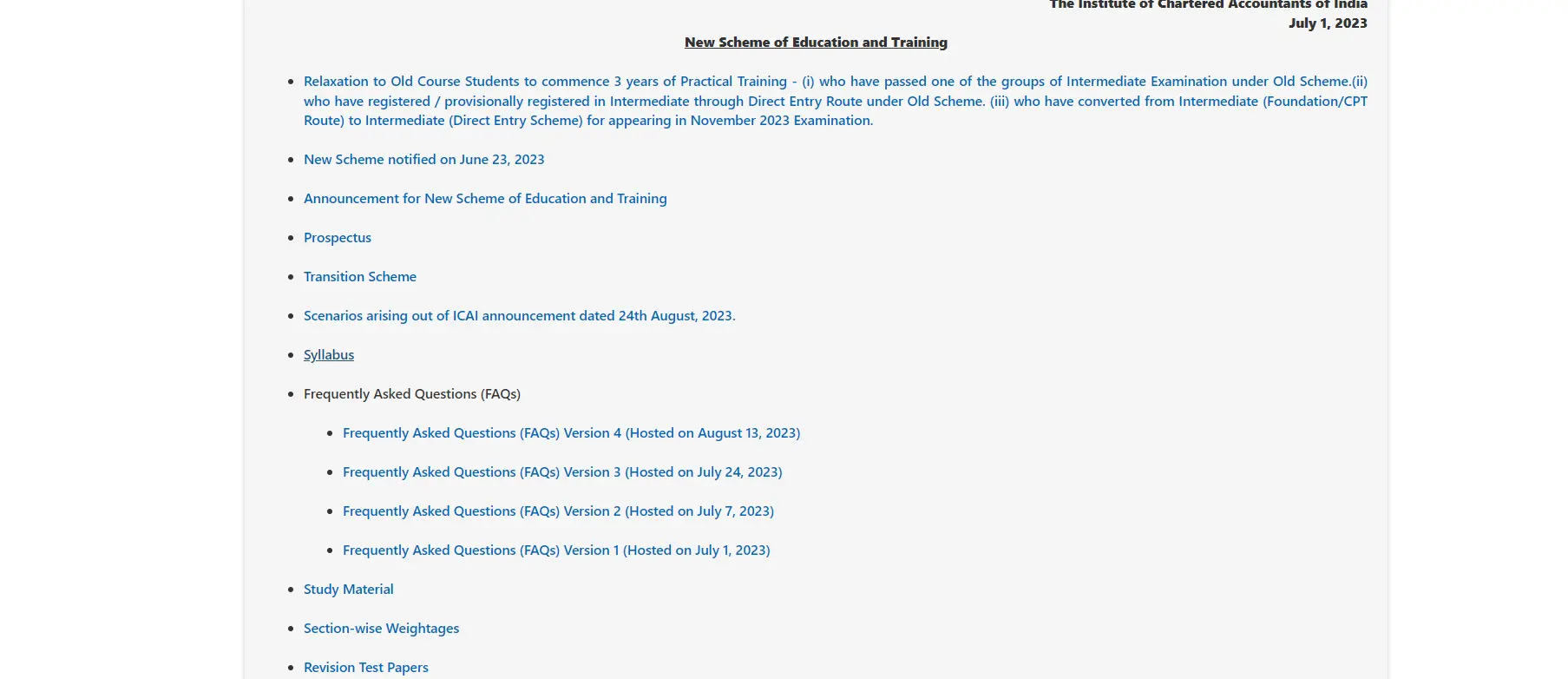

Step 2: Click on the ‘Study Material’ appearing under the New Scheme.

