CA Intermediate Study Material 2025 – ICAI has issued the CA Inter study material applicable for the Sept. 2025 exams. So, Students can download the ICAI CA Intermediate study material 2025 pdf in English and Hindi] from this page.

In the study material, ICAI provides CA intermediate papers from previous years, mock test papers, and revision test papers to help students prepare for the exams.

The ICAI Inter Study Material has detailed knowledge of each chapter and topic and covers the entire CA Intermediate Syllabus. The ICAI CA Intermediate Study Material for the Sept. 2025 exams is below:

Paper-1: Advanced Accounting

Paper-2: Corporate and Other Laws

Paper-3: Taxation

- Section A: Income Tax Law

- Section B: Goods and Service Tax

Paper-4: Cost and Management Accounting

Paper-5: Auditing and Ethics

Paper-6: Financial Management & Strategic Management

- Section A: Financial Management

- Section B: Strategic Management

Students can download the chapter-wise CA Intermediate study material for the 2025 exams from the links below. ICAI will Conduct the CA Inter Exam Three Times a Year: In January, May, and September.

In this article, students will get the download link for the complete CA Intermediate study material PDF for the Sept. 2025 exams in English and Hindi.

ICAI has announced the CA’s new scheme for the 2025 exams onwards. The new scheme includes various changes in the syllabus, exam pattern, exemptions, and more. Check all the details about the CA new scheme 2025 here.

Table of Contents

CA Intermediate New Study Material 2025

Paper 1: CA Intermediate Advanced Accounts Study Material (In Hindi)

| Module 1 | Module 2 | Module 3 |

| Initial Pages | Initial Page | Initial Page |

| Chapter 1: Introduction to Accounting Standards | Chapter 4: Financial Statements of Companies

Unit 1: Preparation of Financial Statements Unit 2: Cash Flow Statement | Chapter 9: Investment Accounts |

| Chapter 2: Framework for Preparation and Presentation of Financial Statements | Chapter 5: Profit or Loss Pre and Post Incorporation | Chapter 10: Insurance Claims for Loss of Stock and Loss of Profit |

Chapter 3: Overview of Accounting Standards

Unit 1: Applicability of Accounting Standards Unit 2: Overview of Accounting Standards | Chapter 6: Accounting for Bonus Issue and Right Issue | Chapter 11: Hire Purchase and Instalment Sale Transactions |

| Chapter 7: Redemption of Preference Shares | Chapter 12: Departmental Accounts | |

| Chapter 8: Redemption of Debentures | Chapter 13: Accounting for Branches Including Foreign Branches | |

| Chapter 14: Accounts from Incomplete Records |

Paper :1 CA Intermediate Advance Accounting Study Material CA New Scheme 2025

Paper 2: CA Intermediate Corporate and Other Laws Study Material (Hindi)

Given below is the study material for the CA Intermediate Company and Other Laws. Students can also download the CA study material pdf for corporate and other law subjects.

| Part 1: Company Law | Part 2: Other Laws |

| Initial Pages | Initial Pages |

| Chapter 1: Preliminary | Chapter 1: The Indian Contract Act, 1872 Unit 1: Contract of Indemnity and Guarantee Unit 2: Bailment and Pledge Unit 3: Agency |

| Chapter 2: Incorporation of Company and Matters Incidental Thereto | Chapter 2: The Negotiable Instruments Act, 1881 |

| Chapter 3: Prospectus and Allotment of Securities | Chapter 3: The General Clauses Act, 1897 |

| Chapter 4: Share Capital and Debentures | Chapter 4: Interpretation of Statutes, Deeds and Documents |

| Chapter 5: Acceptance of Deposits by Companies | |

| Chapter 6: Registration of Charges | |

| Chapter 7: Management & Administration | |

| Chapter 8: Declaration and Payment of Dividend | |

| Chapter 9: Accounts of Companies | |

| Chapter 10: Audit and Auditors |

Paper: 2 CA Intermediate Corporate and Other Laws Study Material CA New Scheme 2025

| Subject | Module 1 |

| Corporate and Other Laws | Initial Page |

| Chapter 1: Preliminary | Preliminary |

| Chapter 4: Share Capital and Debentures | Share Capital and Debentures |

| Module 2 | Initial Page |

| Chapter 5: Acceptnace of Deposits by Companies | Acceptnace of Deposits by Companies |

| Chapter 6: Registration of Charges | Registration of Charges |

| Module 2 | Intial Pages |

| Chapter 7: Management and Administration | Management and Administration |

| Chapter 8: Declaration and Payment of Dividend | Declaration and Payment of Dividend |

