Depreciation is an important and scoring topic in the CA Foundation accounts paper. As per Schedule II under the Companies Act 2013, “Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.”

The concept and accounting of Depreciation are one of the main chapters of paper 1, Accounting of CA Foundation Syllabus. In this chapter, the student will be able to understand the meaning and nature of depreciation, how we determine the amount of depreciation on property and equipment, what are the various methods of depreciation, how to become acquainted with the counting treatments from the straight-line method to reducing balance method, and many more.

Regular practice with the CA Foundation mock test papers and question papers will help the students master Depreciation Accounting. You can easily download all the study material for preparing the Accounting paper that will be held in the June, September and January exams.

Moreover, you can even know the weightage, syllabus and important tips and tricks related to the accountancy exam 2025. As per the CA Foundation Exam Date, the Accounts paper will be conducted on 16th Sept., 2025.

VSI Jaipur is briefly explaining the entire CA Foundation depreciation accounting chapter in this article. Hope this piece of information will help you to understand the simple concept of depreciation and eventually will help you to score good marks in your CA Foundation accounting paper.

CA Foundation January 2025 Achievers

Overview of Depreciation /Accounting Chapter

Before proceeding, students should know that the depreciation chapter is part of the second module of the CA Foundation accounting course, and ICAI assigned it a 25—to 30-person weightage.

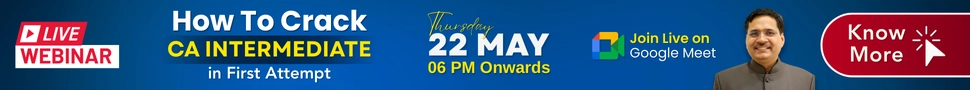

Understand why we provide Depreciation

There are four key reasons why we need to calculate the depreciation of every fixed asset.

- To make sure that every operation done through fixed assets is giving the expected output.

- To have the correct and true review of the financial position

- To get the correct and accumulated fund amount in case of replacement of assets

- To have the true cost of production.

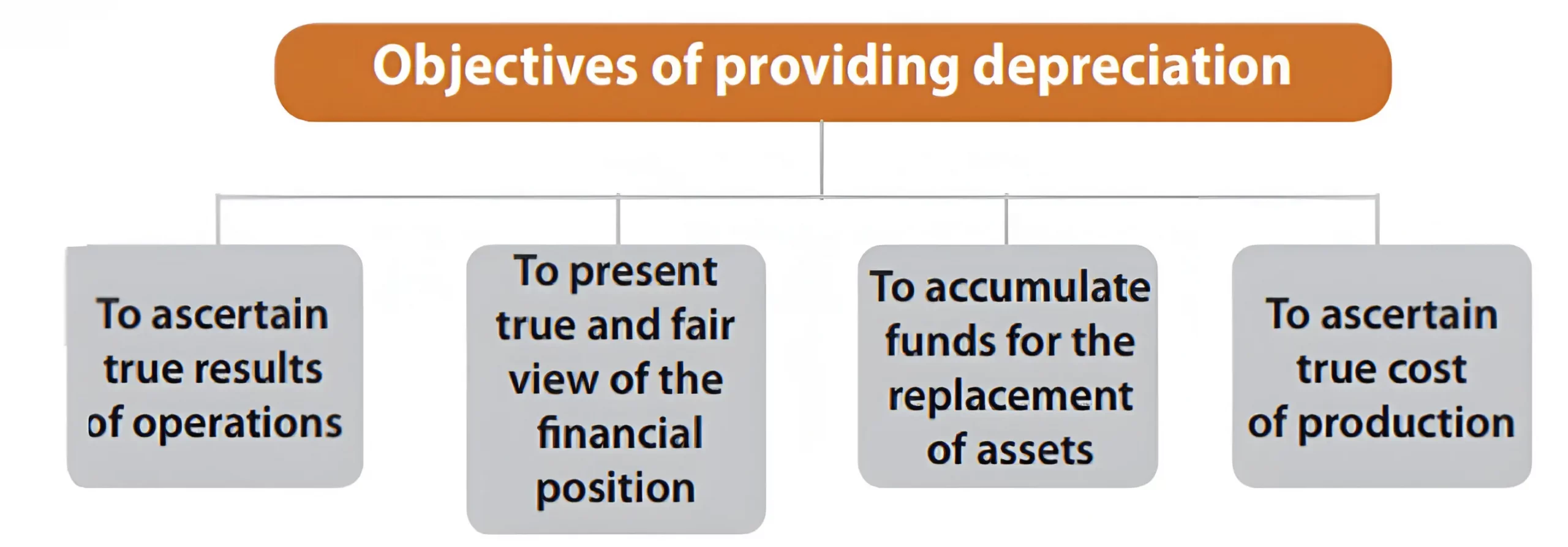

What are the factors that affect the amount of depreciation?

There are three major factors that affect the amount of expense depreciation for any fixed assets.

- The expected uses of the life of assets

- Cost of assets

- The estimated market value of the residual value of an asset

Let’s understand:

This means any asset you buy with the mindset to keep it for the long term and is basically utilised daily is Fixed assets. When we purchase a fixed asset, we tend to use it regularly. We calculate the cost of these uses yearly. We allocate such expenditure in the respective accounting period, This amount is called depreciation.

For example, you bought a car for yourself for “x” cost.

You kept that car for almost four years with you, and then in the 4th year, you plan to replace the car with an alternative model. Or sell in the market. Now the value of your car will not be X cost, instead, we will evaluate it based on its condition, the kilometre it has run, the market value of the product, and the inflation costs in the market. So now, after 4th year, the value of your car would be X-Y=Z. “y” is an expenditure that has been made every year by your fixed assets and is called depreciation.

In Addition, you can also check the complete details of the CA course to gain a better understanding of the entire CA Course.

Why does the value of assets depreciate or decrease with time?

For knowing the true value of an asset it’s important to calculate the depreciated value of an asset and treat it accordingly. The basic reasons the value of an asset decreases or depreciates passage are:

- Wear and Tear of the assets towards regular use in business or in personal use.

- Even if the asset is not used, the time that has been spent or effused.

- The technology has become obsolete.

- The market value of assets decreases.

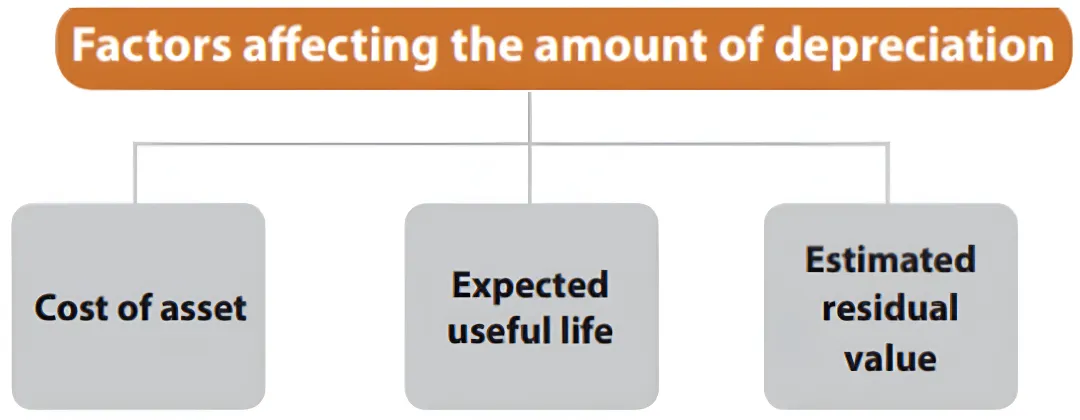

Methods of Providing Depreciation

Basically, there is a formula for calculating depreciation in accounting. The other three methods of calculating depreciation are;

1) The straight-line method, also known as the Original cost method or Fixed Installment method:

In this method, we consider that the residual value of the assets does not change, and the result is a constant change over the useful life.

2) Diminishing Balance Method:

In this method, the result will always decrease over the period of useful life.

3) Units of Production method:

In this method, we expect the result to change with the use of output.

The student must carefully understand the nature of the assets and the condition under which they use it and then choose the appropriate method of providing depreciation,

Download the depreciation Chapter in PDF format

ICAI has revised the CA Foundation syllabus under the new scheme; students can download the Chapter for CA Foundation Depreciation from the link below.

If You want to learn the Complete details of CA Foundation Depreciation Accounting, you can join CA Online Classes and solve all your doubts.

Chapter 5: Concept and Accounting of Depreciation.

Check out the CA Foundation Study material for the May 2025 exams.

Depreciation practical problem:

Problem 1 – On 1 July 2008, a company purchased a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. It provided depreciation @ 15% per annum, using a written-down value method. On 30 November 2011, they dismantled the machine at a cost of Rs 5,000 and then sold it for Rs 1,00,000.

On 1st December 2011, the company acquired and put into operation a new machine at a total cost of Rs 7,60,000. They provided depreciation on the new machine on the same basis as with the earlier machine. The company closes its books of account every year on 31st March.

Prepare Machinery Account and Depreciation Account for four accounting years ended 31st March. 2012:

Problem 2 – The cost of machinery in use with a firm on 1st April 2011 was Rs 2,50,000, against which the depreciation provision stood at Rs 1,05,000 on that date; the firm provided depreciation at 10% of the diminishing value.

On 31st December 2011, two machines, costing Rs 15,000 and Rs 12,000, respectively, both purchased on 1st October 2008, had to be discarded because of damage and replaced by two new machines costing Rs 20,000 and Rs 15,000, respectively.

They sold one of the discarded machines for Rs 8,000; against the other, they expected it that Rs 3,000 would be realisable.

Show the relevant accounts in the ledger on the firm for the year ended 31st March 2012.

Problem 3 – Metropol Ltd. acquired a machine for Rs 5,40,000 on 1 April 2009. Depreciation was to be charged at 20% per annum using the straight-line method.

On 1st October 2011, they made a modification to improve its technical efficiency at a cost of Rs 50,000 we considered which would also extend the useful life of the machine by two years. They replaced an important component of the machine at a cost of Rs 10,000 because of excessive wear and tear.

Routine maintenance during the accounting year ending 31st March 2012 cost Rs 7,500.

Show for the year ending 31st March 2012.

Check all the details for the CA Foundation course here.

CA Foundation Accounts Question Papers with Suggested Answers

ICAI has revised the syllabus under the new scheme. The student can download the CA Foundation question papers with suggested answers to Accounts.

For the new scheme

| Question Papers | Suggested Answers |

|---|---|

| December 2021 | December 2021 |

| July 2021 | July 2021 |

CA Foundation Accounts Question Papers with Suggested Answers

ICAI has revised the syllabus under the new scheme. The student can download the CA Foundation question papers with suggested answers to Accounts.

CA Foundation Accounts Mock Test Papers 2022

ICAI has revised the syllabus under the new scheme. Students can download the suggested Mock Test Paper of Principles and Practice of Accounting from here.

CA Foundation Accounts RTP 2022

ICAI has revised the syllabus under the new scheme. Students can download the RTP of Principles and Practice of Accounting from here.

The formula of Depreciation:

The formula to calculate the depreciation is

***Depreciation= Depreciable amount/ Estimated Useful Life

If you want to score satisfactory marks in CA Foundation exams, It is imperative to have a regular habit of solving at least 20 questions on all the subjects.VSI gives the best and highest CA Foundation Result every year with the most dedicated study pattern. Dr. CA RC Sharma Sir always requests students to keep Practising the ICAI Question paper to get an overview of the CA Foundation Accounting depreciation exam pattern for the planned study.

VSI provides the most sorted and simple study material for the proper and deep understanding of logical reasoning topics. They also provide pen drive classes to their students that covers the entire study material in the most effective way.

VSI also provides the pen drive class for both English and Hindi medium students. You can also download the study material for Hindi medium students for May 2022 CA foundation maths exams.