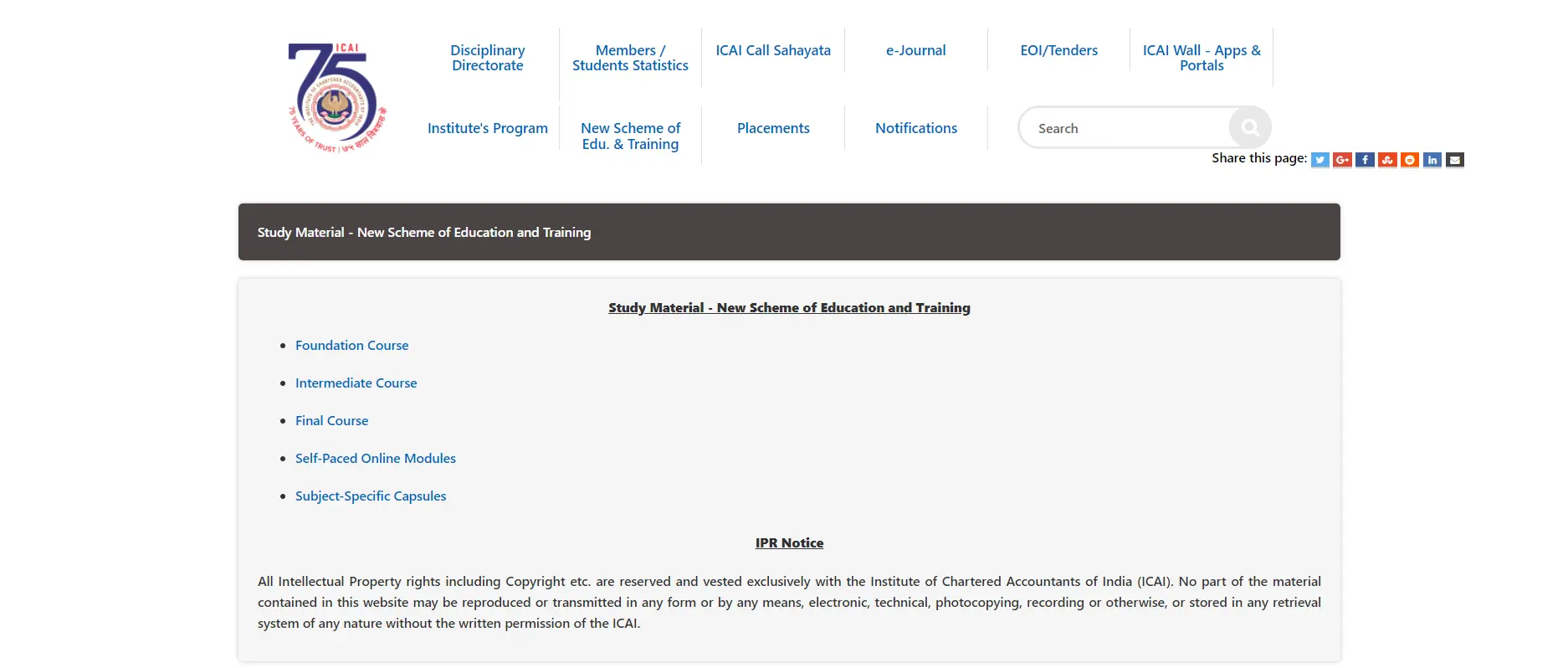

Step 3: Click on the ‘Foundation Course’ appearing under the Study Material.

Step 4: Now, a list will appear on the page with all four papers listed. Click on any of the papers mentioned in the list.

Step 5: Now, a list will appear with all the Character-wise topics. Choose any topic by clicking on it to get the study material. That’s how you can download topic-wise study material for the CA Foundation course.

Other than the ICAI study materials, students can also download the CA Foundation question papers pdf with their solutions from the ICAI website.

Read More: Check out the CA salary in India for 2025.

Download PDF of CA Foundation Study Material 2025 in English

In the following sections, you’ll get the direct link to download the study material for all the CA Foundation subjects and their topics.

Paper 1: Principles and Practices of Accounting

The CA Foundation accounts study modules for Sept. 2025 are given in the table below.

