CA Foundation Course 2025: If you are starting your CA journey, the first step is CA Foundation. The Institute of Chartered Accountants of India (ICAI) conducts the CA Foundation exams throughout the year. Previously the CA Foundation exam was held 2 times a year but from 2024 they are held 3 times a year in Jan, May/June & September.

If you’re planning to clear the CA Foundation exam in the first attempt, choosing the right guidance is crucial. You can explore our expert-led CA Foundation Coaching in Jaipur to get the best preparation and personalized mentorship.

Get the complete detailed overview of the CA Foundation Course from this blog.

CA Foundation January 2025 Achievers

Eligibility for the CA Foundation Course?

According to the CA Foundation eligibility, students who have cleared their class 12 examination constituted by the law or recognized by the Central Government can register for the CA Foundation.

However, due to the delay in the Class 12th Central and State Boards Results declaration, ICAI has modified the eligibility criteria and allowed provisional registration for students who have not cleared their 12th Exams.

ICAI now allows students to preliminarily register for the CA Foundation course after passing the Class 10th examinations. It is also announced that this preliminary admission will only be modulated or regularized when the candidate passes the Class 12th exams.

Further, graduates and post-graduates who want to pursue a CA can register directly for the CA Intermediate exam through the Direct Entry System. This means that they are exempted from the CA Foundation Exam.

Overview of the CA Foundation Course

Based on the eligibility criteria, students who appear or appeared in the Class 12th can register for the CA Foundation course. After registration, you’ll have a 4-month preparation period to study the syllabus. The complete ICAI CA Foundation Syllabus is mentioned below:

- Paper 1: Accounts

- Paper 2: Business Laws

- Paper 3: Quantitative Aptitude

- Paper 4: Business Economics

In Addition, the total Fees for the CA Foundation course 2025 that students have to pay is Rs. 11500. It includes a registration fee of Rs 9800, exam form fees of Rs 1500, journal membership fees of Rs 200, and other fees.

Furthermore, ICAI announced in a recent notification that the last date of registration for the CA Foundation exam is 1 July under the existing scheme. The CA New Scheme will be applicable from May 2024.

In this complete guide for the CA Foundation course, you’ll learn about the eligibility criteria, registration, syllabus, dates, exam form, fees, paper pattern, preparation tips, admit card, results, and what to do after the CA Foundation exam.

CA Foundation Course – Complete Details

Students who want to know the details about the CA Foundation Course can refer to the table below. Here, you’ll get the eligibility criteria, exam level, duration of the exam, mode of the exam, total fees, and more.

| Particular | Details |

| Exam Name | CA Foundation |

| Conducted by | Institute of Chartered Accountants of India (ICAI) |

| Exam Level | National Level |

| Eligibility | Completed or Appearing in Class 12th |

| Preparation Period | 4 Months |

| CA Foundation Course Subjects |

|

| Duration of Exam | 3 Hours |

| Mode of Exam | Offline |

| CA Foundation Total Fees | Rs. 11,500 or $1065 (for Foreign students) |

| Frequency | 3 times in a year i.e. June, September and Dec/Jan |

| Passing Criteria | Per subject – 40% Aggregate – 50% |

Students can visit this link to check the complete guide on the CA Foundation Course in Hindi. Here, all the necessary pointers are mentioned in detail.

CA Foundation Course – Important Dates for Sept. 2025

The table below mentions the important CA Foundation dates for the Sept. 2025 exams:

| Events | Dates for Sept. 2025 |

| CA Foundation Exam Form Date Sept. 2025 | 5th July, 2025 |

| CA Foundation Exam Date Sept. 2025 | Sept. 16, 18, 20 and 22, 2025 |

| Admit Card Release Date | 14 days before the exam |

| CA Foundation Result May 2025 | 30th June, 2025 |

| Last date for Registration in CA Foundation Sept. 2025 | 18th July, 2025 |

Students can check the detailed CA Foundation Exam Date for the Sept. 2025 exam on this blog.

