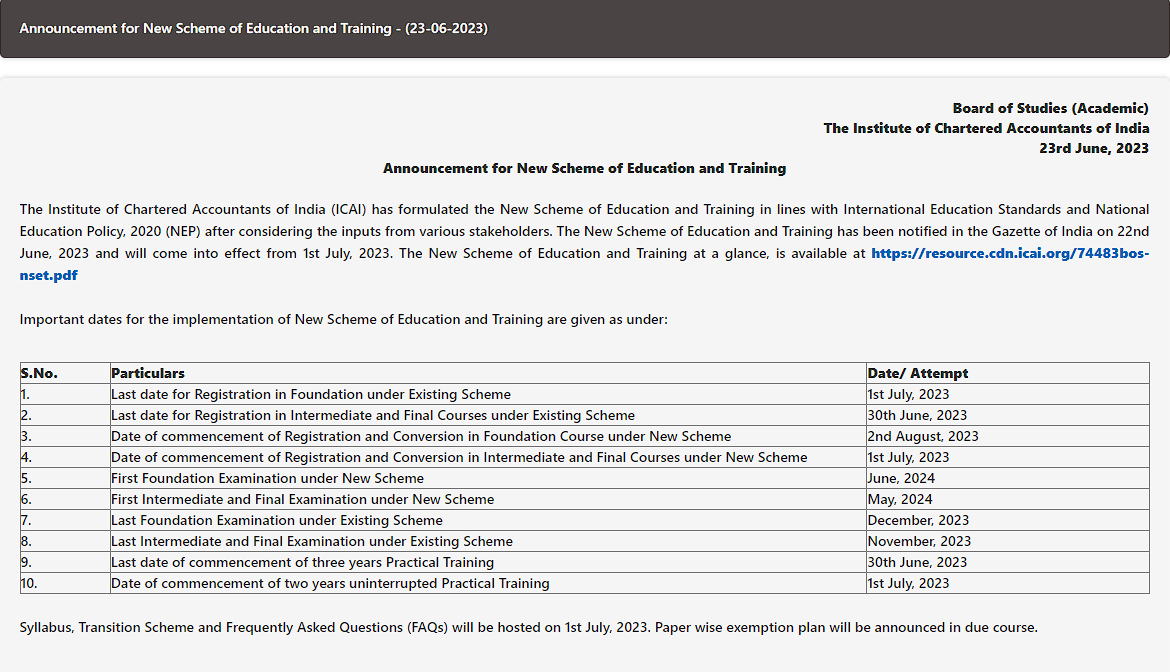

Any new candidate who wants to become a Chartered Accountant who starts their preparations for the May 2025 exams should note that the ICAI has released the CA New Scheme of Education and Training for CA, which has become effective from July 1, 2023. The first exam under the CA New Scheme will be conducted in May 2025.

The ICAI (Institute of Chartered Accountants of India) recently unveiled a CA New Scheme 2025, which was announced in the Indian Gazette on June 22, 2023, and will be implemented on July 1, 2023. Important alterations will be made to the CA course curriculum and practical training duration.

In the CA new syllabus 2025, some papers from all three levels are merged, and some are removed. Moreover, the new scheme reduces the CA articleship period from 3 to 2 years. Student Who wants to know about the complete details of Chartered Accountant. Check this article CA Kaise Bane to know the full details of the CA Process.

| ICAI CA Course Level | New Changes |

| CA Foundation | 4 Subjects from 6 Subjects |

| CA Intermediate | 6 Papers (3 in each Group) |

| CA Articleship | Period Reduced from 3 to 2 years |

| CA Final | 6 Papers (3 in each Group) |

There are also many changes in the eligibility, registration validity, syllabus, subjects, paper pattern, passing criteria, exemptions, training leaves, and leaving the CA course.

Also, check the official Notification ICAI on CA New Scheme on its Official website in the announcement column.

Check the ICAI Official Notification on CA New Scheme 2025.

The ICAI has launched the CA New scheme on July 1, 2023, and it will be applicable from the May 2024 exams. We suggest all the CA students whose papers are scheduled for May 2024 attempt to plan their studies accordingly.