Also check: CA Foundation Fees Structure

Paper 1: Accounts (Sept. 2025)

The CA Foundation accounts study modules for Sept. 2025 are given in the table below.

Chapter 11: Company Accounts Unit 1: Introduction to Company Accounts

CA Foundation May 2025 Paper Solutions

Paper 2: Business Laws and Business Correspondence and Reporting

The Business laws and business correspondence and reporting study material pdf are given below:| Business Law Study Material | |

| Initial Page | |

| Chapter 1: The Indian Contract Act, 1872 | Unit 1: Nature of Contracts |

| Unit 2: Consideration | |

| Unit 3: Other Essential Elements of a Contract | |

| Unit 4: Performance of Contract | |

| Unit 5: Breach of Contract and its Remedies | |

| Unit 6: Contingent and Quasi Contracts | |

| Chapter 2: The Sale of Goods Act, 1930 | Unit 1: Formation of the Contract of Sale |

| Unit 2: Conditions & Warranties | |

| Unit 3: Transfer of Ownership and Delivery of Goods | |

| Unit 4: Unpaid Seller | |

| Chapter 3: The Indian Partnership Act, 1932 | Unit 1: General Nature of a Partnership |

| Unit 2: Relations of Partners | |

| Unit 3: Registration and Dissolution of a Firm | |

| Chapter 4: The Limited Liability Partnership | The Limited Liability Partnership |

| Chapter 5: The Companies Act, 2013 | The Companies Act, 2013 |

| Download Business Correspondence and Reporting Study Material | |

| Initial Page | |

| Chapter 1 | Communication |

| Chapter 2 | Sentence Types and Direct-Indirect, Active-Passive Speech |

| Chapter 3 | Vocabulary |

| Chapter 4 | Comprehension Passages |

| Chapter 5 | Note Making |

| Chapter 6 | Introduction to Basics of Writing |

| Chapter 7 | Precis Writing |

| Chapter 8 | Article Writing |

| Chapter 9 | Report Writing |

| Chapter 10 | Part I: Formal Letters |

| Part II: Official Communication | |

| Chapter 11 | Writing Formal Mails |

| Chapter 12 | Resume Writing |

| Chapter 13 | Meetings |

Paper 2: Business Laws Study Material CA New Scheme 2025

| Business Laws | |

| Initial Page | |

| Chapter 1: Indian Regulatory Framework | Indian Regulatory Framework |

| Chapter 2: The Indian Contract Act, 1872 | Unit 1: Nature of Contracts |

| Unit 2: Consideration | |

| Unit 3: Other Essential Elements of a Contract | |

| Unit 4: Performance of Contract | |

| Unit 5: Breach of Contract and its Remedies | |

| Unit 6: Contingent and Quasi Contracts | |

| Unit 7: Contract of Indemnity and Guarantee | |

| Unit 8: Bailment and Pledge | |

| Unit 9: Agency | |

| Chapter 3: The Sale of Goods Act, 1930 | Unit 1: Formation of the Contract of Sale |

| Unit 2: Conditions & Warranties | |

| Unit 3: Transfer of Ownership and Delivery of Goods | |

| Unit 4: Unpaid Seller | |

| Chapter 4 The Indian Partnership Act, 1932 | Unit 1: General Nature of Partnership |

| Unit 2: Relations of Partners | |

| Unit 3: Registration and Dissolution of a Firm | |

| Chapter 5: The Limited Liability Partnership Act, 2008 | The Limited Liability Partnership Act, 2008 |

| Chapter 6: The Companies Act, 2013 | The Companies Act, 2013 |

| Chapter 7: The Negotiable Instruments Act, 1881 | The Negotiable Instruments Act, 1881 |

