Becoming a Chartered Accountant (CA) is one of the most respected career choices in India, and every year thousands of commerce students and working professionals dream of earning this title. If you are also wondering how to become CA, this guide will help you understand the entire journey in a clear and practical way. The CA course is managed by The Institute of Chartered Accountants of India & it includes three levels—CA Foundation, CA Intermediate, and CA Final—along with articleship training.

Students choose this profession not only for its high salary and job security but also for the respect and global opportunities it offers. In this article, we’ll break down the eligibility, registration process, duration, syllabus, fees, and step-by-step process so you get a complete roadmap to becoming a successful Chartered Accountant in India.

CA Course Details

Mentioned below is a tabular representation of the complete CA Course details, including eligibility, registration, subjects, exams, and fees for all three levels.

| CA Foundation | CA Intermediate | CA Final | |

| Eligibility | Appear in 12th exams | Clear foundation or graduation or PG | Clear intermediate level practical training |

| Examination held | January, May and September | January, May and September | January, May and September |

| Registration Validity | 3 years (6 attempts) | 4 years (6 attempts) | 5 years (10 attempts) |

| Subjects | 4 | 6 (3 each group) | 6 (3 each group) |

| Fees | Rs 11300 | Rs 27200/23200 | Rs 39800 |

Eligibility Criteria to Become CA

Becoming a CA is not only about clearing exams, it is about meeting certain eligibility criteria eligibility criteria at each level of this course. These regulations ensure that all students possess the proper background & sincerity to successfully complete the path.

CA Foundation Eligibility:

You can apply for the CA Foundation after passing your Class 12th exam from any recognized board.

CA Intermediate Eligibility:

There are two ways to enter this stage:

By clearing the CA Foundation exam, or

Through Direct Entry Route, if you are a graduate or postgraduate from a recognized university.

CA Final Eligibility:

To sit for the CA Final, you must:

Clear the CA Intermediate exam, and

Complete at least 2.5 years of articleship training under a practicing CA.

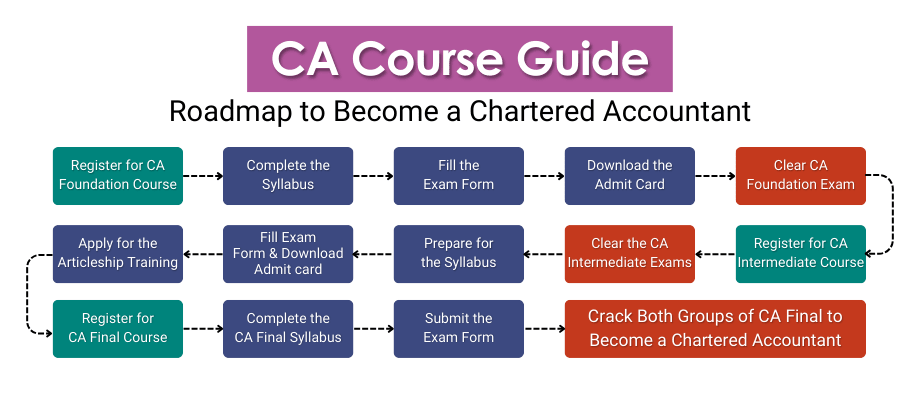

Steps to become a Chartered Accountant(CA)

Step 1. Register for the CA Foundation Exams

The CA Foundation exam is an entry-level exam for becoming a chartered accountant in India. Class 12th appearing or passed students can enrol for the CA Foundation course. Registration for the CA Foundation course is done online through the ICAI official website and is valid for three years.

After registration, you’ll get a study period of 4 months to complete the CA Foundation syllabus. During this period, you must also fill out the CA Foundation exam form to get the admit card and sit in the exams.

CA Foundation Papers – There are 4 papers in the CA Foundation exams that students must clear:

- Paper 1: Accounting

- Paper 2: Business Law

- Paper 3: Quantitative Aptitude

- Paper 4: Business Economics

CA Foundation Exam Pattern – The CA Foundation exam pattern is partially objective and subjective. The first two papers are subjective types, and the following two papers are objective types. However, all the papers consist of 100 marks.

According to the passing criteria, you need to get 40% in each subject and a total of 50% in all the papers to clear the exams. The CA Foundation Result is declared by ICAI 2 months after the exams. Join the CA Foundation coaching from VSI to clear the exams in one go. Along with the result, ICAI also declares the CA Foundation Passing Percentage.