So, in this article, we’ll tell you everything about the ICAI proposed new scheme of education and training in 2025, the latest updates and the comparison between the old and new schemes.

To understand all the points of the CA new syllabus 2025, watch the detailed video explanation by CA DR. RC Sharma sir.

Students can also check out our web story on CA New scheme 2023.

ICAI CA New Scheme of Education and Training 2025

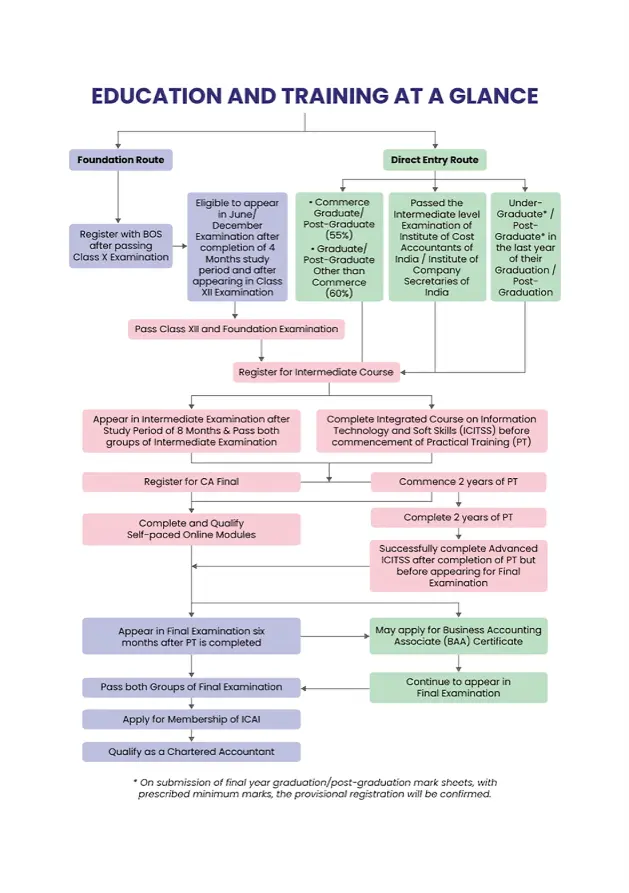

Before jumping into the details of each course and training, let us first check out the CA Course duration under the new scheme.

So, in the CA new scheme applicable from May 2025, a student will now take 42 months to become a Chartered Accountant.

| ICAI CA Course Level | Current | New Changes |

| CA Foundation Registration/ Appear 10 + 2 | Start | Start |

| CA Foundation Study Period | 4 Months | 4 Months |

| CA Intermediate Study Period | 8 Months | 8 Months |

| CA Articleship | 36 Months | 24 Months |

| CA Final Study Period | – | 6 Months |

| Total CA Course Duration | 48 Months | 42 Months |

| Work Experience for CoP | – | 12 Months |

Check out the complete CA syllabus for the 2025 exams.

Latest Update on ICAI CA New Course

Relaxation to Old Course

Relaxation to Old Course Students to commence 3 years of Practical Training –

(i) who have passed one of the groups of Intermediate Examination under the Old Scheme.

(ii) who have registered / provisionally registered in Intermediate through Direct Entry Route under Old Scheme.

(iii) who have converted from Intermediate (Foundation/CPT Route) to Intermediate (Direct Entry Scheme) for appearing in the November 2023 Examination.

Check the article to know the complete details regarding the CA Old Course to CA New Course Relaxation.

CA Foundation New Course 2025

Currently, there are no criteria for the number of attempts in the CA Foundation course. Hence, students can give any number of attempts. The CA Foundation registration validity can also be revalidated multiple times.

However in the proposed scheme of education and training, students can register after the 10th, and the CA Foundation registration in Jan 2025 is valid for four years. Moreover, students cannot further revalidate their foundation registration after those 4 years.

Also, now there will be no cut-off dates like January 1 and July 1 for the CA Foundation registration. This will enable ICAI to conduct three exams in a year.