Paper 3: Business Mathematics and Logical Reasoning and Statistics

The Business Mathematics and Logical Reasoning and Statistics study material pdf are given below:| Download Business Mathematics and Logical Reasoning & Statistics | |

| Initial Pages | |

| Part A: Business Mathematics | Chapter 1: Ratio and Proportion, Indices, Logarithms |

| Chapter 2: Equations and Matrices | |

| Chapter 3: Linear Inequalities | |

| Chapter 4: Time Value of Money | |

| Chapter 5: Basic Concepts of Permutations and Combinations | |

Chapter 6: Sequence and Series – Arithmetic and Geometric Progressions | |

| Chapter 7: Sets, Functions and Relations | |

| Chapter 8: Basic Concepts of Differential and Integral Calculus | |

| Part-B: Logical Reasoning | Chapter 9: Number Series, Coding and Decoding and Odd Man Out |

| Chapter 10: Direction Tests | |

| Chapter 11: Seating Arrangements | |

| Chapter 12: Blood Relations | |

| Chapter 13: Syllogism | |

| Part-C: Statistics | Chapter 14: Statistical Description of Data |

| Chapter 15: Measures of Central Tendency and Dispersion | |

| Chapter 16: Probability | |

| Chapter 17: Theoretical Distributions | |

| Chapter 18: Correlation And Regression | |

| Chapter 19: Index Number and Time Series | |

| Appendices | |

Paper 3: Quantitative Aptitude Study Material CA New Scheme 2025

| Initial Pages | |

| Part A: Business Mathematics | Chapter 1: Ratio and Proportion, Indices, Logarithms |

| Chapter 2: Equations | |

| Chapter 3: Linear Inequalities | |

| Chapter 4: Mathematics of Finance | |

| Chapter 5: Basic Concepts of Permutations and Combinations | |

| Chapter 6: Sequence and Series – Arithmetic and Geometric Progressions | |

| Chapter 7: Sets, Relations and Functions, Basics of Limits and Continuity functions | |

| Chapter 8: Basic Applications of Differential and Integral Calculus in Business and Economics | Differential CalculusIntegral Calculus |

| Part-B: Logical Reasoning | Chapter 9: Number Series, Coding and Decoding and Odd Man Out |

| Chapter 10: Direction Tests | |

| Chapter 11: Seating Arrangements | |

| Chapter 12: Blood Relations | |

| Part-C: Statistics | |

| Chapter 13: | |

| Chapter 14: Measures of Central Tendency and Dispersion | |

| Chapter 15: Probability | |

| Chapter 16: Theoretical Distribution | |

| Chapter 17: Correlation and Regression | |

| Chapter 18: Index Numbers |

Paper 4: Business Economics and Business and Commercial Knowledge

The Business Economics and Business and Commercial Knowledge study material is given below:| Download Business Economics Study Material | |

| Initial Page | |

| Chapter 1 | Nature & Scope of Business Economics |

| Chapter 2 | Theory of Demand and Supply |

| Chapter 3 | Theory of Production and Cost |

| Chapter 4 | Meaning and Types of Markets |

| Chapter 5 | Business Cycles |

| Glossary | |

| Self-Examination Questions | |

| Download Business and Commercial Knowledge Study Material | |

| Initial Page | |

| Chapter 1 | Introduction to Business & BCK |

| Chapter 2 | Business Environment |

| Chapter 3 | Business Organizations |

| Chapter 4 | Government Policies for Business Growth |

| Chapter 5 | Organizations Facilitating Business |

| Chapter 6 | Common Business Terminologies |

Paper 4: Business Economics Study Material CA New Scheme 2025

Download CA Foundation Study Material 2025 PDF in Hindi

Paper 1: Principles and Practice of Accounting (Hindi)