CA Foundation Course – Registration Procedure

All the eligible students can now register for the CA Foundation. ICAI opens the registration window for the whole year, but you have to register for the CA Foundation course before the deadline. The last date to register for the Sept. 2025 exams is 18th July, 2025.

Documents Required for the CA Foundation Course Registration:

The necessary documents needed for the CA Foundation registration are:

- 10th Class Report Card

- 12th Admit card

- Passport-size Photo

- Proof of Nationality for Foreign students

How to Register for the CA Foundation Course?

Follow the step-by-stepCA Foundation registrationSept. 2025 procedure to apply for the course:

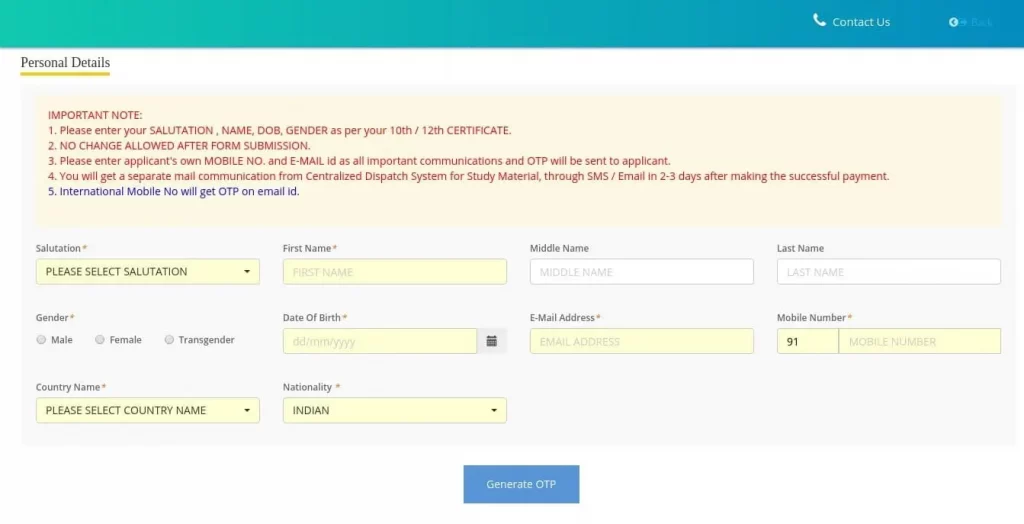

Step 1: Visit the ICAI portal. Tap on the Student’s Tab and go to the ‘Course Registration’ section.

Step 2: On the registration form section, click on ‘New User’.

Step 3: Enter the details such as name, DOB, Gender, Aadhar card number, mobile number, email, and password.

Step 4: Click on “Generate OTP, and then verify it. The OTP will be sent to your registered mobile number, and the verification link will be sent to your email ID.

Step 5: After verification, your profile is created, and you will receive the login credentials.

Step 6: Log in and select “Student Cycle.” Then click on ‘Apply for Foundation’, fill in the necessary details, and click on ‘Save and Next’.

Step 7: Afterwards, pay the registration fees. The fees will be paid online, so you’ll need a Master/Visa/Maestro Credit/Debit/Rupay/Net Banking Card.

Step 8: After successfully paying the CA Foundation registration fee, you’ll receive the registration form.

You have to deposit the form within 7 days, duly signed by the candidate.

CA Foundation Registration Validity

Once you register for the Foundation course, it will be valid for three years. You can also revalidate it any number of times for a further three years by depositing nominal fees of Rs. 300.

CA Foundation Course Fees

The CA Foundation Course fee for Indian students is Rs. 10,900, and for foreign students, it is $1065. However, it is not to be paid as a one-time payment.

At the time of registration, you need to pay Rs. 9000 plus Rs. 200 for the cost of the foundation prospectus. We also recommend subscribing to the student’s journal, as you’ll get the latest updates from it. While filing the foundation exam form, you’ll need to pay Rs 1500.