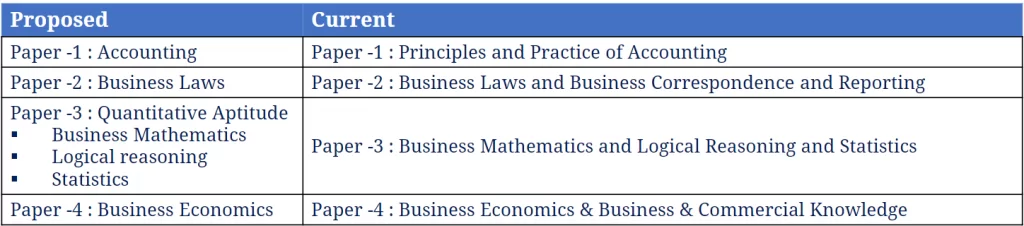

CA Foundation New Syllabus 2025

Currently, the CA Foundation syllabus comprises 6 subjects and 4 papers. In the new scheme, ICAI removed 2 subjects: Business Correspondence & Reporting and Business & Commercial Knowledge.

The CA Foundation’s new syllabus 2025 is as follows:

- Paper – 1: Accounting (100 Marks)

- Paper – 2: Business Laws (100 Marks)

- Paper – 3: Quantitative Aptitude (100 Marks)

- Business Mathematics

- Logical Reasoning

- Statistics

- Paper – 4: Business Economics (100 Marks)

CA Foundation Passing Criteria

The ICAI has also made some changes in the CA Foundation exam pattern. In the new scheme, students have to get 50% marks to crack the CA Foundation exams, and there will be a negative marking of .25 for every wrong MCQ answer.

| Current | Proposed |

|---|---|

| Subjective and Objective both | Subjective and Objective with negative marking (.25) |

These are all the changes in the new scheme of education and training for the CA Foundation course.

If you’re going to prepare for the Jan/May 2025 CA exams, then you can enroll for the CA Foundation coaching of VSI Jaipur. Our classes are completely based on the latest ICAI exam pattern and study materials.

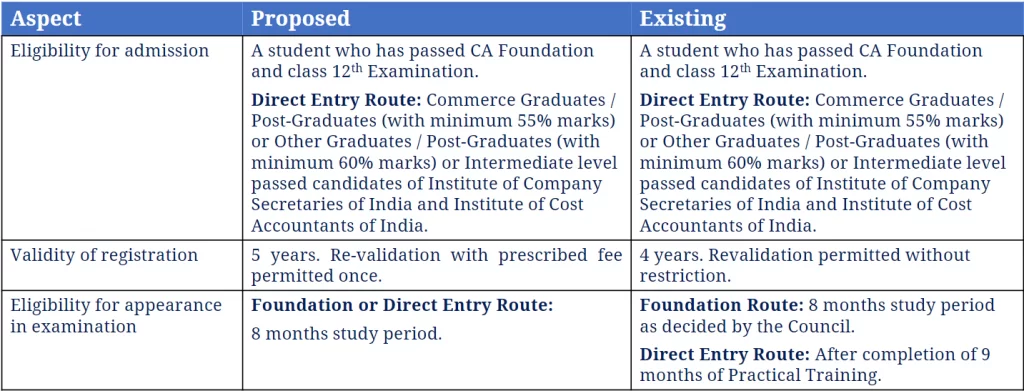

CA Intermediate Course under New Scheme 2025

CA Intermediate Eligibility

The eligibility criteria for the CA Intermediate course are the same as before. However, to appear in the exams, the direct entry route students must undergo an 8-month study period.

CA Intermediate Registration Validity

The validity of the CA Intermediate registration is now for 5 years as against four years. And CA Intermediate students can revalidate their registration form only once with the prescribed fees.