- Module 1

- Initial Pages

- Chapter 1: Theoretical Framework

- Unit 1: Meaning and Scope of Accounting

- Unit 2: Accounting Concepts, Principles And

Conventions - Unit 3: Accounting Terminology – Glossary

- Unit 4: Capital And Revenue Expenditures and

Receipts - Unit 5: Contingent Assets and Contingent

Liabilities - Unit 6: Accounting Policies

- Unit 7: Accounting as a Measurement Discipline –

Valuation Principles, Accounting Estimates - Unit 8: Accounting Standards

- Unit 9: Indian Accounting Standards

- Chapter 2: Accounting Process

- Chapter 3: Bank Reconciliation Statement

- Chapter 4: Inventories

- Chapter 5: Concept and Accounting of Depreciation

- Chapter 6: Accounting for Special Transactions

- Module-2

- Initial Pages

- Chapter 7: Preparation of Final Accounts of Sole Proprietors

- Chapter 8: Partnership Accounts

- Chapter 9: Financial Statements of Not-for-Profit

Organizations - Chapter 10: Company Accounts

Paper 2: Business Laws and Business Correspondence and Reporting (Hindi)

Section A: Business Laws- Initial Pages

- Chapter 1: The Indian Contract Act, 1872

- Chapter 2: The Sale of Goods Act, 1930

- Chapter 3: The Indian Partnership Act, 1932

- Chapter 4: The Limited Liability Partnership Act, 2008

- Chapter 5: The Companies Act, 2013

Paper 3: Business Mathematics and Logical Reasoning and Statistics (Hindi)

- Initial Pages

- Part-A: Business Mathematics

- Chapter 1: Ratio and Proportion, Indices, Logarithms

- Chapter 2: Equations

- Chapter 3: Linear Inequalities

- Chapter 4: Time Value of Money

- Chapter 5: Basic Concepts of Permutations and

Combinations - Chapter 6: Sequence and Series – Arithmetic and Geometric

Progressions - Chapter 7: Sets, Functions and Relations

- Chapter 8: Basic Concepts of Differential and Integral Calculus

- Part-B: Logical Reasoning

- Part-C: Statistics

Paper 4: Business Economics and Business and

Commercial Knowledge (Hindi)

Part-I: Business Economics

- Initial Pages

- Chapter 1: Nature & Scope of Business Economics

- Chapter 2: Theory of Demand and Supply

- Chapter 3: Theory of Production and Cost

- Chapter 4: Price Determination in Different Markets

- Chapter 5: Business Cycles

Part-II: Business and Commercial Knowledge

- Initial Pages

- Chapter 1: Business and Commercial Knowledge – An Introduction

- Chapter 2: Business Environment

- Chapter 3: Business Organizations

- Chapter 4: Government Policies for Business Growth

- Chapter 5: Organizations Facilitating Business

- Chapter 6: Common Business Terminologies

Students can also check the CA Foundation exam

pattern in order to start their preparation in a smart way. This will help them in investing more time in

important and high-scoring topics. Thus, it will help you in getting a good CA Foundation result.

How To Order ICAI CA Foundation Books from the Official Website?

Step 1: Go to the official website of ICAI: icai-cds.org to order CA Foundation books.

Step 2: Now, if you filled out the CA Foundation registration form, then select the sign-in option from the top right corner of the page.

Step 3: A new page will appear showing the student course kit. Click on the Order Now.

Step 4: Now, a page will appear with a category filter box on the top left corner of the page. If you have registered yourself with the Board of Studies (BOS) and paid the registration fee, then you have to select the option Study Material against Registration (New course) and if you haven’t registered then select the option Study Material for Sale (All course).

Step 5: Choose the language Hindi or English after clicking on the Foundation category.

Step 6: A new page will appear with the list of books that are available in the foundation study kit. Choose the books by clicking on them.

Step 7: A list of books in the kit occurs on a new page. Select the books you want to buy and then add to your cart. Proceed to see the books in the cart.

Step 8: Registered users directly place the order without doing payment proceedings, and they have already made the payment included in the registration fee. Non-registered can place their order after making a payment. During your placing an order, an AWB number is noted down. Your delivery will be made within 12 working days by AWB tracking using the AWB number.