For foreign students, the registration fee is $700 plus $20 for the cost of the foundation prospectus. The exam form fee is $325.

Check the complete CA Foundation fee structure for Indian and Foreign students in the table below:

| CA Foundation Fee Details | Indian Students | Foreign Students ($) |

| Cost of Foundation Prospectus | 200 | 20 |

| Foundation Registration Fees | 9000 | 700 |

| Subscription for Students Journal (For one Year- Optional) | 200 | 20 |

| Foundation Examination Fee | 1500 | 325 |

| Total | Rs. 10,900 | $1065 |

The CA exam form fee for the Kathmandu center is Rs. 2200. Once the above registration process is completed, the CA Foundation study material will be dispatched to the candidates through the Centralized Dispatch System (CDS).

CA Foundation Syllabus and Study Material 2025

The CA Foundation course is divided into four subjects. The syllabus includes accounting, business law, mathematics, and economics. ICAI releases the CA Foundation Syllabus every year for students. Check the subjects below.

- Paper 1 – Accounting

- Paper 2 – Business Law

- Paper 3 – Quantitative Aptitude

- Paper 4 – Business Economics

To complete the syllabus, you have a study period of four months. Students can also check the complete CA Syllabus to get an idea of what they are going to study in the next few years.

CA Foundation Exam Pattern and Papers

To perform better in the exams, you must be aware of the CA foundation course, the paper pattern, the marking scheme, etc. The first two papers (accounting and law) are subjective, consisting of theory and practical questions, while the latter two (mathematics and economics) are objective with MCQs. A negative marking of 0.25 will continue to remain in the objective papers as per the revised scheme.

ICAI has given a detailed and revised CA Foundation Exam Pattern with marks and weightage distribution in all four subjects. You must refer to the latest Exam Pattern before starting your CA Foundation preparations.

You can also download the CA Foundation question papers, mock test papers, and revision test papers directly from VSI. Further, to know about CA exams for the foundation level, you can check the detailed guide.

CA Foundation Exam Form for Sept. 2025

Registration for the CA Foundation course is not enough to appear in the exams. You also have to fill out the exam form to inform ICAI that you are appearing in the exam. You can fill out the CA Foundation Exam form from the ICAI portal and pay the requisite examination fees. The examination form for Sept. 2025 exams will be available from July 5 to July 18 2025.

Candidates also need to attest to the CA Foundation declaration form with the exam form. The declaration form is the validation that the documents submitted and attested are original and not fake.

Due to some unavoidable circumstances, if the registration details entered by the candidate do not match with records maintained by the ICAI, for eg, your registration number, then you can be offered to register provisionally.

| Details | Foundation Exam Form Date |

| Commencement of Submission of Online Examination Application Forms | 5th July, 2025 |

| Last date for submission of online examination application forms (without late fees) | 18th July, 2025 |

| Last Date for Submission of online examination application forms (with late fees of 600/- or US $10) | 21st July ,2025 |

| Students seeking change of examination city/ medium, the correction window for the examination forms already filled will be available during the dates mentioned | 22nd to 24th July |

| Paper 3rd and 4th | 2 PM to 4 PM |

CA Foundation Admit Card

Admit cards are required to sit in the examination hall. ICAI generally issues admit cards 14 days before the exams. Moreover, it has ceased to send admit cards physically or offline. Now, you can only download the CA Foundation admit card online from the ICAI website.

Take the printout at least 10 days before the exam to avoid a last-minute rush. The admit card can be downloaded a maximum of three times, so take 3-4 photocopies of the admit card. After downloading, if you find any error in Center/Medium (resulting from incorrect details submitted in the application form), you have a chance to rectify such an error.

You can also check the details regarding the CA Foundation Admit Card in Hindi on this blog.