Also Check: CA Course Fees

CA Intermediate New Syllabus 2025

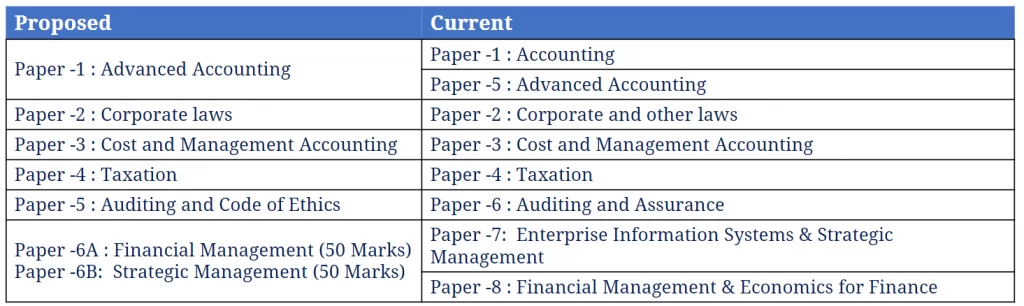

Now, there will be only 6 papers in the CA Intermediate course and not 8 papers. The changes proposed by the ICAI in the CA Intermediate subjects are:

- Papers 1 and 5 are merged into one, and the 1st paper will be – Advanced Accounting.

- Enterprise Information Systems is removed from paper 7, and Economics for Finance is removed from paper 8. The remaining part is merged in paper 6 as Financial Management and Strategic Management (50 marks + 50 marks).

- Paper 2 of corporate law will cover the Companies Act entirely. Its portion of Business law will be covered at the CA Foundation level.

| Proposed | Current |

| Paper – 1: Advanced Accounting | Paper – 1: Accounting

Paper – 5: Advance Accounting |

| Paper – 2: Corportate Laws | Paper – 2: Corporate and Other Laws |

| Paper – 3: Cost and Management Accounting | Paper – 3: Cost and Management Accounting |

| Paper – 4: Taxation | Paper – 4: Taxation |

| Paper – 5: Auditing and Code of Ethics | Paper – 6: Auditing and Assurnace |

| Paper – 6A: Financial Management (50 Marks)

Paper – 6B: Strategic Management (50 Marks) | Paper – 7: Enterprise Information System & Strategic Management

Paper – 8: Financial Management & Economics for Finance |

Now, there will be 2 groups of 3 papers each.

CA Intermediate Passing Criteria

The passing criteria for the CA Intermediate exams will also change. So, there will be 30% MCQ-based questions in all 6 papers. Furthermore, the negative marking of .25 will be deducted for every wrong answer.

Must Check: CA Intermediate Classes for the May 2025 exams.

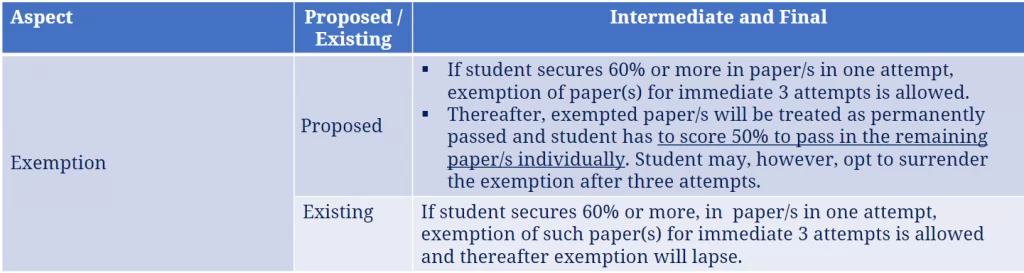

Exemption Criteria for CA Intermediate

After the new scheme, if you get an exemption in any paper, then the exemption will be permanent for that paper. That means the ICAI will treat the exempted papers as permanently passed. However, you need to clear the rest of the papers with 50% marks in the CA intermediate result.

CA Intermediate Exam Pattern under New Scheme

Major changes are expected in CA Intermediate Accounting and Auditing with the introduction of a code of ethics in CA Inter Auditing.

| CA Intermediate | Subjective | Objective |

| Paper 1 :Advance Accounting | 70 Marks | 30 Marks |

| Paper 2 :Corporate Laws | 70 Marks | 30 Marks |

| Paper 3 :Cost and Management Accounting | 70 Marks | 70 Marks |

| Paper 4 :Taxation | 70 Marks | 30 Marks |

| Paper 5 :Auditing and Code of Ethics | 70 Marks | 30 Marks |

| Paper 6 :Financial Management | 35 Marks | 15 Marks |

| Paper 6 :Strategic Management | 35 Marks | 15 Marks |

Read More: CA Exemption Rules

CA Articleship Training

In the CA articleship Training, ICAI has proposed significant changes that will benefit the students.