| Chapter 9: Accounts of Companies | Accounts of Companies |

| Chapter 10: Audit and Auditors | Audit and Auditors |

| Chapter 11: Companies Incorporated Outside India | Companies Incorporated Outside India |

| Module 3 | Initial Page |

| Chapter 12: The Limited Liability partnership Act, 2008 | The Limited Liability partnership Act, 2008 |

| Chapter 1: The General Clauses Act, 1897 | The General Clauses Act, 1897 |

| Chapter 2: Interpretation of Statutes | Interpretation of Statutes |

| Chapter 3: The Foreign Exchange Management Act, 1999 | The Foreign Exchange Management Act, 1999 |

Paper 3: CA Intermediate Taxation (Section A – Income Tax Law) Study Material CA New Scheme (In English)

Paper: 3 CA Intermediate Taxation (Section B – Goods and Service Tax) Study Material CA New Scheme (In English)

| Module 1 | Initial Page |

| Chapter 1: GST in India – An Introduction | GST in India – An Introduction |

| Chapter 2: Supply under GST | Supply under GST |

| Chapter 3: Charge of GST | Charge of GST |

| Chapter 4: Place of Supply | Place of Supply |

| Chapter 5: Exemptions from GST | Exemptions from GST |

| Chapter 6: Time of Supply | Time of Supply |

| Chapter 7: Value of Supply | Value of Supply |

| Module 2 | Initial Page |

| Chapter 8: Input Tax Credit | Input Tax Credit |

| Chapter 9: Registration | Registration |

| Chapter 10: Tax Invoice; Credit and Debit Notes | Tax Invoice; Credit and Debit Notes |

| Chapter 11: Accounts and Records | Accounts and Records |

| Chapter 12: E-Way Bill | E-Way Bill |

| Chapter 13: Payment of Tax | Payment of Tax |

| Chapter 14: Tax Deduction at Source and Collection of Tax at Source | Tax Deduction at Source and Collection of Tax at Source |

| Chapter 15: Returns | Returns |

Paper 4: Cost and Management Accounting Study Material CA New Scheme 2025 (In English)

| Module 1 | Initial Page |

| Chapter 1: Introduction to Cost and Management Accounting | Introduction to Cost and Management Accounting |

| Chapter 2: Material CostGST | Material Cost |

| Chapter 3: Employee Cost and Direct Expenses | Employee Cost and Direct Expenses |

| Chapter 4: Overheads – Absorption Costing Method | Overheads – Absorption Costing Method |

| Chapter 5: Activity Based Costing | Activity Based Costing |

| Chapter 6: Cost Sheet | Cost Sheet |

| Chapter 7: Cost Accounting Systems | Cost Accounting Systems |

| Module 2 | Initial Page |

| Chapter 8: Unit & Batch Costing | Unit & Batch Costing |

| Chapter 9: Job Costing | Job Costing |

| Chapter 10: Process & Operation Costing | Process & Operation Costing |

| Chapter 11: Joint Products and By Products | Joint Products and By Products |

| Chapter 12: Service Costing | Service Costing |

| Chapter 13: Standard Costing | Standard Costing |

| Chapter 14: Marginal Costing | Marginal Costing |

| Chapter 15: Budgets and Budgetary Control | Budgets and Budgetary Control |

Paper 5: Audit and Ethics Study Material CA New Scheme 2025 (In English)

| Module 1 | Initial Page |

| Chapter 1: Nature, Objective and Scope of Audit | Nature, Objective and Scope of Audit |

| Chapter 2: Audit Strategy, Audit Planning and Audit Programme | Audit Strategy, Audit Planning and Audit Programme |

| Chapter 3: Risk Assessment and Internal Control | Risk Assessment and Internal Control |

| Chapter 4: Audit Evidence | Audit Evidence |

| Chapter 5: Audit of Items of Financial Statements | Audit of Items of Financial Statements |

| Module 2 | Initial Page |

| Chapter 6: Audit Documentation | Audit Documentation |

| Chapter 7: Completion and Review | Completion and Review |

| Chapter 8: Audit Report | Audit Report |

| Chapter 9: Special Features of Audit of Different Type of Entities | Special Features of Audit of Different Type of Entities |

| Chapter 10: Audit of Banks | Audit of Banks |

| Chapter 11: Ethics and Terms of Audit Engagements | Ethics and Terms of Audit Engagements |