The fee for the CA Foundation course is Rs 11,300. It includes the registration fee of Rs 9800 and the exam form fee of Rs 1500. Upon clearing the CA Foundation course, you will be eligible to register for the CA Intermediate course.

Must Check: CA Foundation Preparation

Step 2. Register & Crack the CA Intermediate Exams

Eligible students can register for the CA Intermediate exams for the January, May and September sessions, respectively. The CA Inter registration is valid for four years, which means you have 8 attempts to clear the exams.

After registration, you will get 4-month periods to study for the exams. Moreover, you must fill out the CA Inter exam form and also download the admit card on the prescribed date by the ICAI.

CA Intermediate Subjects – CA Intermediate Syllabus consists of 6 subjects categorized into 2 groups. The CA Inter subjects are:

CA Inter Group 1 Subjects:

- Paper-1: Advanced Accounting

- Paper-2: Corporate Laws & Other Laws

- Paper-3: Taxation

Section A: Income Tax Law

Section B: Goods and Service Tax

CA Inter Group 2 Subjects:

- Paper-4: Cost and Management Accounting

- Paper-5: Auditing and Assurance

- Paper-6: Financial Management and Economics for Finance

Section A: Financial Management

Section B: Strategic Management

The exam pattern of CA Intermediate is both subjective and objective. All four papers of both groups consist of 100 marks each. To clear a CA Intermediate group, you need to get 40% in each subject and 50% aggregate.

Students who get more than 60 marks in a subject get an exemption. It means they don’t have to appear in that subject in the successive 2 attempts. The CA Intermediate result is announced 2 months after the last paper.

To prepare for this exam, you’ll need to join a good CA Intermediate Coaching that guarantees course completion within 5-6 months. It will give you enough time for self-study and revision.

Furthermore, students also need to complete 4 weeks of the short integrated course on information technology and soft skills (ICITSS). The ICITSS training needs to be completed before commencing the practical training.

The CA Inter course fee is Rs. 18,000 for both groups and Rs. 13,000 for a single group. Furthermore, the examination fee is Rs 2700 for both groups and Rs 1500 for a single group.

Must Check: Study Plan for CA Intermediate Exams

Step 3. Complete the CA Articleship Training of 2 Years

Candidates can start their CA articleship training as soon as they pass any CA Intermediate groups and complete the ICITSS training. Afterward, they can register for practical training.

The 3 years of articleship training will give you vast exposure to practical work that a Chartered Accountant does in the real world. After completing 2 years of articleship training, students become eligible to appear for the CA Final exams. The fee to register for the CA Articleship is Rs 2000.

We have seen that some students go for dummy articleship. But they are making a big mistake as they’ll not get practical exposure while working on an article. So, never opt for a dummy articleship.

Step 4. Crack Both Groups of the CA Final Exams

Students need to clear both groups of CA Intermediate to be eligible to appear for the CA Final exams. Its registration is valid for 5 years, which means 10 attempts.

Moreover, to fill out the CA Final Exam Form, they need to complete 4 weeks of ICITSS & Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) training and 2 years of articleship.

CA Final Subjects – The CA Final New Syllabus includes 6 subjects that are categorized into two groups:

Group I Subjects:

- Paper-1: Financial Reporting

- Paper-2: Advanced Financial Management

- Paper-3: Advanced Auditing, Assurance, and Professional Ethics

Group II Subjects:

- Paper-4: Direct Tax Laws & International Taxation

- Paper-5: Indirect Tax Laws

- Paper-6: Paper-6: Integrated Business Solutions

Section A: Corporate and Economic Laws

Section B: Strategic Cost & Performance Management

CA Final Exam Pattern – Again, the CA Final exams are both subjective and objective. Here also, each paper consists of 100 marks. Paper 6 is an open-book exam, and you can choose from 6 optional subjects.

To clear the CA Final exams, you have to obtain 40% in each subject and 50% in aggregate. Those who got more than 60 marks in a paper get an exemption in the subsequent 3 attempts. The CA Final Result will be released by ICAI about 2 months after the last paper.

The fees for the CA Final course are ₹ 22000 for both groups. The examination fee is ₹ 3300 for both groups and ₹ 1800 for one group. At the final level, the registration fee is the same whether you enroll for one or two groups.

Furthermore, ICAI has released the CA Final Exam Date for the May 2025 Exam. To know the complete details click the link to check the exam dates.