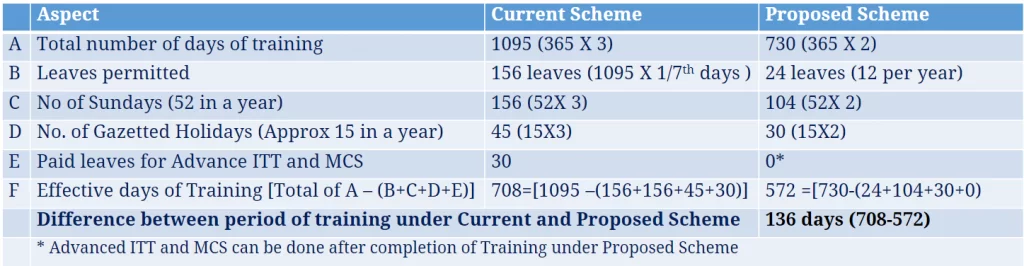

Practical Training Period/Duration

ICAI has reduced the CA articleship duration from 3 years to 2 years. It is good news for all the CA aspirants as now they can become CA earlier than before.

However, with the reduced period of CA Articleship, there comes a condition for aspirants who want to become a practitioner.

Students who want to practice CA must have 1 year of experience in a Chartered Accountancy firm. Afterward, they will get a certificate of practice.

For existing CAs, if they have worked for one year in a CA firm in the last 5 years, then this condition will be treated as fulfilled. This condition does not apply to aspirants who want to do a job.

Note: Students can undergo industrial training for nine months to 1 year (in the last 1 year of the articleship).

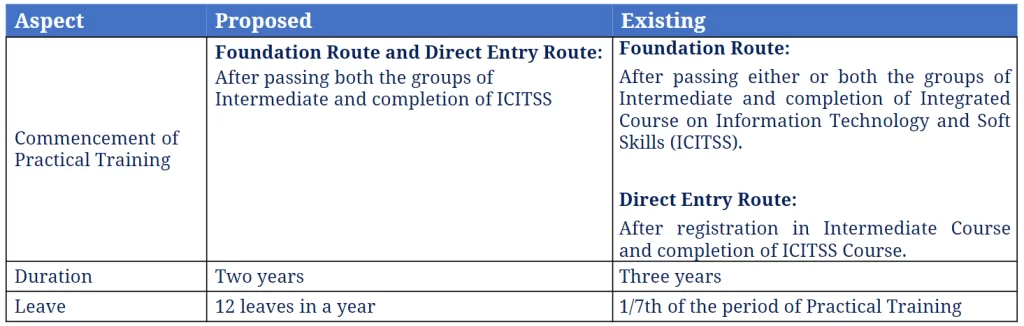

CA Articleship Eligibility

Under the CA new scheme 2025, students have to clear both the groups of CA Intermediate and completion of ICITSS training to be eligible to start the articleship training.

The move will benefit the students, as now they can focus entirely on the practical training and don’t have to worry about exam preparation.

CA Articleship Stipend

Many students often complain that their CA articleship stipend is low. So, ICAI has decided to increase the stipend by 100%.

CA Articleship Leaves

Since students don’t have to take any exams during the practical training, ICAI has reduced the number of leaves. Students can take only 12 leaves in a year, which means 24 leaves in two years.

ICAI Self-paced Modules

ICAI has introduced self-paced modules under the new scheme of education and training. Students can study these modules at their own pace and take online exams.