Paper 6: Financial Management and Strategic Management

Section A: Financial Management

Syllabus Modules |

Chapters |

Module-1 | |

| Chapter 1: Scope and Objectives of Financial Management | |

| Chapter 2: Types of Financing | |

| Chapter 3: Financial Analysis and Planning – Ratio Analysis | |

| Chapter 4: Cost of Capital | |

| Chapter 5: Financing Decisions – Capital Structure | |

| Chapter 6: Financing Decisions – Leverages | |

Module-2 | |

| Chapter 7: Investment Decisions | |

| Chapter 8: Dividend Decision | |

| Chapter 9: Management of Working Capital |

Section B: Strategic Management:

Syllabus Modules | Chapters |

Module-1 | |

| Chapter 1: Introduction to Strategic Management | |

| Chapter 2: Strategic Analysis: External Environment | |

| Chapter 3: Strategic Analysis: Internal Environment | |

| Chapter 4: Strategic Choices | |

| Chapter 5: Strategy Implementation and Evaluation |

CA Inter Study Material for Sept. 2025 Exams

Paper 1: Advanced Accounting

Paper: 2 CA Intermediate Corporate and Other Laws

| Part 1: COMPANY LAW AND LIMITED LIABILITY PARTNERSHIP LAW | |

| Subject | Module |

| Module 1 | Initial Page |

| Chapter 1: Preliminary | Preliminary |

| Chapter 2: Incorporation of Company and Matters Incidental Thereto | Preliminary |

| Chapter 3: Prospectus and Allotment of Securities | Preliminary |

| Chapter 4: Share Capital and Debentures | Preliminary |

| Chapter 5: Acceptance of Deposits by Companies | Acceptance of Deposits by Companies |

| Chapter 6: Registration of Charges | Acceptance of Deposits by Companies |

| Module 2 | Initial Page |

| Chapter 7: Management & Administration | Acceptnace of Deposits by Companies |

| Chapter 8: Declaration and Payment of Dividend | Registration of Charges |

| Chapter 9: Accounts of Companies | Accounts of Companies |

| Chapter 10: Audit and Auditors | Audit and Auditors |

| Chapter 11: Companies Incorporated Outside India | Companies Incorporated Outside India |

| Module 3 | Initial Page |

| Chapter 12: The Limited Liability partnership Act, 2008 | The Limited Liability partnership Act, 2008 |

| Part 2: Other Laws | |

| Chapter 1: The General Clauses Act, 1897 | The General Clauses Act, 1897 |

| Chapter 2: Interpretation of Statutes | Interpretation of Statutes |

| Chapter 3: The Foreign Exchange Management Act, 1999 | The Foreign Exchange Management Act, 1999 |

Paper 3: Taxation

Section B: Goods and Services Tax

| Module 1 | Initial Page |

| Chapter 1: GST in India – An Introduction | GST in India – An Introduction |

| Chapter 2: Supply under GST | Supply under GST |

| Chapter 3: Charge of GST | Charge of GST |

| Chapter 4: Place of Supply | Place of Supply |

| Chapter 5: Exemptions from GST | Exemptions from GST |

| Chapter 6: Time of Supply | Time of Supply |

| Chapter 7: Value of Supply | Value of Supply |

| Module 2 | Initial Page |

| Chapter 8: Input Tax Credit | Input Tax Credit |

| Chapter 9: Registration | Registration |

| Chapter 10: Tax Invoice; Credit and Debit Notes | Tax Invoice; Credit and Debit Notes |

| Chapter 11: Accounts and Records | Accounts and Records |

| Chapter 12: E-Way Bill | E-Way Bill |

| Chapter 13: Payment of Tax | Payment of Tax |

| Chapter 14: Tax Deduction at Source and Collection of Tax at Source | Tax Deduction at Source and Collection of Tax at Source |

| Chapter 15: Returns | Returns |

Paper 4: Cost and Management Accounting

| Module 1 | Initial Page |

| Chapter 1: Introduction to Cost and Management Accounting | Introduction to Cost and Management Accounting |

| Chapter 2: Material Cost | Material Cost |

| Chapter 3: Employee Cost and Direct Expenses | Employee Cost and Direct Expenses |

| Chapter 4: Overheads – Absorption Costing Method | Overheads – Absorption Costing Method |