Must Check: All Information regarding CA Exams

Step 5. Apply for the ICAI Membership

After clearing both groups of the CA Final course, students can apply for ICAI membership. Thus, this is the complete procedure to become a CA in India.

Here is the summary of the steps to become a Chartered Accountant in India:

- Register for the CA Foundation Course.

- Crack the CA Foundation exams.

- Register for the CA Intermediate Course.

- Crack any one group of CA Intermediate.

- Enrol for the CA Articleship training after clearing any one group of CA Intermediate.

- Crack both groups of the CA Intermediate Course.

- Complete the CA Articleship Training (2 years).

- Register for the CA Final Course.

- Clear Both groups of CA Final Exams.

- Apply for the ICAI Membership.

ICAI has recently proposed the CA New Scheme Course 2025. In the new scheme, ICAI has proposed many changes, such as reducing articleship training duration, removing subjects, etc. Check out the article for full details about the New CA Course curriculum.

Also Check: CA Salary in India

Skills Needed to Become a Chartered Accountant

Essential skills that you’ll need to become a CA in India:

- Critical Thinking and Problem-solving.

- Sound Communication skills.

- Organisational skills.

- Discipline and the ability to accept failures.

- IT proficiency.

You should also know the main Qualities of a Chartered Accountant student, and try to learn and inculcate qualities.

Knowledge Base for the Students

Important ICAI links for the Chartered Accountancy Course:

Benefits of Becoming a Chartered Accountant(CA)

Let us look at the benefits of a career in Chartered Accountancy and, why you should consider it.

1. High CA Salary – Chartered Accountants are one of the highest-paid professionals in India. The average salary offered to a fresher CA is around 7 to 8 lakhs per annum. After gaining experience of 4-5 years and the necessary skills, a CA can earn 30 lakhs per annum.

2. Growing Future Scope – The scope of the CA career is growing and is estimated to grow consistently in the coming years. With the establishment of new businesses and the development of financial sections, the demand for CAs will only increase.

3. Safe & Secure Career Path – CA is among those professions that everyone knows about. There are higher chances that you’ll find a CA in your family relations only. So, becoming a CA is considered a safe and secure career option.

4. Numerous Career Choices – As a Chartered Accountant, there are many options open for you. You can do a job, practice independently, offer consultation, teach, and many more. Talking about the job roles, you can go for, accounting, auditing, financial management, etc. You can also do further courses and apply to international companies.

5. High Growth Opportunity – Another advantage that motivates many students to become a CA after 12th or graduation is the opportunity to grow.

Compare: CA vs CMA

Conclusion

Becoming a Chartered Accountant is a rigorous but rewarding journey—and now, with clarity on “how to become a CA,” whichever path you choose, success is truly within reach.

First, if you’re asking how to become CA after 10th, the path starts early but purposefully. You can provisionally register for the Foundation course right after passing Class 10, formalizing your spot once you clear Class 12. The Foundation route takes approximately 4.5–5 years—Foundation exam, ICITSS, Intermediate, 2‑year articled training, Advanced ICITSS, Final exam—and wraps up in about 54 months total.

Frequently Asked Questions

Q1.Which stream is best for the Chartered Accountancy course?

Ans: Commerce is the best stream for the students who want to do CA.

Q2. Is maths compulsory for CA?

Ans: Students need to study maths for the CA Foundation course. Other than that, there is no paper for maths in CA Intermediate and Final exams. However, there will be long calculations at every stage, so students must have a basic knowledge of mathematics and calculation.

Q3. Is it easy to become a CA (Chartered Accountant)?

Ans: CA is undoubtedly one of the most difficult courses in India. However, if a student prepares for this exam smartly, with full discipline and dedication, it can be cleared in the first attempt.

Q4. Is there any age limit to pursuing a CA?

Ans: No, there are no age limit criteria to pursue the CA course in India.

Q5. Should I pursue my CA Course after the 12th or graduation?

Ans: Candidates can pursue CA courses after the 12th and after graduation. It depends upon their preferences when they want to start their courses.

Q6. Is a job guaranteed after becoming a Chartered Accountant?

Ans: Yes, you’ll get a job but the package will depend on the candidate’s performance in exams, his personality, and communication skills.

Q7. Is CA a government job?

Ans: No, CA is not completely a government job. However, a Chartered Accountant can work in PSUs to handle their finances and accounts.