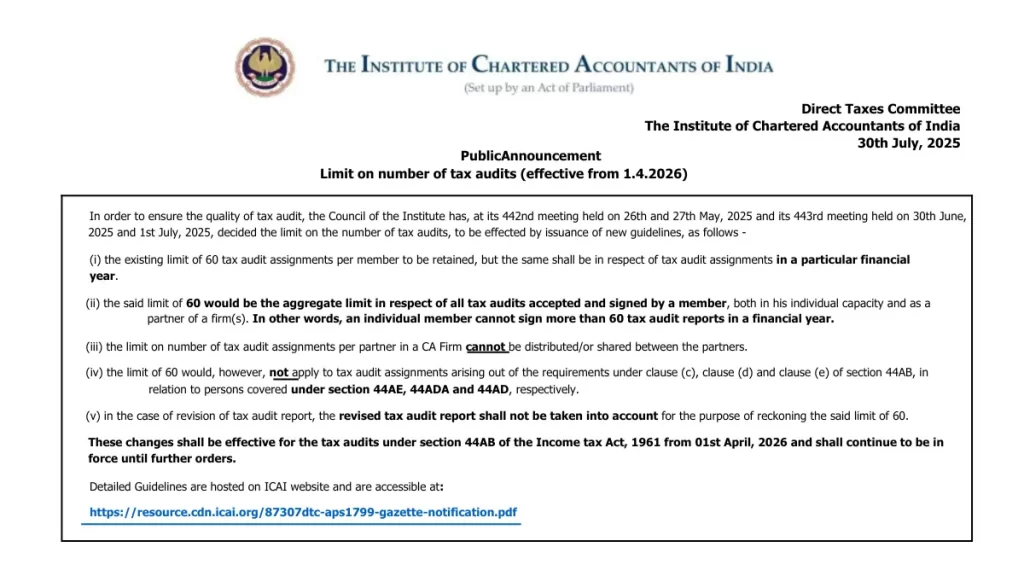

Tax Audit Limit Reduced by ICAI – The Institute of Chartered Accountants of India (ICAI) has issued new guidelines which have lowered the number of tax audits that may be done by a Chartered Accountant (CA) in a financial year from April 1, 2026.

The decision has been taken after the council meetings on May 26-27, June 30, and July 1, 2025. The measures are being taken so that the quality of tax audits is improved and they are done with the highest level of caution and scrutiny.

In the new rules, every member of ICAI will be able to sign up to a maximum of 60 tax audit reports during a year. This is either individual work or work carried out under a firm. Crucially, the 60-audit cap is neither transferable nor sharable among partners of a CA firm. This implies that every partner falls under the same cap.

The new ICAI tax audit limit guidelines do not extend audits conducted under some sections of the Income Tax Act, such as Sections 44AE, 44ADA, and 44AD. Additionally, if the tax audit report is revised, the revised report is not subject to the 60-audit cap.

These amendments will enhance the quality and integrity of tax audits in India. The entire set of guidelines has been published on the ICAI website and will be effective from April 1, 2026.

Also Check: ICAI Convocation August 2025