Students can also download the CA Foundation books PDF from the ICAI official website. Students can fill out the CA Foundation exam form for the May 2025 exams form starting from March 1 to March 14, 2025(without late fees).

Register Now for CA Foundation online classes

Best CA Foundation Books to Crack the 2025 Exams

The best books required for the CA Foundation exams preparation are:1. Principles And Practice Of Accounting Books

- General Economics – S.K.Agarwal

- Fundamentals of Accounting for CA – Foundation – P.C Tulsian and Bharat Tulsian

- Padhuka Basics of Accounting for CA Foundation – G. Sekar & b Saravana Prasath

- Fundamentals of Accounting – D.G Sharma

- Foundation Grewal’s Accountancy – M.P Gupta & B.M Aggarwal

2. CA Foundation Mercantile Law Books

- Mercantile Laws for CA Foundation – P C Tulsian

- S Chand Mercantile Laws for CA Foundation – P P S GOGNA

- Mercantile Law – M.C.Kuchhal and Vivek Kucchal

- Padhuka MCQ Bank – G Sekar and B Sarvana Prasath

3. Quantitative Aptitude Books

- Quantitative Aptitude Mathematics With Short Tricks – CA Rajesh Jogani

- Quantitative Aptitude – Dr T.Padma and K.C.P Rao

- Quantitative Aptitude for Foundation: mathematics and Statistics – Tulsian P. C. and Jhujhunwala Bharat

- Padhuka’s Practical Guide On Quantitative Aptitude For CA Foundation – G.Sekar, B.Saravana Prasath

4. CA Foundation Other Reference books

- Quantitative Aptitude – P. N. Arora

- General Economics – P M Salwan & Pranjal B Deshpande by Taxmann

- Question Bank with Model Test Papers for CA – Foundation – Accounting, Mercantile Laws, General Economics & Quantitative Aptitude – R C Bhatt

How to Select the Best CA Foundation Books?

Students must look for various points before picking up the best books for their CA Foundation preparation:

- Always choose the latest books as they will contain all the latest amendments.

- Check the contents of the books. The book must have all the topics that are relevant to your Dec 2023 exams.

- Check the reviews of the books. Students can get reviews from their seniors and teachers as they will have a better knowledge about the books and the exams.

FAQs on CA Foundation Study Material

Ques 1. Is the CA Foundation study material available for free?

Yes, ICAI provides free Study material to students. Registered students can also get the ICAI CA Foundation books for free, as the registration fees already cover the cost.

Ques 2. How can I get CA Foundation study material?

You can download the Study Material online from the BoS portal of ICAI. Moreover, you can also order the study material from the ICAI official website.

Ques 3. Why study the ICAI CA Foundation Modules?

The CA Foundation modules by ICAI are the finest study material available for exam preparation. You’ll get enough knowledge to prepare for the exams, along with exam patterns, important topics and how to write answers.

Ques 4. Which study material is best for the CA Foundation preparation?

The CA Foundation study material provided by the ICAI is the best for exam preparation.

Ques 5. Does ICAI CA Foundation study material cover the complete syllabus?

Yes, the study material provided by ICAI covers the complete CA Foundation syllabus. Therefore, we advise all the students to focus only on the ICAI CAFC study material.

Ques 6. Which books should I prefer for the CA Foundation?

You should read the study material and books provided by the ICAI. We have also mentioned some other best reference books recommended by our expert teachers.

Ques 7. Are CA Foundation exams easy?

Yes, CA Foundation exams are easy. You will crack it by studying thoroughly from ICAI study modules and books, by solving mock test papers, revision test papers, and previous year question papers.

Ques 8. Can I do self-study for the CA Foundation exams?

Yes, you can prepare yourself for the CA Foundation exams. But make sure to focus on understanding the concept rather than memorising the syllabus.