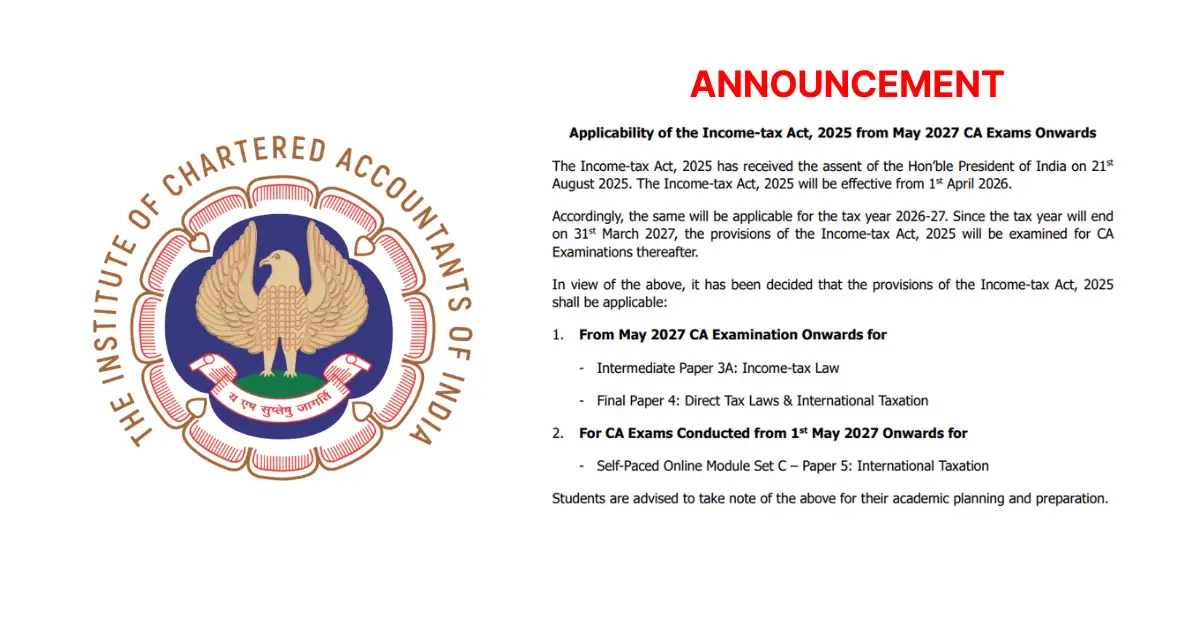

ICAI News – The Institute of Chartered Accountants of India (ICAI) has officially announced that the Income Tax Act 2025 will be applicable in the CA Exams from May 2027 onwards. This update is important for every CA student preparing for the upcoming exam cycles, especially those appearing for CA Intermediate, CA Final, & the Self-Paced Online Modules. The announcement clearly states that the new Income Tax Act 2025 has received Presidential assent, & will soon replace the earlier tax law for examination purposes.

The Income Tax Act 2025 will come into effect from 1 April 2026, & it will be applicable for the tax year 2026–27. Since this tax year ends on 31 March 2027, ICAI will test provisions of the new Act only in exams conducted after this period. This means students preparing for tax papers must now shift their studies to the updated law, & align their preparation accordingly.

According to the ICAI notification, the Income Tax Act 2025 will apply to the following papers:

- CA Intermediate Paper 3A: Income-tax Law

- CA Final Paper 4: Direct Tax Laws & International Taxation

- Self-Paced Online Module Set C – Paper 5: International Taxation

These papers will include the new provisions from May 2027 CA exams onwards. For the Self-Paced Modules, every exam conducted on or after 1 May 2027 will follow the latest Act.

This update has created a major shift in tax preparation strategy. Students now need to start understanding the structure, changes, and application of the Income Tax Act 2025, as this law will shape future taxation concepts and exam trends. Coaching institutions, mentors, and authors are also expected to update their study material soon.

The announcement also advises students to take note of these changes carefully to avoid studying outdated content. Early awareness will help them plan their preparation timeline, especially for those attempting exams in 2027 & onward.

The introduction of the Income Tax Act 2025 marks a significant transformation in India’s taxation framework, and ICAI has ensured that students get enough time to adapt before the new law becomes examinable. This clarity allows aspirants to stay aligned with the latest legal and academic requirements.

Also Read: