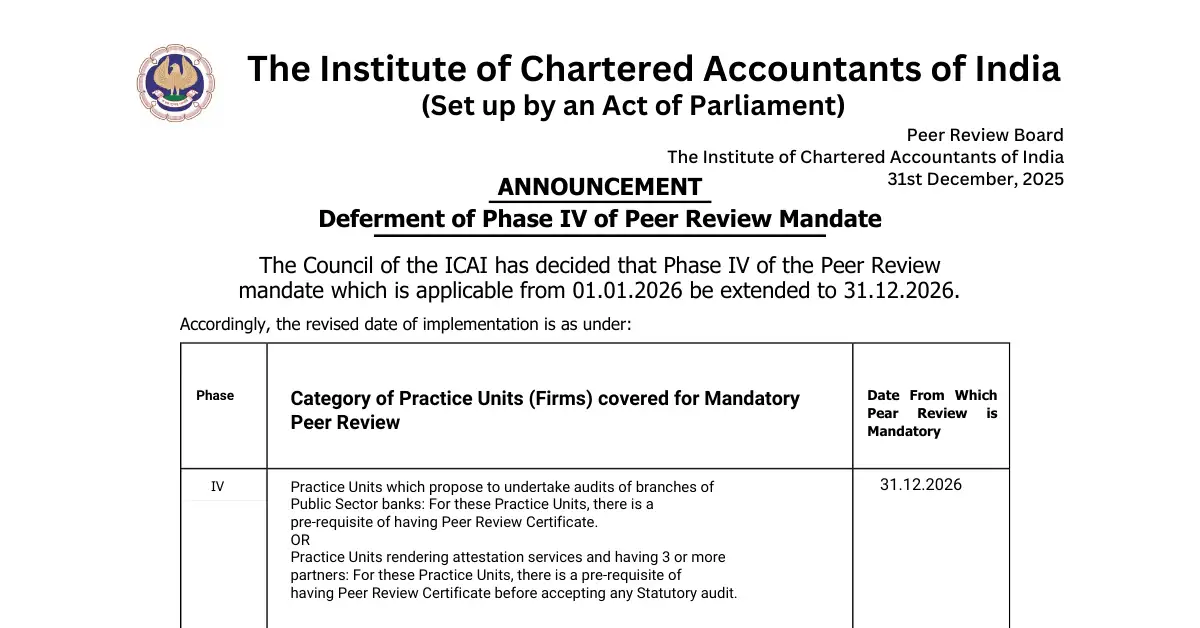

ICAI News – The Institute of Chartered Accountants of India (ICAI) has officially announced an important update regarding the ICAI Peer Review Mandate. As per the latest announcement, the Phase IV of the Peer Review Mandate has been deferred by one year. This decision has been taken by the ICAI Council to provide additional time to affected practice units.

What Is the ICAI Peer Review Mandate?

The ICAI peer review mandate is a compulsory quality review system for Chartered Accountant firms. It ensures that audit and attestation services meet ICAI’s prescribed standards. Peer Review focuses on improving audit quality, compliance, and professional discipline across CA firms.

What Was the Original Date for Phase IV?

Earlier, Phase IV of the ICAI Peer Review Mandate was scheduled to be applicable from 1st Jan., 2026. However, ICAI has now extended this deadline.

New Revised Date for Phase IV Implementation

As per the official ICAI announcement, Phase IV will now be mandatory from 31 December 2026. This means firms covered under Phase IV get an additional one-year relaxation to obtain the Peer Review Certificate.

Which Firms Are Covered Under Phase IV?

Phase IV of the ICAI peer review mandate applies to the following practice units:

- CA firms planning to undertake audits of branches of Public Sector Banks

→ These firms must hold a valid Peer Review Certificate before accepting such audits.

- CA firms providing attestation services with three or more partners

→ These firms must obtain a Peer Review Certificate before accepting any statutory audit.

Why Did ICAI Defer Phase IV?

ICAI has taken this decision to help firms prepare better for compliance. The deferment allows CA firms to strengthen their internal systems, documentation & audit processes without last minute pressure.

What Should CA Firms Do Now?

- Firms covered under Phase IV should start peer review preparation early.

- Apply for Peer Review well before December 2026.

- Strengthen audit quality controls & documentation.

- Stay updated with ICAI announcements related to peer review mandate.

Final Takeaway

The deferment of Phase IV of the Peer Review Mandate gives much needed relief to CA firms. However, it is not a cancellation. Firms must use this time wisely to ensure smooth compliance before 31st December, 2026.

For all Chartered Accountants, staying aligned with the ICAI’s peer review mandate remains critical for professional growth, credibility and regulatory compliance.

Also Read: