CMA intermediate is the second stage of the CMA course, and the conducting and governing body is ICMAI or Institute of Cost and Management Accountants. ICMAI releases the dates, exam pattern, syllabus, and other important notices regarding the CMA Intermediate Exam.

All the candidates who have passed the CMA Foundation or any equivalent exam can register for the CMA Intermediate course. But before appearing in the exam, you must be aware of all the essential information regarding the ICMAI CMA Intermediate Course June 2026 .

In this complete guide on the CMA Intermediate Course, you’ll get details about important dates, eligibility criteria, registration process, fees, syllabus and marking scheme, admit card, preparation tips, results, etc.

Table of Contents

ICMAI CMA Intermediate Course 2026 – Important Dates

Let us first begin with the significant dates that you must know about the CMA Intermediate Course.

| Topics | Important Dates |

| Registration for CMA Intermediate | TBA |

| Last date of Registration | TBA |

| Availability of exam form | TBA |

| Release of admit card | Last week of May 2026 |

| CMA Intermediate exam dates | TBA |

The ICMAI has released the CMA exam dates for the June 2026 exams. The CMA Inter papers will conduct from the second week of June 2026.

ICMAI CMA Intermediate Course Eligibility 2026

To register for the CMA Intermediate course, students have to fulfil the eligibility criteria set by ICMAI. Once you have cross-checked your criteria, you can go forward with filling out the form.

- Cleared the senior secondary and higher secondary exams from a recognized board.

- Candidates who have cleared the CMA Intermediate exam conducted by ICAI or have cleared the Part I exam of CAT

from the Course of the Institute of Cost Accountants of India. - Students holding a degree from any recognized university or having completed their two years or four semesters of

engineering. Also, the students with equivalent degrees in music, photography, dance, painting, etc.

Must Check: CMA Salary in India

ICMAI CMA Intermediate Registration for June 2026

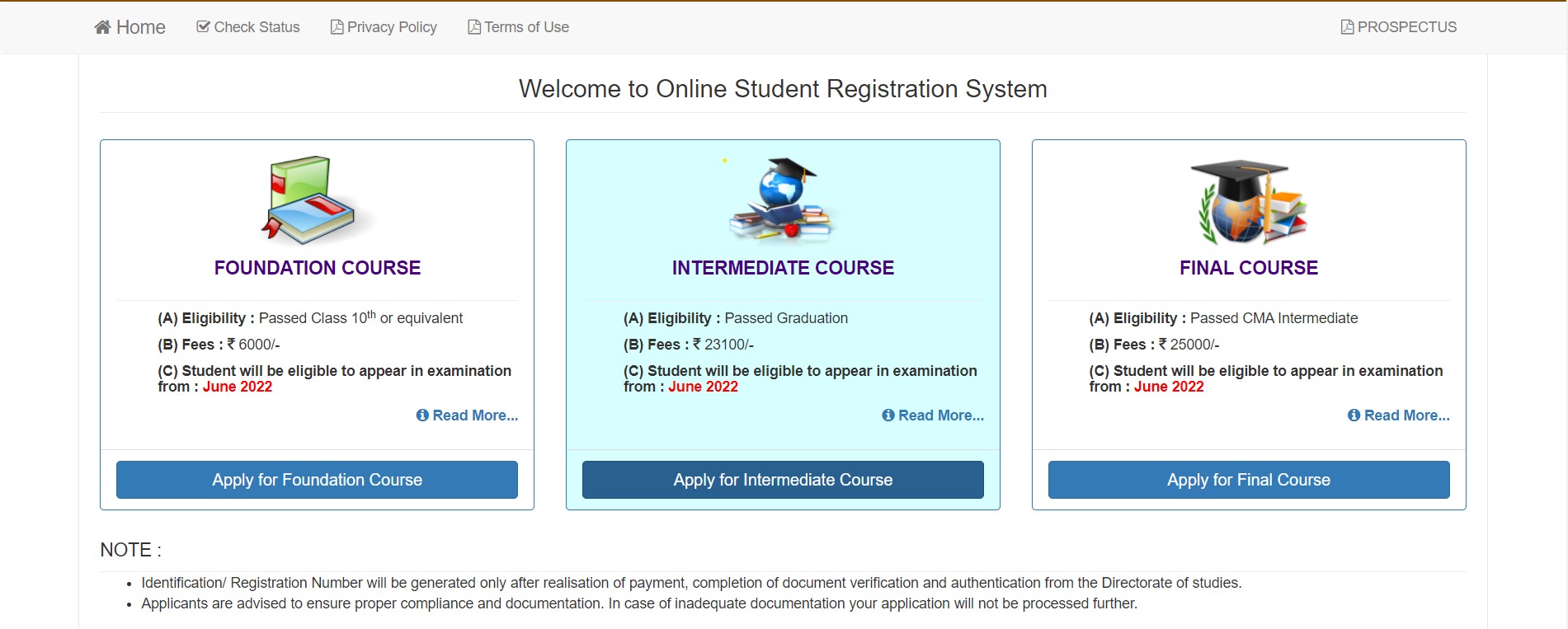

Before appearing in the ICMAI CMA Intermediate examination or even before filling out the form, the student must have registered online with ICMAI. Here are the steps that you can follow for the CMA Intermediate registration for June 2026 exams. You have two ways to apply:

- Apply through the CMA Foundation Course

- Direct entry route

After defining which mode you are opting to apply for the CMA Intermediate Course, you go through the following steps:

Step 1. Open the official website of ICMAI, i.e. icmai. In. Once you have opened the website, click on the “Students” tab in the menu bar.

Step 2. From there, click on the admission link, which will redirect you to a new admission

page.

Step 3. There will be several options given on the screen’s left side. Here, you have to select

the option of “Online Admission”.

Step 4. Afterwards, apply for the CMA Intermediate course and fill out the application form.

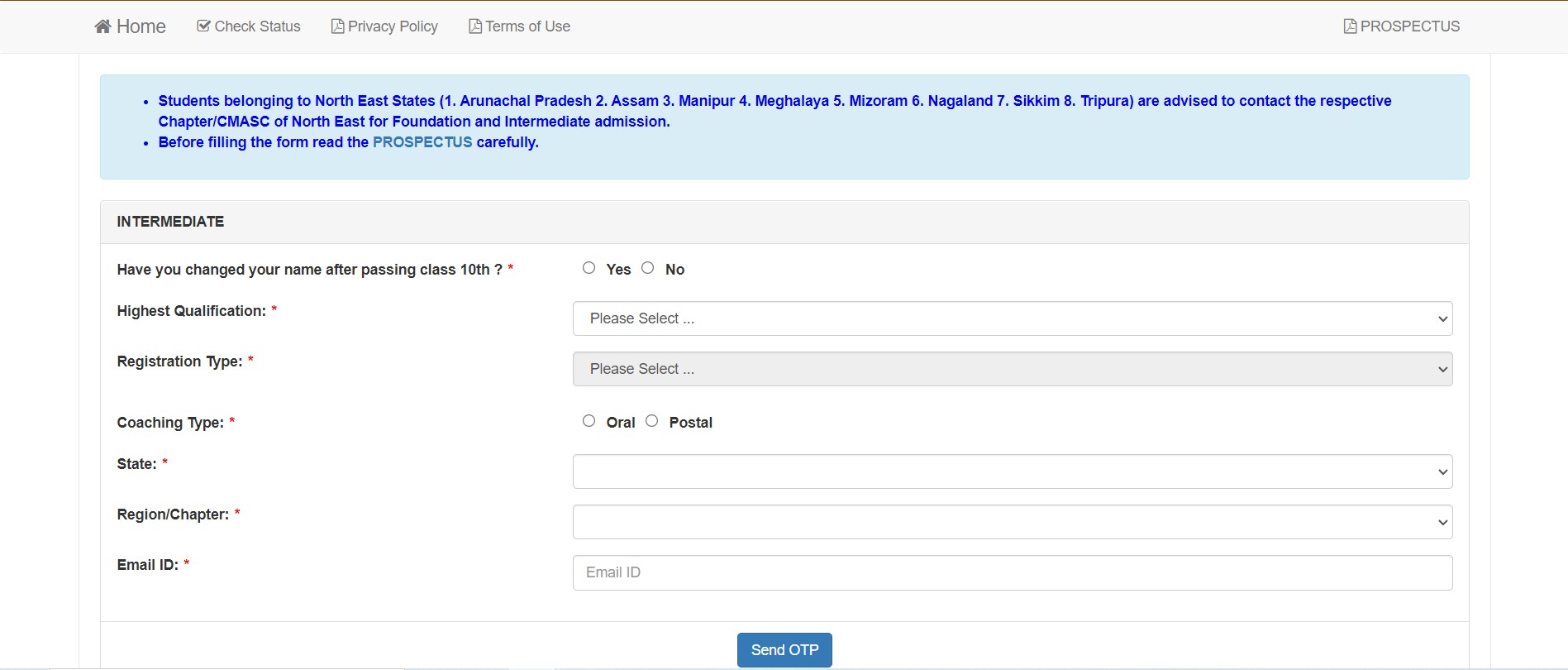

Step 5. Enter all the details asked on the page, such as qualification, email id, coaching type, registration type, etc. After submitting the information, you have to generate OTP for registration in CMA Intermediate.

Step 6. After this, login credentials will be sent to your registered email id, and then you can proceed towards filling out the CMA Intermediate exam application form for 2026. Now, submit the rest of the basic details and click on save & next. Also, make sure to verify the details entered.

Step 7. Upload the scanned copy of the documents.

Step 8. Finally, submit the required fee to confirm your registration with ICMAI CMA Intermediate.

CMA Intermediate Registration Fees

To complete the CMA Intermediate registration process, you have to pay the required fees. The CMA Intermediate registration fee is Rs. 22,000 for students who want to pay without any instalment. Students who prefer paying the amount in instalments have to pay Rs. 12000 and Rs. 10,000.

| Particular | CMA Intermediate Fees |

| Without Instalments | Rs. 23100 |

| With Instalment | Rs. 12000 + 11100 |

Important Note – In order to sit in the June 2026 exams, students have to pay the 2nd instalment of

CMA Intermediate application form fees before 31st January 2026.

CMA Intermediate Exam Pattern 2026

After successfully registering for the CMA Intermediate course, students now have to start their preparation. However, to prepare effectively, they must know about the CMA Intermediate exam pattern, i.e., time duration, type of exam, marking scheme, subject weightage, time duration, and language. Check the CMA Intermediate exam pattern for June 2026.

| Particulars | Detail |

| Mode of Exam | Online-centre based |

| Type of Questions Asked | Objective and Subjective |

| Maximum Marks | 100 |

| Total Papers | 8 |

| Exam Duration | 3 hours |

| Total Number of Questions | 120 |

| Negative Marking | No |

ICMAI CMA Intermediate Syllabus 2026

ICMAI released the syllabus for the candidates who have registered for the CMA Intermediate course. Students must go through each subject and the syllabus in detail to understand the demands of the exam.

Check out the table below to get the downloadable link for the 2026 syllabus of the CMA Intermediate subjects.

| Subject | |

| CMA Intermediate Group-I Subjects | |

| Financial Accounting | Download |

| Laws and Ethics | Download |

| Direct Taxation | Download |

| Cost Accounting | Download |

| CMA Intermediate Group-II Subjects | |

| Operation Management and Strategic Management | Download |

| Cost and Management Accounting and Financial Management | Download |

| Indirect Taxation | Download |

| Company Accounts and Audits | Download |

Hence, all the candidates must be aware of the topics mentioned above and the concepts. It can be helpful in your

exam preparation.

CMA Intermediate Marking scheme for June 2026 exams

Paper 5 – Financial Accounting

| Topics | Marks |

| Section – A: Accounting | 25 marks |

| 1. Fundamentals of Accounting | |

| 2. Accounting for Special Transactions | |

| Section – B: Preparation of Financial Statements | 40 marks |

| 3. Preparation of Final Accounts of Profit Oriented organizations, Non-Profit Organizations and from Incomplete Records | |

| 4. Partnership Accounts | |

| Section – C: Self Balancing Ledgers, Royalties, Hire Purchase & Installment System, Branch & Departmental Accounts | 20 marks |

| 5. Self-Balancing Ledgers | |

| 6. Royalties, Hire-Purchase and Installment System | |

| 7. Branch and Departmental Accounts | |

| Section – D: Accounting in Computerised Environment and Accounting Standards | 15 marks |

| 8. Overview of Computerised Accounting | |

| 9. Accounting Standards | |

| Total | 100 maximum marks |

Paper 6 – Laws and Ethics

| Topics | Marks |

| Section – A: Commercial Laws | 30 marks |

| 1. Laws of Contracts (Advanced level) | |

| 2. Laws relating to Sale of Goods (Advanced level) | |

| 3. Negotiable Instruments Act,1881 (Advanced Level) | |

| 4. Indian Partnership Act, 1932 | |

| 5. Limited Liability Partnership Act, 2008 | |

| Section – B: Industrial Laws | 25 marks |

| 6. Factories Act, 1948 | |

| 7. Payment of Gratuity Act, 1972 | |

| 8. Employees Provident Fund and Miscellaneous Provisions Act, 1952 | |

| 9. Employees State Insurance Act, 1948 | |

| 10. Payment of Bonus Act, 1965 | |

| 11. Minimum Wages Act, 1948 | |

| 12. Payment of Wages Act, 1936 | |

| 13. Pension Fund Regulatory and Development Authority Act, 2013 | |

| Section – C: Corporate Law | 35 marks |

| 14. Companies Act, 2013 | |

| Section – D: Ethics | Ten marks |

| 15. Business Ethics | |

| Total | 100 maximum marks |

Paper 7 – Direct Taxation

| Topics | Marks |

| Section – A: Income Tax Act Basics | Ten marks |

| 1. Introduction to Income Tax Act, 1961 | |

| 2. Income which does not form part of Total Income (Section 10, 11 to 13A) | |

| Section – B: Heads of Income and Computation of Total Income and Tax Liability | 70 marks |

| 3. Heads of Income and Computation of Total Income under various heads | |

| 4. Clubbing Provisions, Set – off and Carry forward of Losses, Deductions | |

| 5. Assessment of Income and tax liability of different persons | |

| Section – C: Tax Management, Administrative Procedures, and ICDS | 20 marks |

| 6. TDS, TCS and Advance Tax | |

| 7 Administrative Procedures | |

| 8. Income Computation and Disclosure Standards – (ICDS) | |

| Total | 100 maximum marks |

Paper 8 – Cost Accounting

| Topics | Marks |

| 1. Introduction to Cost Accounting | 40 marks |

| A. Cost Ascertainment – Elements of Cost | |

| B. Cost Accounting Standards | |

| C. Cost Book Keeping | |

| 2. Methods of Costing | 30 marks |

| 3. Cost Accounting Techniques | 30 marks |

| Total | 100 maximum marks |

Paper 9 – Operation Management and Strategic Management

| Topics | Marks |

| Section – A: Operations Management | 70 marks |

| 1. Operations Management – Introduction | 15 marks |

| 2. Operations Planning | |

| 3. Designing of Operational Systems and Control | 35 marks |

| 4. Production Planning and Control | |

| 5. Productivity Management and quality management | |

| 6. Project Management | 20 marks |

| 7. Economics of Maintenance and spares management | |

| Section – B: Strategic Management | 30 marks |

| 8. Strategic Management Introduction | |

| 9. Strategic Analysis and Strategic Planning | |

| 10. Formulation and Implementation of Strategy | |

| Total | 100 maximum marks |

Paper 10 – Cost and Management Accounting and Financial Management

| Topics | Marks |

| Section – A: Cost & Management Accounting and Financial Management | 50 marks |

| 1. Cost and Management Accounting – Introduction | |

| 2. Decision-Making Tools | |

| 3. Budgeting and Budgetary Control | |

| 4. Standard Costing and Variance Analysis | |

| 5. Learning Curve | |

| Section – B: Financial Management | 50 marks |

| 6. Introduction to Financial Management | |

| 7. Tools for Financial Analysis and Planning | |

| 8. Working Capital Management | |

| 9. Cost of Capital, Capital Structure Theories, Dividend Decisions, and Leverage Analysis | |