| Chapter 5: Activity Based Costing | Activity Based Costing |

| Chapter 6: Cost Sheet | Cost Sheet |

| Chapter 7: Cost Accounting Systems | Cost Accounting Systems |

| Module 2 | Initial Page |

| Chapter 8: Unit & Batch Costing | Unit & Batch Costing |

| Chapter 9: Job Costing | Job Costing |

| Chapter 10: Process & Operation Costing | Process & Operation Costing |

| Chapter 11: Joint Products and By Products | Joint Products and By Products |

| Chapter 12: Service Costing | Service Costing |

| Chapter 13: Standard Costing | Standard Costing |

| Chapter 14: Marginal Costing | Marginal Costing |

| Chapter 15: Budgets and Budgetary Control | Budgets and Budgetary Control |

Paper 5: Audit and Ethics

| Module 1 | Initial Page |

| Chapter 1: Nature, Objective and Scope of Audit | Nature, Objective and Scope of Audit |

| Chapter 2: Audit Strategy, Audit Planning and Audit Programme | Audit Strategy, Audit Planning and Audit Programme |

| Chapter 3: Risk Assessment and Internal Control | Risk Assessment and Internal Control |

| Chapter 4: Audit Evidence | Audit Evidence |

| Chapter 5: Audit of Items of Financial Statements | Audit of Items of Financial Statements |

| Module 2 | Initial Page |

| Chapter 6: Audit Documentation | Audit Documentation |

| Chapter 7: Completion and Review | Completion and Review |

| Chapter 8: Audit Report | Audit Report |

| Chapter 9: Special Features of Audit of Different Type of Entities | Special Features of Audit of Different Type of Entities |

| Chapter 10: Audit of Banks | Audit of Banks |

| Chapter 11: Ethics and Terms of Audit Engagements | Ethics and Terms of Audit Engagements |

CA Intermediate Mock Test Papers

Along with the CA Intermediate study material, ICAI also provides mock test and revision test papers for the students. In the previous articles, we have shared with you a study plan for CA inter group 1 and CA inter group 2 papers (You must read once) along with the understanding of the significance of practicing CA Intermediate Mock Test Papers.

You must complete your studies before time, so you can solve mock test papers and practice from revision papers. Furthermore, CA Online Classes are also help to start you preparation. Instead of searching various websites on the internet for these papers, visit the VSI pages where we have all the papers assembled for you.

Practising regularly and cross-checking your answers from the solution key will help you improve your performance. You will not feel nervous during the exam if you solve revision papers and mock test papers, they make you confident.

Must Check: CA Intermediate exam pattern for Jan 2025.

Strategies to Clear CA Intermediate Course on the First Attempt

To clear the CA intermediate course, CA candidates need to follow some strategies. The strategies are as follows:

- Prepare a study plan according to the CA Inter exam dates.

- As the Jan 2025 exams are the next, only download the ICAI CA Inter study material for the 2025 attempt. We have also shared the ICAI Inter study material in both English and Hindi.

- Join the best coaching—Candidates must join the best CA intermediate coaching centre to prepare well for the CA intermediate course.

- Students must prepare their own revision via inter notes pdf, which will help at the time of revision.

- Candidates must focus on logical reasoning and focus on statistics.

- Students must have a command over calculators.

- Candidates must take a short break during the study.

- CA intermediate candidates must try to do at least three-time revisions.

- Candidates should solve model test papers for better practice.

- Candidates should also focus on how to write an answer during the exam.

- CA candidates must plan to try to do the last one-month revision.

These strategies have helped many students in getting good CA Intermediate results. If you follow proper strategies and good study material, then clearing intermediate or IPCC is not a tough job for you.

Furthermore, you can also check the complete details of CA Intermediate Registration Sept 2024.

CA Intermediate Preparations Tips New Syllabus 2025

Understand the New Syllabus and Pattern

Aspirants Should Understand the CA New Scheme Syllabus. ICAI has Changed the Syllabus for the Jan 2025 Examination. Students have to go through the complete syllabus first and then start their preparation for the CA Intermediate exam.

Create a Study Schedule

Students should make a study plan for the CA intermediate exam in Jan 2025. With a perfect study plan, students can consistently focus on their studies and give proper time to every subject.

Practise Regularly

Students must regularly practise practical subjects like Accounts, Cost Accounting, and Taxation. These three Subjects contain most of the practical questions in the examination.

Time Management

CA Intermediate is the Second stage of the Chartered Accountant Course. The Syllabus for the Intermediate exam is very lengthy, and because of its vast syllabus, the paper is also very lengthy. Students have to manage their time properly. Without efficient time management, many students cannot complete the paper, and it will affect their results.