Correction Window for the CA Foundation

The ICAI provides 2 correction windows for students who want to change something in their exam form. In the first window, you don’t need to pay the correction fees. In the second window, you have to pay the correction fees of Rs. 1000/—per application. The correction window for the Sept. 2025 exam will start from 22nd July to 24th July 2025.

- Free Window Facility– Under the first correction window, a student can change his/her Center/Medium within one week after the last date of submission of the Examination form.

- Correction Window Facility (with fees)– Under this window, a student can change his/her Center/Medium with the payment of Rs. 1000/- per application. Generally, this window is open for correction up to one week before the exam. But requests made immediately before 7 days will not be entertained by the ICAI in any case.

CA Foundation Results

The results of the CA Foundation exams for May 2025 will be declared in June 2025(tentatively). You can check your CA Foundation Result September 2024 through the ICAI website/SMS/Email. You can see the steps on how to get your results on our blog. Further, If you want to check the CA Foundation Pass Percentage, click on the mentioned link. If any student has scored more than 70%, then he will receive a certificate with “Pass with Distinction” from ICAI.

How to Prepare for the CA Foundation 2025 Exams?

CA Foundation exams are not tough but students need to prepare well to crack them on the first attempt. So, check these effective CA Foundation preparation tips for the exams.

- Prepare a study plan for yourself before starting to study, and strictly follow it.

- Students who are weak in Maths must focus on Statistics and Logical Reasoning.

- While studying, make proper notes on each topic. They will help in revising the syllabus on exam days.

- Make a strong command over the calculator. Know the time-saving calculator tricks to get more time in the exams.

- Complete the entire CA Foundation course early so that you can revise at least 3 times.

- After completing the syllabus, solve an ample amount of mock test papers.

You can download the CA Foundation Question Bank to make your preparations even better.

What after the CA Foundation Exams?

After the CA Foundation course, you have to prepare and register yourself for the next step, CA Intermediate. Start your preparation by going through the CA Intermediate study materials and recommended books. Also, solve the previous year’s question papers, MTPs, and RTPs provided by the ICAI. Candidates who prefer Hindi can read our blog on What to do after CA Foundation in Hindi.

Check out our detailed article on How to become a CA.

About VSI Jaipur CA Foundation Coaching

VSI Jaipur is the best CA Foundation coaching that helps students get 300+ marks in CA Foundation exams. Our 50+ students scored 300+ marks in last year’s CA foundation exams.

Further, our experienced faculty provides offline and online classes for CA foundation exams with a result-oriented approach. This approach helps students pass the CA foundation exams on the first attempt.

If you want to clear the CA foundation level in the first attempt with high marks, then you must consider our CA foundation classes for your next attempt.

Frequently Asked Questions

Ques 1. What is the CA Foundation exam?

Ans. The CA Foundation exam is the first level of the Chartered Accountancy course to become a CA. The exams for the CA Foundation course are usually conducted in June, September, and January.

Ques 2. How many subjects are there in the CA Foundation Course?

Ans. The CA Foundation course has four subjects: Accounts, Business Law, Quantitative Aptitude, and Business Economics.

Ques 3. What are the passing criteria for the CA Foundation examination?

Ans. Candidates need to get at least 40% in all four papers and a total of 50% marks, i.e., 200 out of 400 marks, to pass the CA Foundation 2025 exams.

Ques 4. Is the CA Foundation easy to clear?

Ans. CA Foundation is not a hard exam, as students have already studied the major portion of the exam in their 11th and 12th classes. However, they have to study hard to clear the papers easily.

Ques 5. How long is the CA Foundation course?

Ans. The duration of the CA Foundation course is 6 months. Here, the 4 months are the study period, and the next 2 months are the waiting period for the CA Foundation result.

Ques 6. What are the criteria for negative marking in the CA foundation papers?

Ans. ¼ mark is deducted in objective papers for every wrong answer.

Ques 7. How many times can I appear in the CA Foundation Exam?

Ans. The CA Foundation registration is valid for 3 years, so students can appear in the CA Foundation exams for a maximum of 6 attempts.