| 10. Capital Budgeting – Investment Decisions | |

| Total | 100 maximum marks |

Paper 11 – Indirect Taxation

| Topics | Marks |

| Section – A: Cannons of Taxations – Indirect Tax GST | 80 marks |

| Section – B: Customs Laws | 20 marks |

| Total | 100 maximum marks |

Paper 12 – Company Accounts and Audits

| Topics | Marks |

|---|---|

| Section – A: Accounts of Joint Stock Companies | 50 marks |

| 1. Accounting of Shares and Debentures (25 marks) | |

| 2. Presentation of Financial Statements (as Per Schedule III) | |

| 3. Cash Flow Statement | |

| 4. Accounts of Banking, Electricity and Insurance Companies (25 marks) | |

| Section – B: Auditing | 50 marks |

| Part – A: Auditing Concepts (20 marks ) | |

| Part – B: Provision relating to Audit under Companies Act (30 marks ) | |

| Total | 100 maximum marks |

Preparation Tips for CMA Intermediate Course

The CMA Intermediate course should not be taken lightly by the students. It can be cracked on the first attempt, but you have to prepare well and with full dedication. Check out the preparation tips for the inter-exams to get the best ICMAI result.

- The candidate should go through the exam pattern and the syllabus very carefully and note it down somewhere.

- Students need to make proper short notes on important topics.

- The students should consider the study materials and the books recommended by ICMAI.

- Make sure to solve the CMA Intermediate papers of past years and sample papers released by ICMAI.

- Students should go for CMA Intermediate coaching. However, they have to keep in mind that self-study is also crucial.

- So, the student must make a proper timetable for studying.

CMA Intermediate Admit Card 2026

As soon as the application exam form windows are closed, ICMAI will release the admit cards on the official website

for the CMA Intermediate exams. From there, the students must download their admit card before the exams because,

without it, no one will be allowed to give the exam. Some vital information that students must know regarding the

ICMAI CMA Intermediate admit card are:

- The admit card should be compulsorily brought to the exam centre else the candidates cannot appear in the exam.

- The admit card should contain all the information such as the student’s name, date and time of exam, signature,

photograph, test centre, address, etc. - Candidates should also have downloaded the instruction related to the exam.

ICMAI CMA Intermediate Result 2026

The students who want to check their ICMAI CMA Intermediate result 2026 should keep checking the notification by ICMAI. As soon as the ICMAI releases the notice of result announcement, the students can follow the given steps to get their results,

- The results of the CMA Intermediate course will be announced online by ICMAI.

- Candidates have to log in to the ICMAI website through their registered number to see and download their

Intermediate results. - You can also check the rank list released by the ICMAI that contains the centre’s name, roll number and name of

the candidates.

Upon clearing the Intermediate level, students are eligible to register for the CMA Final course and start their preparation.

Now, you have all the details regarding the CMA Intermediate course, from registration to important dates, fees, syllabus, admit card, and results. Also, make sure to follow the dates released by the ICMAI for the CMA Intermediate exam 2026. Join VSI Jaipur’s CMA Intermediate classes if you want to crack this exam on the first attempt.

FAQs

Ques 1. What are the eligibility criteria for the CMA Intermediate Course?

Ans. All candidates who have cleared the CMA Foundation paper and the other equivalent paper mentioned by ICMAI in the eligibility criteria can appear in the CMA Intermediate exam.

Ques 2. When will ICMAI conduct the CMA Intermediate Exam 2026?

Ans. The exams will be conducted in June 2026. The Exam Dates for CMA Intermediate will be out soon.

Ques 3. What is the last date to register for CMA Intermediate Course 2026?

Ans. Students can register for the CMA Intermediate till 31st Jan 2026.

Ques 4. How many papers are there in the CMA Intermediate Course?

Ans. There are eight papers in the CMA Intermediate course, categorized into two groups.

Ques 5. How can I download the CMA Intermediate Study Material for the 2026 exams?

Ans. Students can download the CMA Intermediate Study Material from the official website of ICMAI. You can also download the study material from this page.