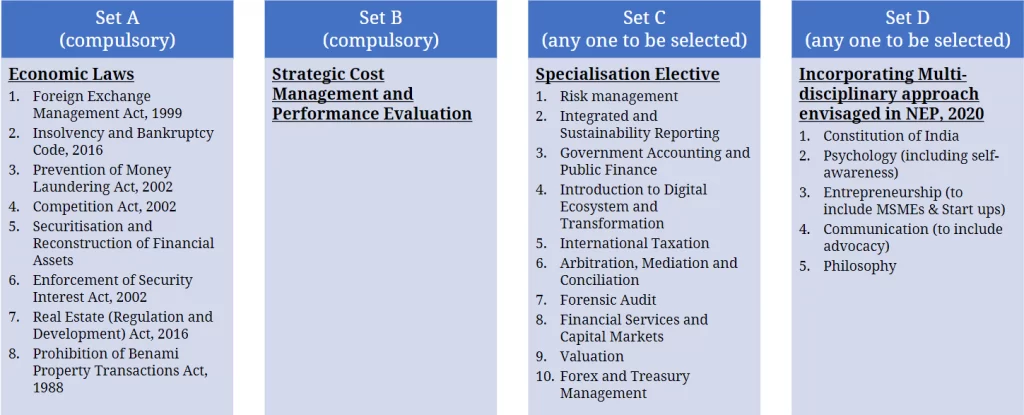

The self-paced modules are divided into four sets: Set A, Set B, Set C, and Set D.

To become eligible for the CA Final exams, students have to clear these 4 sets. To clear these modules, they have to score more than 50% marks in each module.

Among the 4 sets, Sets A and B, which are Economics Law and Strategic Cost Management, are compulsory. Also, these are the deleted subjects of the CA Final old course.

In the other two sets, students can choose the topic of their own choice. Students can study for these self-paced modules online during the articleship training and clear their exams simultaneously.

CA Final Course under New Scheme of Education and Training

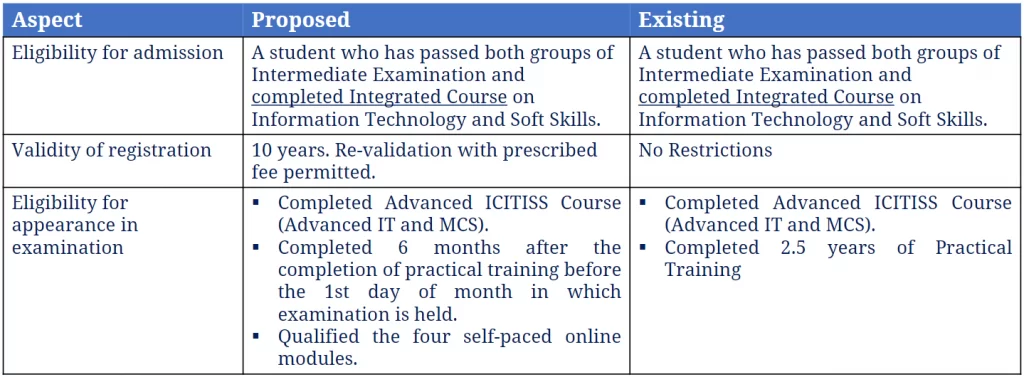

CA Final Eligibility and Registration

To become eligible to register for the CA Final course, students have to pass both groups of CA Intermediate exams and complete the ICITSS training.

However, to appear in the CA Final exams, students need to:

- Complete the Advanced ICITISS Course

- Complete 6 month study period after the practical training is over.

- Crack all 4 self-paced modules.

The CA Final registration is valid for 10 years. Aspirants can revalidate their registration after 10 years with the prescribed fee.

CA Final New Syllabus 2025

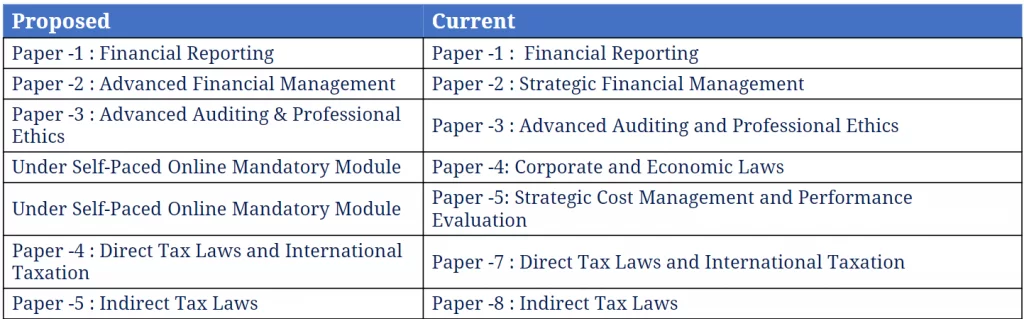

In the CA new scheme 2025, ICAI has reduced the CA Final Question papers from 8 to 6. Now, there are 2 groups that will include 3 papers each.

Major changes done in the CA Final Subjects are:

- Subjects of papers 4 and 5 will be removed and included in the self-paced modules.

- Now, there will be no options in Paper 6. It will be a Multi-disciplinary case study with Strategic Management

- Elective subjects such as risk management, financial services and capital markets are now part of the Set C of the self-paced modules.

| Proposed | Current |

| Paper – 1: Financial Reporting | Paper – 1: Financial Reporting |

| Paper – 2: Advanced Financial Management | Paper – 2: Strategic Financial Management |

| Paper – 3: Advanced Auditing & Professional Ethics | Paper – 3: Advanced Auditing and Professional Ethics |

| Under Self Paced Online Mandatory Module | Paper – 4: Corportate and Economics Laws |

| Under Self- Paced Online Mandatory Module | Paper – 5: Strategic Cost Management and Performance Evaluation |

| Paper – 4: Direct Tax Laws and International Taxation | Paper – 7: Direct Tax laws and International Taxation |

| Paper – 5: Indirect Tax Laws | Paper – 8: Indirect Tax Laws |

CA Final Exam Pattern

Like CA Intermediate new course 2024, all CA Final papers will also have 30% MCQ-based questions. And, there will be a negative marking of 25% on every wrong objective answer.

CA Final May 2024 Subject and New Exam Pattern

| CA Intermediate | Subjective | Objective |

| Paper 1 :Final Reporting | 70 Marks | 30 Marks |

| Paper 2 :Advance Financial Management (AFM) | 70 Marks | 30 Marks |

| Paper 3 :Advance Auditing and Professional Ethics | 70 Marks | 70 Marks |

| Paper 4 :Multi- Disciplinary Case Study with Strategic Management | 70 Marks | 30 Marks |

| Paper 5 :Direct Tax Laws and International Taxation | 70 Marks | 30 Marks |

| Paper 6 :Indirect Tax Laws | 35 Marks | 15 Marks |

Talking about the CA Final exemption rules, are the same as CA Intermediate. Check the latest update on the CA Final result for the Nov 2024 Exam in this detailed article.

Exit Route – Business Accounting Associate

The exit route will also change under the new CA Course 2025. Students generally exit the CA Course as they are not able to crack the CA Final exams.

Now, instead of Accounting Technician, ICAI will provide the certificate of Business Accounting Associate. However, they need to fulfill the following criteria:

- Cleared both groups of CA Intermediate.

- Complete the CA Articleship Training.

- Completed the soft skills and Information technology courses.

- Cleared all 4 self-paced modules.

Students can check the PPT presentation and pdf made by the ICAI for the new proposed scheme, which is also the source of this article.

Conclusion

This is all about the CA New scheme of education and training proposed by ICAI recently and which will be applicable from the May 2025 exams. The new course will benefit future Chartered Accountants as it will prepare them for the International markets.

Stay connected with this page of VSI Jaipur, as we will update this page with all the ICAI announcements regarding the new scheme of the CA Course.

FAQs

Que 1: When Will the ICAI CA New Scheme of Education come into effect?

Ans. The ICAI CA New Scheme of Education and Training has come into effect from July 1, 2023.

Que 2: IS the CA New Scheme applicable for the Nov 2023 Exam?

Ans. The ICAI has notified that the CA New Scheme will not be applicable for the Nov 2023 session.

Que 3: Will the CA syllabus change in 2025?

No, the CA New Syllabus Implementation was confirmed from the May 2025 Attempt. So the first exam under the new scheme has already been conducted in the May 2025 attempt. The same pattern will be followed in the 2025 exams as well.

Que 4:What is the structure of the Chartered Accountancy Course under the New Scheme of Education and Training?

Ans. The New Scheme of Education and Training has three levels – Foundation, Intermediate, and Final, including Self-Paced Online Modules.

Que 5: How do you register under the New Scheme of Education and Training?

Ans. Students need to register for Foundation/ Intermediate/ Final level under the New Scheme of Education and Training through Self Service Portal (SSP) at the link https://eservices.icai.org/