Concept Clarity

Students have to revise their subject at least 2 to 3 times before the exam. Revision gives clarity over the concept and gives the power to remember the topic during the examination. You also have to work on concept clarity. Don’t memorise your subject; try to understand the topic or subject.

Practice Mock Test Papers

By practising Mock test Papers, Students get an idea of their strengths and weaknesses. Solving Mock test Papers allows students to identify their weak areas, which they can work on before exams. Mock test papers also give students an experience of the exam.

Can Students Crack CA Inter in 3 Months From New Scheme Syllabus

You will have three months to prepare for your exams. The students should set a target for every month and can then complete the entire syllabus of the CA intermediate course.

- Time hours to study: 12-15 hours daily

- Subjects to revise daily: Advanced Accounts, Cost accounting, Taxation (4 hours practical daily)

- Subjects to revise weekly: Law, Eco, Sm (fix one day of the week)

- Papers to revise fortnightly (15 days): Audit, Enterprise information system (Assign the number of hours to be devoted in each subject)

- Choose a proper studying place for yourself.

- The seat should be comfortable, and the room should have proper lights.

- Sit in a comfortable and erect position while studying

- There should be no disturbance while you study.

- Make neat notes and use markers to underline important topics.

- Use the compilers of the updated syllabus.

First Month Study Plan for CA Intermediate 2025

During the first month of preparation, try to cover the theoretical portion of the chapter. Keep working on the theoretical part of the subjects and try to understand the basic concepts so that things become easier for you for further studies. The course is vast so you need to be regular with your studies.

Second Month Study Plan for CA Intermediate 2025

It’s time to practice practical problems for the entire day. With only one month left for exams, you need to cover the course in time with regular studies.

If you have any doubts, ask your teachers or seniors to help you. It is the time when your concepts about the subject should be clear and completely focused on a practical part of the course.

Sit back and concentrate on the topic you are efficient at, working to clear up any problems or dilemmas connected to that subject or question. You can again seek guidance from Teachers or your seniors.

CA Intermediate Third-Month Preparation Strategy

Eventually, you are here for the last 2 days for your exams. Your exams are approaching, so don’t stampede if you are still pending with the course. Adhere to your study plan, and you will surely be able to review those remaining topics.

Don´t be nervous or overconfident during this time. It is time to keep your mind and body stable and fit. With a focused and consistent study plan, you will be well-prepared and feel confident about your potential.

Must Check: Tips To Choose the best CA Intermediate Classes Web Story

Join VSI for the CA Intermediate Course

VSI is always aimed at developing a system that can help each and every student to find his/her greatest

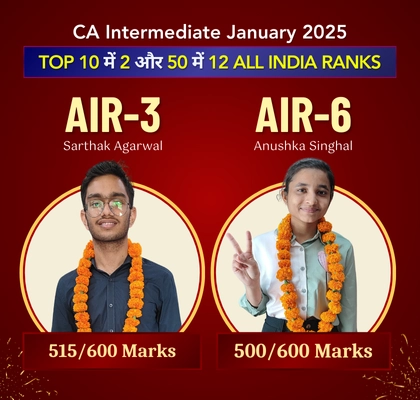

potential. VSI CA Foundation Results have proven that we prepare every single student for Rank rather than just crack this exam. That’s what makes us the best CA coaching institute in India. Our dedicated and experienced teachers have given three AIR – 1 in CA Exams in the last six years and established a benchmark for every coaching institute. So, join the VSI and become a successful Chartered Accountant.

Frequently Asked Questions(FAQ)

Q 1. How do I download the pdf of the ICAI CA Inter Study Material?

Ans. Students can download the CA Intermediate Study material from the ICAI official website. Other than that, we have also mentioned the download links for the ICAI Inter material 2025 pdf.

Q 2. Is ICAI Intermediate Study Material enough for the CA Intermediate exam?

Ans. No, only the ICAI CA Inter study material is not enough for preparing for the CA Intermediate exams. However, it should be the first priority for all the students.

Q 3. Are the ICAI CA Intermediate study materials available for free?

Ans. Yes, the ICAI CA Inter study material is freely available to students.

Q 4. Does ICAI CA Intermediate study material cover the whole Syllabus?

Ans. Yes, CA Intermediate study material covers the whole syllabus. You can rely on that CA Study Material as it is available on the official platform for aspiring CA Students.

Q5. How to Download ICAI CA Intermediate admit card?

Ans. Students can download CA Inter admit card from the official website of ICAI. To know the details of admit card click on CA Inter admit card this link.